Stock Forecast: Abiomed (ABMD) Surpasses 52-Week High, Becoming a High-Flier After Beating Q4 Expectations

This article was written by Esther Hanon, a Financial Analyst at I Know First.

[Source: MassDevice.com, May 9th, 2018]

“Abiomed delivered another record quarter and fiscal year. I am proud of our Patients First execution and operational discipline from research to manufacturing to customer support. We earned multiple global regulatory approvals in the US, Germany, and Japan on new products, new indications, and reimbursement,”

—Michael R. Minogue, Chairman, President and Chief Executive Officer, ABIOMED, Inc.

Stock Forecast: Abiomed (ABMD) Surpasses 52-Week High, Becoming a High-Flier After Beating Q4 Expectations

Summary:

- Abiomed stock is flying high today, rising nearly 15%, after issuing better-than-expected results and issuing bullish guidance. In the past six months, Abiomed’s shares have gained 77.3% against the industry ‘s decline of 10.1%.

- The company has hit maximum technical strength and has broken out to a five bull momentum rating is extreme strength and through technical resistance.

- Revenue jumped 40% to $174.4 million. For context, Wall Street was only expecting $164 million.

- Stock have surpassed their 52-week high, as positive news of beating Q4 earnings and new product expansions.

- The company received two label expansion claims for its Impella heart pumps in February. These new indications should expand its addressable market in the U.S.

- Abiomed received FDA approval for a new Impella pump called the CP in early April, and also won European approval for its Impella 5.5

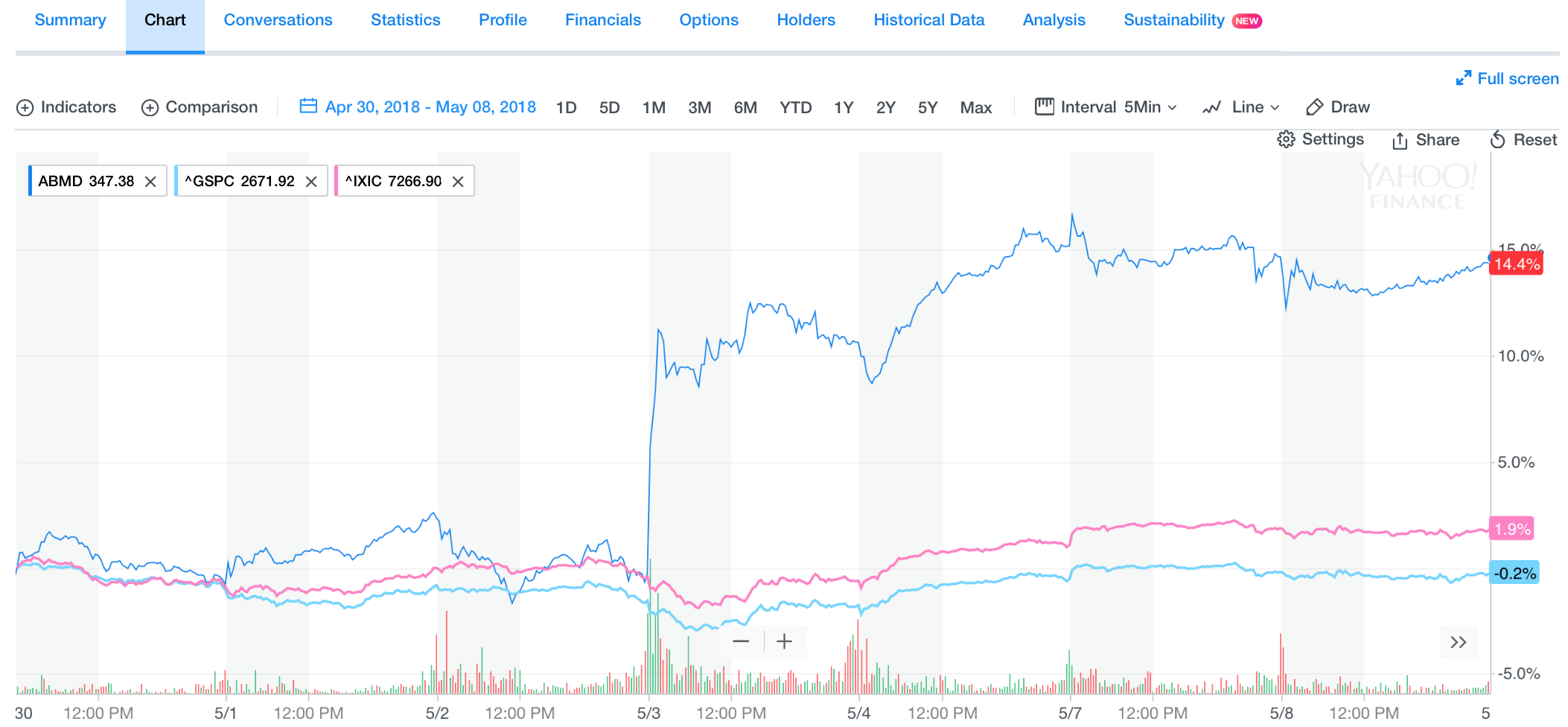

Investors in Abiomed should be smiling from ear to ear this week. Shares of the heart recovery medical device maker jumped as much as 12% in early morning trading on Thursday after the company reported stellar fiscal 2018 fourth-quarter results and issued bullish guidance. Since then, ABMD stock has outperformed the market and rose nearly 15% since they issued their earnings announcement.

During the past six months, Abiomed shares have gained 77.3% against the industry ‘s decline of 10.1%. Abiomed’s fiscal fourth-quarter results were strong across the board. The company reported fourth-quarter fiscal 2018 earnings per share of 80 cents, which beat investor’s estimated by 25%. Earnings improved a huge 142.4% from the year-ago quarter. In the past six months, Abiomed’s shares have gained 77.3% against the industry ‘s decline of 10.1%.

[Source: Yahoo Finance, May 9th, 2018]

Q4 Overview:

Revenue jumped 40% to $174.4 million. For context, Wall Street was only expecting $164 million. Operating margin soared to 27.3% for the period. That was up 400 basis points year over year. GAAP net income was $36.8 million, or $0.80 per share. That was far higher than the $0.64 that analysts were projecting. Cash balance at quarter-end stood at $400 million. The balance sheet remains debt-free. Revenues in the reported quarter came in at $174.4 million, beating investor’s estimate 6.3%. Revenues also increased 40% from the prior-year quarter. Per management, the upside was driven by U.S. patient utilization growth of 35% on a year-over-year basis.

Reorder performance on products continued to be strong in the quarter. U.S. reorders increased 35% to 140 million from the prior-year quarter, which translated into a reorder rate of approximately 100%. Average combined inventory at the hospitals for the Impella 2.5 and the Impella CP rose slightly to 3.8 units per site versus 3.7 in the prior quarter and 3.4 last year. In the quarter under review (Q4), gross margin was 82.7%, down 190 basis points (bps) year over year. Operating income in the quarter grossed $47.6 million, up 64.1% on a year-over-year basis. Operating margin was 27.3% which expanded 400 bps. Abiomed’s balance sheet has been strong at the end of fiscal 2018. The company generated $49.1 million of cash, cash equivalents and marketable securities at the end of fourth quarter. The company is currently debt-free.

Looking beyond the financials, Abiomed had a number of other positive updates to share with investors, and shared guidance that suggests that the good times will continue:

- The company received two label expansion claims for its Impella heart pumps in February. These new indications should expand its addressable market in the U.S.

- Abiomed received FDA approval for a new Impella pump called the CP in early April.

- Also in April, the company won European approval for its Impella 5.5.

- Revenue in the fiscal year 2019 is expected to land between $740 million and $770 million. This represents growth of 25% to 30% over the prior year, and the midpoint of this range exceeds the $747 million that Wall Street was expecting.

- GAAP operating margin is forecast to continue moving higher, to a range of 28% to 30%.

ABIOMED, Inc. Price, Consensus and EPS Surprise

[Source: Zack’s Consensus Estimate, May 9th, 2018]

[Source: Zack’s Consensus Estimate, May 9th, 2018]

FY18 Highlights:

- In fiscal 2018, total revenues were $593.7 million, up 33% from fiscal 2017.

- Fiscal 2018 worldwide Impella heart pump revenues totaled $570.9 million, showing an increase of 35% year over year. In the United States, 2018 Impella revenues totaled $505.1 million, up 30% from 2017.

- Outside the United States, revenues from Impella heart pumps totaled $65.7 million, up 81% year over year. Revenues of $45.2 million came from Germany, up 70% on a year-over-year basis.

- Full-year gross margin was 83.4%, down 70 bps year over year.

- Operating income in the full year came in at $157.1 million, operating margin being 26.5%. Operating margin expanded 630 bps.

- Cash and cash equivalents totaled $399.8 million in fiscal 2018.

What to Look Forward to:

For fiscal 2019, the company expects total revenues in the range of $740-$770 million, reflecting an increase of 25% to 30% over the prior fiscal. Notably, the Zacks Consensus Estimate for revenues is pegged at $753.9 million, which lies within the projected range. Full-year tax rate is expected between 28% and 30%. Impella heart pump worldwide revenues in the quarter under review totaled $198.3 million, up 42% year over year. In the United States, Impella raked in $146.2 million, up 35% from the year-ago quarter.

Outside the United States, fourth-quarter revenues generated from Impella heart pumps was $22.1 million, up a whopping 107%, year over year. Significant contributions came from Germany which recorded $15 million of revenues, up 95% year over year. Recently, the Impella line clinched a plethora of regulatory approvals from the FDA.

All in all, Abiomed proved once again that its business remains on fire. In total, Abiomed continues to provide investors with reasons to believe that its exponential growth rate can continue from here. While shares continue to trade at a nosebleed valuation — the stock is currently selling for more than 27 times trailing sales — I don’t think that long-term investors should be looking to cash in their chips anytime soon.

Analyst Recommendations:

According to analyst recommendations from Yahoo Finance, the current consensus is a “Strong Buy” in ABMD Stock, with 6 dvising a “Strong Buy”, 2 advising a “Buy” and 1 advising a “Hold”.

I Know First’s Success With ABMD:

Current I Know First subscribers received a bullish forecast for ABMD stock on April 10th, 2017. Over the span of the year, from April 10th, 2017 to April 10th, 2018, ABMD stock jumped 139.29% supporting the accuracy of the I Know First algorithm in predicting future stock movements for many time horizons.

Conclusive Thoughts:

ABIOMED ended fiscal 2018 on a solid note. The flagship Impella line continues to drive growth. A string of FDA approvals is encouraging. An expansion in operating margin is also a major positive. The company also has a solid global foothold, which buoys optimism. However, a decline in gross margin raises concern. The company continues to face foreign exchange volatility. Intense competition in the niche space adds to the woes.

I Know First Algorithm Heatmap Explanation:

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day and can be simplified explained as the correlation-based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.

To subscribe today and receive exclusive AI-based algorithmic predictions, click here.

About Abiomed Inc.:

ABIOMED, Inc. (NASDAQ: ABMD), incorporated on June 4, 1987, is a provider of temporary percutaneous mechanical circulatory support devices. The Company offers care to heart failure patients. The Company operates in the segment of the research, development and sale of medical devices to assist or replace the pumping function of the failing heart. The Company develops, manufactures and markets products that are designed to enable the heart to rest, heal and recover by improving blood flow to the coronary arteries and end-organs and/or temporarily performing the pumping function of the heart. The Company’s product portfolio includes the Impella 2.5, Impella CP, Impella RP, Impella LD, Impella 5.0 and AB5000. Its products are used in the cardiac catheterization lab (cath lab), by interventional cardiologists, the electrophysiology lab, the hybrid lab and in the heart surgery suite by heart surgeons.