TER Stock Forecast: Teradyne Keeps Building Momentum, Tops Q2 Expectations

This article was written by Julia Masch, a Financial Analyst at I Know First.

“And the growing silicon content enabling AI at the edge is driving up device complexity and test time. Whereas training algorithms usually get developed in the cloud, those honed algorithms are often deployed in the real world in edged optimized silicon for AI inference and decision-making in realtime. Teradyne is well positioned in this growing edge AI space.”

-Mark E. Jagiela, Teradyne, Inc. – CEO, President & Director

(Source: Wikimedia Commons)

Highlights:

- A Phenomenal Q2 2018

- Even More Momentum, What’s Still In The Pipeline

- I Know First Algorithm Is Currently Bullish Forecast For TER

Teradyne, Inc. (NYSE: TER) is a developer, manufacturer, seller, and supporter of semiconductor testing equipment. As the semiconductor environment has grown in the past few years, the demand for accurate testing has consequently increased. The company has segments for semiconductor tests, wireless tests, industrial automation, and more. On July 24, 2018, Teradyne released its Q2 2018 earnings report which outperformed expectations. As a result, TER jumped 8% immediately following the results.

A Phenomenal Q2 2018

Teradyne’s second quarter revenue exceeded analyst expectations with a non-GAAP EPS of $0.59. Incorporating GAAP standards, earning were still a high $0.52. These earning increased 32% quarter-over-quarter, however, decreased 35% year-over-year. However, the YoY decrease was the result of the previous year’s mobility tooling ramp which the company did not expect to continue in 2018.

(Source: Yahoo Finance)

Revenues for the company increased 14.9% sequentially, but decreased YoY by 24.4% to $526.9 million. Nearly 70% of this revenue came from the company’s semiconductor testing platforms. A highlight within the semiconductor testing unit was the Memory Test segment. Memory Test has standout sales accounting for $67 million of revenue, a 34% increase YoY. The industrial automation, system test, and wireless test sectors also helped to boost the company’s revenue.

Additionally, gross margin increase 310 basis points YoY and to 58.4%. Operating expenses increased 1.4% YoY due to SG&A expenses in combination with engineering and development expenses. However, these are both integral to the company’s future success, therefore, the increase in operating expense and subsequent decrease of operating margin to 25.2%. is not cause for alarm. Cash flow from operations increased from $81.9 million last quarter to $130.2 million

During the quarter, the company also bought back a large portion of their own shares. Teradyne spent $226.5 million in share repurchases increasing the total amount spent on stock repurchases in the first 6 months of the 2018 fiscal year to $361 million. The company has now spent a total of ~ $1 billion on stock buybacks since 2015.

This shows great confidence in the company by its management. Moreover, Teradyne awarded investor $17.1 million in dividends this quarter which adds value to the stock.

The company also outlined their expectations for the upcoming quarter: they expect revenues between $540 million and $570 million which will be a quarterly increase from Q2 2018 even at the lower end of this spectrum. If revenue falls within this range non-GAAP earnings will be between $0.59-0.66. Teradyne also expects gross margin of 57%, OpEx between 31-33%, and operating profit rate ~25%.

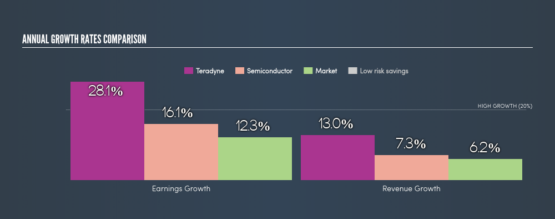

Teradyne’s earnings and revenue growth outpace those of the semiconductor and market at 28.1% and 13% respectively.

(Source: Simply Wall Street)

The strong results for the quarter and high expectations for the upcoming quarter increased investor confidence in TER and resulted in the jump in stock price.

Even More Momentum, What’s Still In The Pipeline

Teradyne has a lot of new testing products in the work. The company’s 802.11ax production test product is ready and demand is expected to increase in 2019 as more cell phones utilize new technologies. Additionally, the company’s millimeter wave and sub-6G cellular production test products are currently being qualifies and will most likely begin impacting revenue in 2020.

Moreover, Teradyne is currently expanding its Magnum 5 beyond just a flash package to both flash and DRAM wafer test which should boost the already high memory text segment in the upcoming years. The flash and DRAM wafer markets are larger than the current flash package market and should drive Teradyne’s memory market share up to and even past 30%.

DRAM (Source: Wikimedia Commons)

In the semiconductor test segment, Teradyne is working on new products that focus on new standards across markets. In the high speed serial market, the company is working on new 6G instruments with interface speeds up to 60 gigabits per second. Additionally, in the RF market the company is testing silicon in many ways including the aforementioned 802.11ax. Because silicon drives up test time and device complexity and are then used for AI immediately, the company has large potential in the ever-growing AI market.

The company also maintains a high-growth segment in Industrial Robots, particularly through Universal Robots. Teradyne has been increasing its field distribution and expect high growth for the rest of the year. Moreover, the company expects greater adoption as companies realize the impact of these industrial robots through fast payback and flexibility.

The new MiR 500 (Source: mobile-indsutrial-robots.com)

Teradyne recently acquired MiR which has boosted its industrial automation unit and gives the company one of the leading platforms in the autonomous mobile robot market. At the end of last month, the company introduced a new 500-kilogram payload robot, the MiR500. This newest product has greater capabilities than the MiR 100 and 200 because it allows the automation of pallet-moving systems such as forklifts. Teradyne’s acquisition of MiR highlights the company’s commitment to successful mergers.

Teradyne also has loyal customers thanks to its strong customer service. For the past 6 years, Teradyne has been voted the highest in customer service rankings by VLSIreseasch which surveys and assigns ranking to companies in the semiconductor industry.

Technical Analysis

Over the past year, TER has increased to $42.96. The stock had a large drop in value in late April which led to a bearish cross as the 200-day simple moving average (SMA), shown below in light blue, surpassed the stock price and 50 day SMA which is shown in purple. However, this has recently been offset by the company’s jump that followed the earnings report. Thanks to this, the company now has bullish momentum again as its stock price is greater than both the 50 day and 200 day SMAs.

(Source: Yahoo Finance)

Current I Know First Bullish Forecast For TER

The I Know First self-learning algorithm is currently bullish for Teradyne in the 1 month, 3 month, and 12 month time horizons. The extremely strong signal of 530.51 in the long run with an also high predictability indicator of .81 signifies a bright future for TER.

How to read the I Know First Forecast and Heatmap

Conclusion

Teradyne has started off its 2018 fiscal year on a strong note and the Q2 earnings report only solidified this. Moreover, the demand for semiconductors has grown exponentially in the last few years and will continue to grow in the upcoming years, thus increasing demand for the test products Teradyne produces. TER is also continuing to push ahead and is expanding its market shares across different testing areas by introducing and improving new products. The company’s acquisitions have also benefitted the company and its new MiR 500 will increase the capabilities of its industrial robots. On top of all this, the technical analysis and I Know First forecast show bullish momentum for Teradyne and build on its status as a strong long term buy.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.