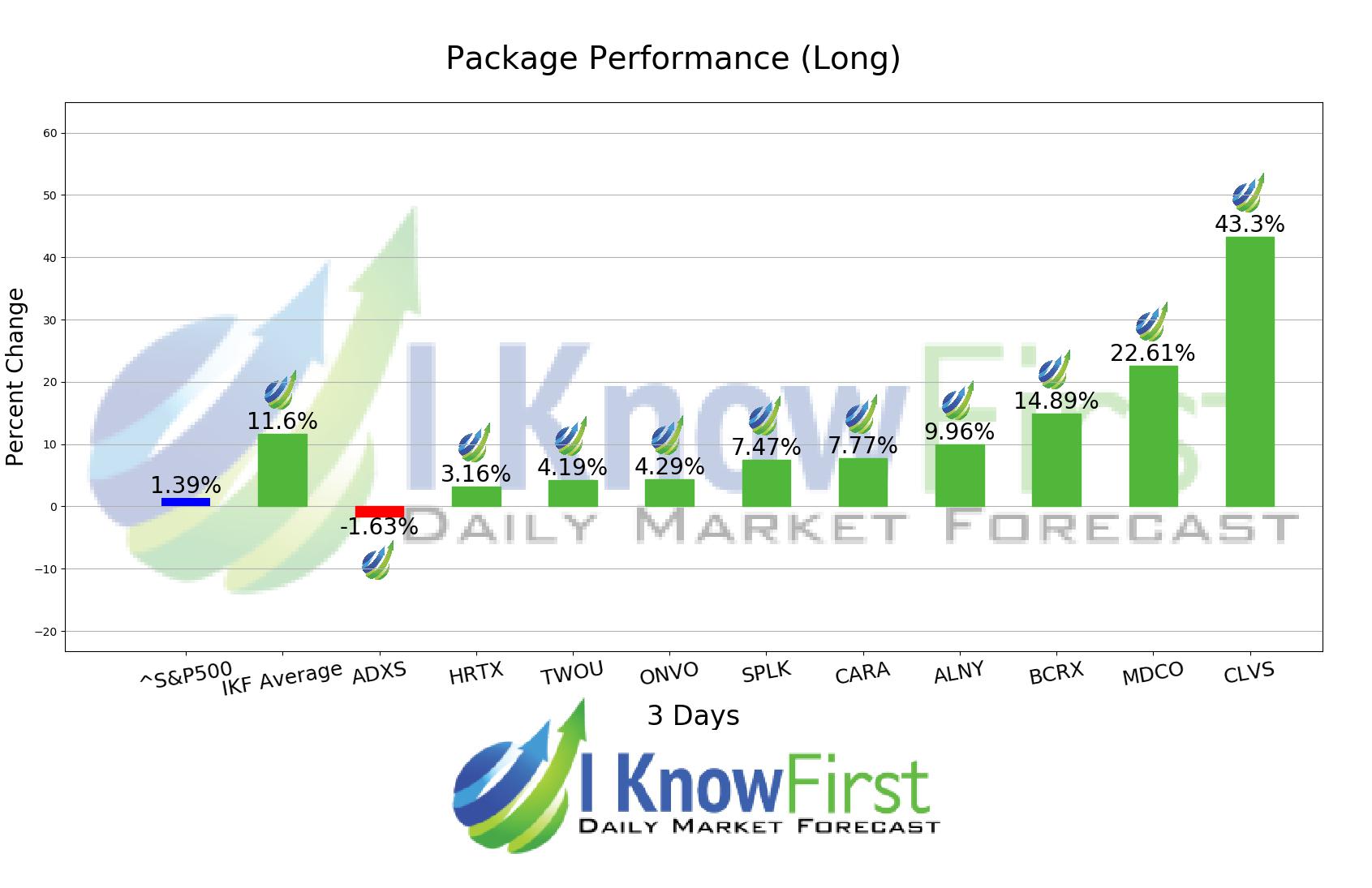

Trade Ideas Based on Artificial Intelligence: Returns up to 43.3% in 3 Days

Trade Ideas

The Fundamental Package includes our algorithmic forecasts for stocks screened by fundamental criteria. Our algorithms help you find best opportunities for both long and short positions for the stocks within each fundamental screen. The trade ideas are selected according to five basic valuation categories:

- P/E (price to earnings ratio)

- PEG (price/earnings to growth ratio)

- price-to-book ratio

- price-to-sales ratio

- short ratio

Package Name: Fundamental – High Price-to-Sales ratio Stocks

Recommended Positions: Long

Forecast Length: 3 Days (11/24/2019 – 11/28/2019)

I Know First Average: 11.6%

For this 3 Days forecast the algorithm had successfully predicted 9 out of 10 movements. CLVS was our best stock pick this week a return of 43.3%. MDCO, and BCRX had notable returns of 22.61% and 14.89%. The overall average return in this Fundamental – High Price-to-Sales ratio Stocks package was 11.6%, providing investors with a 10.21% premium over the S&P 500’s return of 1.39% during the same period.

Clovis Oncology, Inc., incorporated on April 20, 2009, is a biopharmaceutical company focused on acquiring, developing and commercializing anti-cancer agents in the United States, Europe and other international markets. The Company’s product candidates include Rociletinib, Rubraca (Rucaparib) and Lucitanib. Its commercial product Rucaparib is an oral, small molecule poly adenosine diphosphate (ADP)-ribose polymerase (PARP), inhibitor of PARP1, PARP2 and PARP3 approved in the United States by the Food and Drug Administration (FDA), as monotherapy for the treatment of patients with deleterious breast cancer (BRCA) (human genes associated with the repair of damaged deoxyribonucleic acid (DNA)) mutation (germline and/or somatic) associated advanced ovarian cancer, who have been treated with two or more chemotherapies, and selected for therapy based on an FDA-approved companion diagnostic for Rubraca.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.