Verizon Wireless Stock Forecast: An Algorithmic Analysis

Verizon Wireless Stock Forecast

Verizon Communications is a provider of communications, information, and entertainment products to consumers globally. The largest telecommunications company in the United States, it is a well-established company that offers a strong dividend to income investors and continues to post good sales growth for a company of its size.

Over the last month, Verizon’s stock price has fallen over 5.5% as investors are unsure of where future growth will come from. A downgrade from JPMorgan Chase based off such a claim had a large part to do with the sell-off of the stock, presenting a strong investing opportunity for patient, long-term investors seeking solid dividend performance and steady growth.

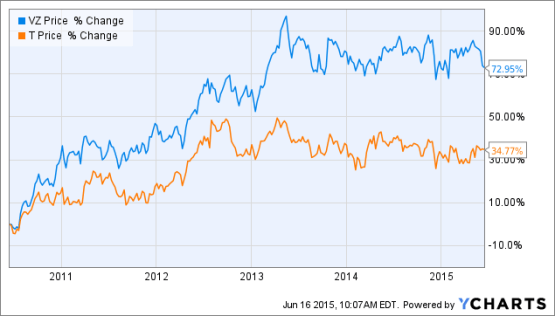

Figure 1. Source: YCharts

The stock price is currently trading over 9.5% lower than its 52-week high, but it should return to that level and surpass it within the next year. Along with its strong financial performance and track record of returning value to shareholders, the stock price will also be boosted by the release of an over-the-top (OTT) service in the next few months.

Current Valuation More Than Fair

A stock that analysts like to compare Verizon to is AT&T Inc. as they are the two dominant US telecomm providers. Both are stable companies that offer a strong dividend yield, but analysts have recently been picking AT&T as the better investment choice because it has a more clear cut catalyst to cause the stock price to climb in the near future. This catalyst is in the form of its acquisition of DirecTV.

Figure 2. Source: YCharts

However, Verizon is still the better investment, simply because of its superior financial health. The figure above shows the movement of these two telecommunication giants’ stock performance over the past five years. Verizon has more than doubled the return of AT&T in that time, and it should continue to do so over the long term going forward.

AT&T offers a higher dividend yield than Verizon currently. However, AT&T is currently acquiring DirecTV for $49 billion, limiting its ability to return value to shareholders in the immediate future. Meanwhile, Verizon continues to increase revenues, and its recent acquisition of AOL Inc. for $4.4 billion seems cheap in comparison. With a better free cash flow than AT&T, Verizon will have more flexibility going forward, either to increase the dividend or make another acquisition of its own to drive future growth.

Verizon’s valuation is more than fair at this point taking all of this into account, as it has a forward P/E ratio of 12.20, below that of rival AT&T. This low valuation is rather attractive for income investors searching for a strong performing company. With a solid dividend yield of 4.64%, now is a good time to invest if you are a patient, income searching investor.

Growth Outlook Not So Bleak

The recent downgrade by JPMorgan is in part because it believes that it will take years for the acquisition of AOL to provide any benefits to the top and bottom lines of the company. However, the acquisition should play a major role in Verizon’s release of its own OTT service later this summer, a field that is going to expand rapidly within the next 5 years.

Verizon’s strategy is different than that of most other players in this market, though, as it is going for mobile users, a field that happens to be growing even more rapidly. More and more, millenials are using their mobile phones and tablets to watch video. Verizon’s Chief Financial Officer Fran Shammo put it best, saying that the company was going for content rights outside the home, where the customer does not need any linear TV subscriptions.

Figure 3. Source: BusinessInsider

Verizon has made deals with ESPN, CBS Sports, and other platforms focused on college sports in recent months, which will offer a large portion of the available video to users. Besides sports and other live events, the service will also offer content from the YouTube programming network AwesomenessTV and from the Huffington Post, which Verizon will receive in the deal for AOL.

Where the acquisition of AOL will really help Verizon is the ability to earn advertising revenue from this field. The advertising tech that Verizon bought the company for is expected to eventually be a multimillion-dollar business in the long run, and it will act as a growth business independent from its main telecommunications business.

Further, the company could still make a play for DISH Network Corporation (NASDAQ: DISH). Shammo recently said that it was not looking into acquiring the company after speculation surrounding such a deal picked up, with Citigroup analyst Michael Rollins saying it was the most likely situation.

These comments should not be taken as fact, however, as executives at Verizon said similar things about their being nothing true surrounding a potential acquisition of AOL. We all know how that one played out. Such an acquisition of Dish would make sense for many reasons, and it could add to the company’s OTT service that will be released.

Algorithmic Analysis

I Know First supplies financial services, mainly through stock forecasts via their predictive algorithm. The algorithm incorporates a 15-year database, and utilizes it to predict the flow of money across 2000 markets. The self-learning algorithm uses artificial intelligence, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets.

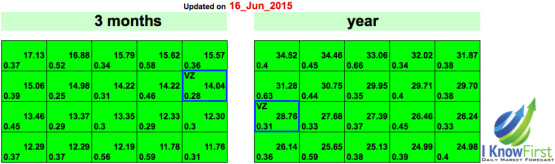

The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

Having explained how I Know First’s algorithm works, it is worthwhile to see if the algorithm agrees with the bullish fundamental analysis of the company. The three-month and one-year forecasts for Verizon are included.

Figure 4. Long-Term Algorithmic Forecast For Verizon.

Verizon is among the algorithm’s top stock picks for both time horizons. The signal strengths are both strong, especially for the one-year time horizons. The predictabilities are also impressive, indicating that the algorithm has had success predicting the movement of the stock price in the past.

Conclusion

The bullish algorithmic analysis fits well with the fundamental analysis of the company. Verizon is a strong play at the current price, which is trading around $47. The stock price has shown a solid track record in the past, and its revenues have continued to grow. With a strong dividend yield and impressive financial standing, this company is a stable provider of income. On top of that, the stock offers plenty of upside potential at the current deflated price and will offer significant returns in the next 12 months, especially if it uses its cash for an acquisition of Dish, which is still clearly a possibility.