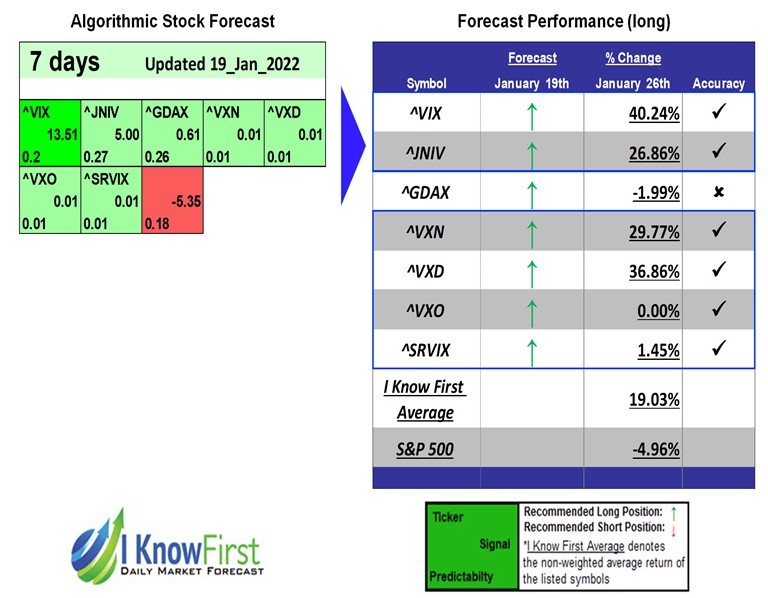

Volatility Forecasting Based on Big Data: Returns up to 40.24% in 7 Days

Volatility Forecasting

This Volatility forecasting is designed for investors and analysts who need predictions of the implied volatility for a basket of put and call options related to a specific index. It includes 8 volatility indices with bullish and bearish signals and indicates the best Volatility Index to trade:

- Volatility indices for the long position

- Volatility indices for the short position

Package Name: Volatility Forecast

Recommended Positions: Long

Forecast Length: 7 Days (1/19/22 – 1/26/22)

I Know First Average: 19.03%

Several predictions in this 7 Days forecast saw significant returns. The algorithm had correctly predicted 6 out of 7 stock movements. The highest trade return came from ^VIX, at 40.24%. Further notable returns came from ^VXD and ^VXN at 36.86% and 29.77%, respectively. The package had an overall average return of 19.03%, providing investors with a premium of 23.99% over the S&P 500’s return of -4.96% during the same period.

The Volatility Index, or VIX, is an index created by the Chicago Board Options Exchange (CBOE), which shows the market’s expectation of 30-day volatility. It is constructed using the implied volatilities on S&P 500 index options. This volatility is meant to be forward looking, is calculated from both calls and puts, and is a widely used measure of market risk.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 7 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.