Valhi Stock Analysis: Growth of Titanium Dioxide Market Could Provide Sizable Returns

Summary

- Valhi’s subsidiary Kronos, has ability to retain share of Titanium Dioxide (TiO2) market

- There is a positive growth outlook for the demand of TiO2 across the globe

- Valhi is also attractive for having a good dividend

- I Know First is bullish on a 1-month, 3-month, and 1-year time horizon for Valhi, Inc. (VHI)

Chemical Manufacturing Plant

Valhi – Chemicals and Component Products

Valhi Inc. was founded in 1987 when LLC Corporation and Amalgamated Sugar Company entered into a merger. Valhi, located in Dallas, Texas, is primarily a holding company and are the majority owners in subsidiaries such as Kronos Worldwide, CompX International Inc., and NL Industries. The Company’s primary stream of revenue comes from Kronos, a major producer of Titanium Dioxide (~90% of gross sales) and CompX, a manufacturer of specialty components such as locks and ignition switches (~6% of gross sales).

U.S. Titanium Dioxide Historical Price

(Data: U.S. Geological Survey)

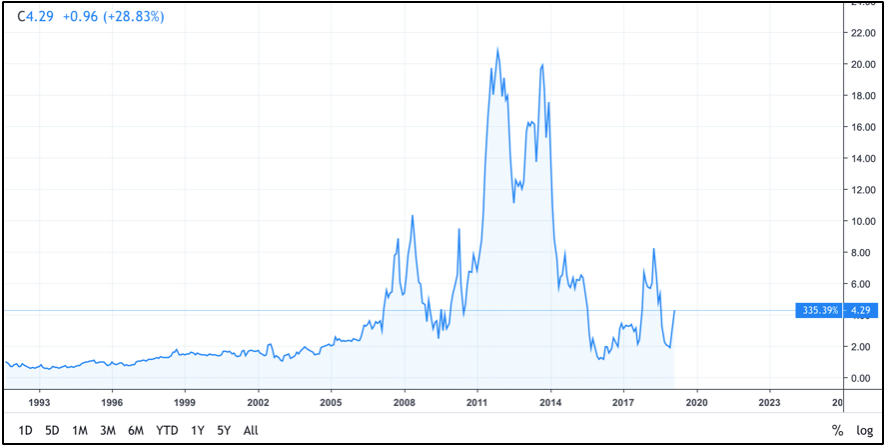

Valhi, Inc. Stock Historical Price

(Source: TradingView, February 24, 2019)

As can be seen from the graph above, the price of Titanium Dioxide (in the U.S.) is near historically low levels. Dating back to 1940, the price has rarely remained as low as it is now. This is a key factor to consider when analyzing the Titanium Dioxide market going forward. If the price of Titanium Dioxide rises again in the coming months/years, it is very likely that the value of Valhi Inc. will also increase. Mahitha Mallishetty, a lead analyst of specialty chemicals research at Technavio, recently explained that “The Global Titanium Dioxide Market is projected to grow to more than 7,480 thousand metric tons by 2021, at a CAGR of 4% over the forecast period. Increase in penetration of doped and coated titanium dioxide nanomaterials is one of the key drivers responsible for the growth of the market.”

Because Kronos comprises such a large portion of business Valhi is involved in, the value of Valhi as a company is highly dependent on Kronos’ success and the market for Titanium Dioxide (TiO2). When comparing the historical stock price of Valhi with the latter section of the historical graph of Titanium Dioxide price, the high correlation between the two can be seen. The fact that the value of Titanium Dioxide is currently lower than normal serves as a good indication that Titanium Dioxide price will rise in the future, and subsequently that Valhi, Inc. stock will rise.

Titanium Dioxide is naturally occurring and is typically found in deposits of ilmenite or rutile. In powder form, Titanium Dioxide creates a bright, white pigment that is used in paints and coatings. It is also an important chemical for plastic and paper production.

For Kronos, the make-up of it’s Titanium Dioxide sales by end-use are 58% for Coatings, 30% for Plastics, 5% for Paper, and 7% for other uses. Kronos estimates its market share for Titanium Dioxide is 17% in Europe and 18% in North America. Valhi notes in its 10K filing from 2018 that the market for Titanium Dioxide is incredibly and increasingly competitive, with companies such as Chemours, CRISTAL, Venator, Lomon Billions, and Tronox posing the greatest threat to their bottom line. One concern for Kronos – and its competitors – going forward is regulation of Titanium Dioxide products for environmental reasons. The company currently faces several class action lawsuits regarding this issue. These lawsuits, Kronos acknowledges, can result in heavy fines and/or required damages payments, which could drastically affect its stock price.

End Use Cases of Kronos’ Titanium Dioxide

(Source: Valhi 10K)

Valhi has advantages over its Competitors

Despite potential dangers ahead, Kronos – and by extension Valhi – sits in a prime position to capitalize on the growing Titanium Dioxide market. When comparing Valhi to its competitors, there are some clear advantages. Kronos owns and operates two ilmenite mines in Norway. As mentioned before, ilmenite is a raw material used directly in the production of Titanium Dioxide. Valhi estimates that these ilmenite reserves are expected to last at least another 50 years. Some of the ilmenite that is produced by the mine is often sold to third parties, some of which are direct competitors to Kronos.

Diagram of Market Share for TiO2 Production Capacity

(Source: Valhi 10K)

Kronos’ ability to own a source for ilmenite allows them to produce a supply of Titanium Dioxide that is in increasing demand. In addition to this, they hold some amount of leverage over their competitors by controlling the supply of the mineral ilmenite. This distinguishes Kronos from the other top companies for Titanium Dioxide production and distribution and will allow them to grow in the years to come. The amount of Titanium Dioxide on Earth is limited and therefore the supply and demand balance will shift in the future. Current projections are that the price of Titanium Dioxide could rise as much as 9% per year. This puts Valhi, as well as other Titanium Dioxide production companies, in the perfect position to grow and make returns for shareholders.

When comparing Valhi to alternative investments, Valhi’s quarterly dividend also makes Valhi attractive. Their current dividend yield is 2.48% compared to the average of 2.0% of service companies in the S&P 500. This dividend serves as a mitigating factor when considering Valhi for investment. Valhi has also successfully increased its Earnings Per Share (EPS) over the past 4 years and is now positive. Despite a recent drop in Earnings Per Share in the second quarter of 2018, the third quarter earnings have climbed back up.

Valhi Quarterly Earnings Per Share (2017 Q1 – 2018 Q3)

Historically, there seems to be risk when investing in Valhi and other companies so heavily reliant on the Titanium Oxide market. Over the past 5 years, Valhi has experienced volatile stock returns, reaching a maximum of 121.2 dollars per share in 2018, then falling over 38%. Currently, the stock price for Valhi sits at 85.32 dollars per share. This volatility should serve as a sign of risk for potential investors, but also means return on investment can be outsized if the forecast proves to be correct.

Conclusion

Based solely on the anticipated rise in demand for Titanium Dioxide in the world marketplace, Valhi seems to be a great investment going forward. In addition to this, it seems to Valhi’s market share is very stable, and has the potential for further growth. Risks of environmental civil lawsuits and regulation should be examined when buying this stock, as these could negate any advantage Valhi has in the Titanium Dioxide market. Likewise, if a competitor happened to face serious damages from an environmental hazard claim, Valhi would be poised to claim an even greater market share. The risks of future environmental actions against Titanium Dioxide could be either a benefit or detriment for the company; only time will tell.

In Valhi’s 10K filed in 2018, they mention that the outcomes of some of their lawsuits are uncertain. They warn that plaintiffs in the cases seek recovery from claims of “public and private nuisance, negligent product design, negligent failure to warn, strict liability, breach of warranty, conspiracy/concert of action, aiding and abetting, enterprise liability, market share or risk contribution liability, intentional tort, fraud and misrepresentation, violations of state consumer protection statutes, supplier negligence and similar claims.” They also mention that the fallout from these lawsuits may very well be “material,” meaning they could significantly affect the company and its cash holdings.

Though Valhi is a historically volatile stock, many indications point to a rise in the price in the coming months.

On March 3, 2019, I Know First issued bullish forecasts for Valhi Inc. Stock on the 1-month, 3-month, and 1-year time horizon. I Know First sees this stock as a great opportunity to make outsized profits in the coming months. Check out the diagram below to see our forecast:

Follow us on :

Facebook: I Know First: Daily Market Forecast

Twitter: I Know First

Instagram: I Know First