Tech Stocks To Buy Based on Stock Market Algorithm: Returns up to 85.53% in 1 Year

Tech Stocks To Buy

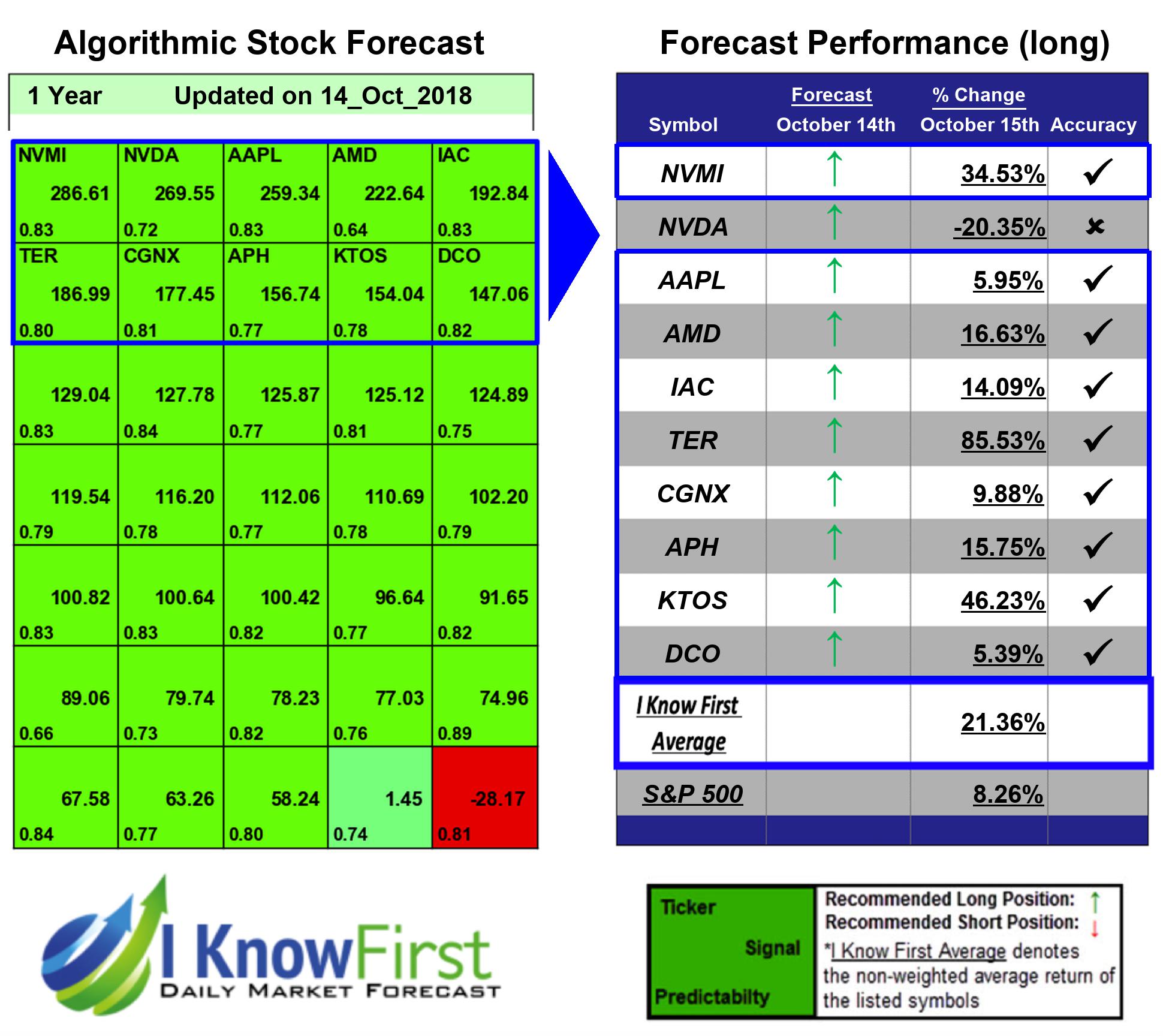

This Tech Stock forecast is based on stock picking strategies for investors and analysts who need predictions for the 10 best tech stocks in the Technology Industry (see Tech Stocks Package). It includes 20 stocks with bullish and bearish signals and indicates the best tech stocks to buy and sell:

- Top 10 Tech stocks for the long position

- Top 10 Tech stocks for the short position

Package Name: Tech Stocks Forecast

Recommended Positions: Long

Forecast Length: 1 Year (10/14/2018 – 10/15/2019)

I Know First Average: 21.36%

During the 1 Year forecasted period several picks in the Tech Stocks Forecast Package saw significant returns. The algorithm had correctly predicted 9 out 10 returns. The top performing prediction from this package was TER with a return of 85.53%. The suggested trades for KTOS and NVMI also had notable 1 Year yields of 46.23% and 34.53%, respectively. This algorithmic forecast package presented an overall return of 21.36% versus S&P 500’s performance of 8.26% providing a market premium of 13.10%.

Teradyne, Inc. (TER) designs, develops, manufactures, and sells automatic test equipment worldwide. Its Semiconductor Test segment designs, manufactures, sells, and supports semiconductor test products and services for wafer level and device package testing in automotive, industrial, communications, consumer, computer and electronic game applications, and others. This segment offers FLEX test platform systems; Magnum platform that tests memory devices, such as flash memory and dynamic random access memory; J750 test system to address the highest volume semiconductor devices; and ETS platform for use by semiconductor manufacturers, and assembly and test subcontractors in the low pin count analog/mixed signal discrete markets. It serves integrated device manufacturers (IDMs) that integrate the fabrication of silicon wafers into their business; fabless companies, which outsource the manufacturing of silicon wafers; foundries; and outsourced semiconductor assembly and test providers. The company’s Wireless Test segment designs, develops, and supports wireless test equipment for developing and manufacturing wireless devices, including smart phones, tablets, notebooks, laptops, personal computer peripherals, and other Wi-Fi, Bluetooth, and cellular enabled devices. This segment offers IQxstream solution for testing GSM, EDGE, CDMA2000, TD-SCDMA, WCDMA, HSPA+, LTE-FDD, TD_LTE, and LTE-A technologies for calibration and verification of smartphones, tablets, small cell wireless gateways, and embedded cellular modules; test equipment for connectivity testing; IQfact chipset software; and modular wireless test instruments. The company’s System Test segment offers defense/aerospace test instrumentation and systems; storage test systems; and circuit-board test and inspection systems. Its Industrial Automation segment provides collaborative robots for manufacturing and light industrial customers. The company was founded in 1960 and is headquartered in North Reading, Massachusetts.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.