Sustainable Stock Forecast: Sustainable Investing Is The Key To The Future Trend

This Sustainable stock Forecast article was written by Huaiyi Jiang – Financial Analyst at I Know First.

Highlights

- Increasing signatories of PRI indicates the growing trend of sustainable investing

- Risks and opportunities have been involved for businesses in the process of climate change

- The development of sustainable stock will face several pressures

Overview

Sustainable investing is an investing practice that considers a company or investment’s impact on the environment and society, The aim of sustainable investing is to bring investors financial returns and positively impact the world. Investors who use a sustainable investment strategy will choose companies that have a solid and concrete development plan to significantly improve sustainable performance. Sustainable investment covers several aspects. From an investment perspective, businesses that have a high score on the ESG criteria can be described as sustainable companies. In 2022, ESG is one of the top 8 investment themes. An increasing number of people pay attention to sustainability and ESG metrics and try to use sustainable investment strategies.

Increasing Signatories of PRI means the Growing Trend of Sustainable Investing

An increasing number of asset owners have signed the Principles for Responsible Investment. The Principles for Responsible Investment (PRI) collaborates with its global network of signatories to implement the six Principles for Responsible Investment. PRI’s objectives are to help signatories incorporate environmental, social, and governance (ESG) problems into investment and ownership decisions and comprehend the financial repercussions of these issues. The PRI acts in the long-term interests of its signatories, of the financial markets and economies in which they operate, and ultimately of the environment and society as a whole. The six Principles for Responsible Investment are a set of investment guidelines that are voluntary and aspirational. They include a list of potential activities for integrating ESG problems into investment practice. The principles were developed by investors, for investors. Signatories help create a more sustainable global financial system by putting them into practice. The figure 1 below shows that the number of signatories has grown a lot in the recent five years, which means more and more asset owners considering sustainable investing.

(Figure1: PRI Asset Owner signatory growth )

Figure 2 shows the types and regions of asset owners that signed the PRI. More than half of the total business is made up of retirement plans (35% non-corporate plus 18% corporate), with insurance funds coming in second at 17%. Regarding the region of signatories, traditionally large markets for responsible investment continue to dominate. 57% of the asset owners are headquartered in Europe, with another 21% based in North America. Four nations—the United Kingdom, the United States, Canada, and the Netherlands—account for 41% of asset owner signatories on their own. Also, the two biggest developing market contributors to PRI signatories are Brazil (3%) and South Africa (2%).

(Figure2: Asset Owner by Type & Assets Owner by Region )

Climate Change Brings Both Risks and Opportunities

According to the World Economic Forum, ESG-related risks account for an increasing proportion of the top five global risks. Before 2010, economic and financial risks accounted for a large proportion of the top five risks. After 2019, environmental issues dominated the “world risks” list, while “climate change” ranked second on both the global risks and impacts list.

According to the Task Force on Climate-related Financial Disclosures (TCFD), businesses may face transition or physical risks in the process of climate change. Transition risks may come from changes in policies and regulations or changes in production and operation mode brought by science and technology. Physical risks include acute risks and chronic risks. Acute risks refer to event-driven risks, including the intensification of extreme weather events such as typhoons, hurricanes, or floods. The chronic risks include rising sea levels and persistent high temperatures. Both risks will adversely affect the development of enterprises. At the same time, climate change can also bring potential business opportunities, such as cleaner production and more climate-friendly products. Enterprises may use these advantages and reputations to enhance their competitiveness. Figure 3 below shows the risks and opportunities of climate change.

Also, the TCFD provides a global framework to translate non-financial information into financial metrics. The TCFD recommendations provide guidance to all market participants on the disclosure of information on the financial implications of climate-related risks and opportunities. So market participants can use that information in business and investment decisions.

According to the words of the TCFD Secretariat: “As countries and companies around the world set net-zero targets, the TCFD framework is increasingly becoming the foundation for standards and requirements needed to chart the transition to the low-carbon economy.” The TCFD’s recommendations have been endorsed by twelve governments (including the EU, UK, and Hong Kong) alongside dozens of central banks, supervisors, and regulators. Here is the figure4 of TCFD recommendation and supporting recommended disclosure.

(Figure 4: TCFD Recommendation)

The development of sustainable Stock will face several pressures

In the past two years, ESG investment concepts based on environmental, social, and corporate governance have gained popularity. This year, however, geopolitical conflicts led to higher energy prices and increased market volatility. Those reasons may discourage the investor’s expectation of a sustainable stock market. In addition, the conflict between Russia and Ukraine broke out in February this year. Russia was unable to export oil under economic sanctions from Europe and the United States. So energy prices have risen sharply. As energy prices rise, energy stocks also increase a lot. As a result, many investors expect ESG portfolios to underperform traditional portfolios.

Nevertheless, the US government has published a series of sustainable finance policies, including Executive Order 14030, signed by President Biden on May 20, 2021. There has been a surge of legislative and regulatory developments and initiatives in the US financial services industry this year.

For instance, the Securities and Exchange Commission (SEC) has released a series of sustainability-related proposals that PRI supported, such as proposals that would enhance and standardize registrants’ climate-related disclosures for investors. The SEC also proposed adviser and fund disclosure as well as fund name requirements, whose main purpose is to reduce greenwashing. It is noteworthy that the Supreme Court rendered a decision on June 30, 2022, that could adversely impact climate-related proposals of US federal agencies. Another major development is the Inflation Reduction Act’s adoption, enabling climate actions in various sectors and paving the way for a just and inclusive transition to net zero. Moreover, the Department of Labor issued a new rule allowing private pension managers to consider ESG factors in their investment practices.

Sustainable Stock Market Forecast: Investing in Sustainable Stocks with I Know First

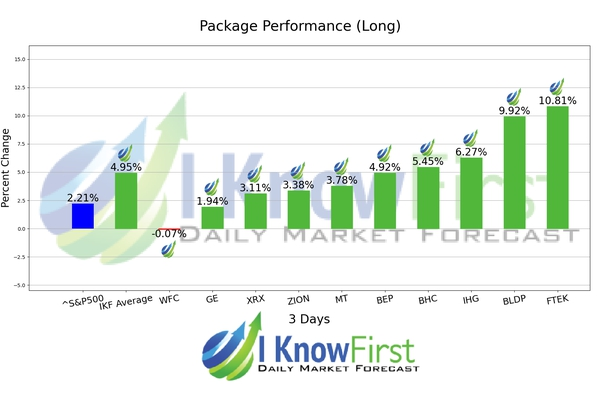

I Know First provides predictions for the Sustainable and Responsible stock market based on the AI algorithm for six horizons: 3-day, 7-day, 14-day, 1-month, 3-months, and 1-year. I Know First has constructed Sustainable packages that cover Sustainable and Responsible Companies. Below, we can observe the performance of the prediction of the Sustainable and Responsible stock packages which were sent to our clients (you can access our forecast packages here).

Package Name: Sustainable and Responsible Companies

Recommended Positions: Long

Forecast Length: 3 Days (1/6/23 – 1/9/23)

I Know First Average: 4.95%

Sustainable Stock: Conclusion

In 2022, the sustainable stock market got lots of focus from investors. Businesses intend to create a development schedule for sustainable performance in the environmental, social, and governance aspects respectively. The government also pays more attention to sustainable development and encourages more climate-related disclosure. However, investors may be discouraged by the international situation and worried about the performance of the sustainable stock market. I Know First provides a forecast package for short-term and long-term periods to help our clients to find the most promising investment opportunities in the sustainable stock market.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.