SAIA Stock Forecast: Road to Growth

This SAIA Stock Forecast article was written by Meiru Zhong – Financial Analyst at I Know First.

Highlights

- The potential for above-market revenue growth results from regional expansion, service differentiation, and yield enhancement.

- Significant quarterly revenue growth compared to the last year leads to $0.79 earnings per share.

- DCF supports the $250 target stock price for Saia, Inc. in 2022, 17% upside potential from the Dec. 29th price of $213.92.

Overview

Saia, Inc. (SAIA) is a leading transportation company focused on transporting less-than-truckload (LTL) shipments across 45 states. The company was founded by Louis Saia, Sr. in 1924 and is headquartered in Johns Creek, Georgia. By the third quarter of 2022, SAIA has 187 terminals, 12,500 non-union employees, and 28,000 tractors, trailers, and forklifts. No single customer represents greater than 5% of shares.

Apart from providing national LTL services, accounting for more than 97% of revenue, the company also provides other value-added services across North America, such as non-asset truckload, expedited, and logistics services.

Significant Revenue Growth Opportunities

Compared to Q3 2021 results, SAIA had a strong quarterly revenue of $729.6 million in the third quarter 2022, an 18% increase. Operating income also grew by 26%, reaching $128.5 million. Operating ratio was 82%, 100 basis point declined compared to 83% in the last third quarter, showing the company’s efficient management to reduce costs when generating sales. Operating margin was increased by 1%, resulting in $0.79 earnings per share.

The increased revenue primarily derives from pricing initiatives, in addition to increased volumes, terminal expansion, and improvements in the mix of business.

Manage pricing and business mix

SAIA tries to maximize profits by managing both the price charged for services and the mix of freight. With the improvements in the economy and the tightening capacity in the industry over the last few years, the company can implement pricing initiatives to increase yields. For example, although LTL shipments per workday decreased 2.5% and LTL tonnage per workday decreased 0.4% for Q3 2022, LTL revenue per shipment rose 20.1% to $359.04 and LTL revenue per hundredweight increased 17.5%, both including fuel surcharge.

Focus on offering best-in-class service

The foundation of SAIA’s growth is high-quality service by delivering on time and reducing claims for lost and damaged. The fined service allows the company to charge premiums and build a strong service brand gaining more market shares.

Increase density in enhanced geographies

SAIA will further pursue geographic expansion and build additional density in new and existing markets by investing in new terminals, tractor and trailer fleets, and new technology. The company opened five new terminals in the third quarter and opened one more in October, totaling new openings 11 at the end of 2022. It will continue the expansion, anticipating another 10-15 openings in 2023. The terminal expansion strategy will help the company provide differentiated service levels.

Net capital expenditures were $278 million during the three quarters of 2022, which increased by 87.3% compared to the previous year. In 2022, the net capital expenditures are expected to be approximately $500 million.

Strong Fundamentals for SAIA

SAIA has a great leverage rate its Total Debt/ EBITDA ratio is around 0.23, compared to the industry average of 1.85 and median of 1.24. This shows the company has a lower bankruptcy risk that its EBITDA can cover about 5 times the total debt.

In terms of profitability, SAIA’s margins are all higher than the industry median. the company’s net margin is about two times the median, reaching 13.1% compared to the industry level at 7.4%. The outstanding performance represents SAIA has the great operating ability and its business strategies regarding pricing action, different services, and terminal expansion have a positive impact on the company’s further development.

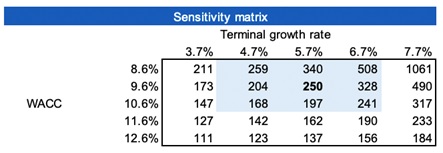

DCF Estimates $250 SAIA Stock Forecast

The DCF analysis shows that SAIA’s intrinsic, 1-year, and 2-year stock price should be around $250, $274, and $294 respectively, which is 17%, 28%, and 37% upside potential from the price of $213.92 on Dec 29th, 2022. It’s clear that SAIA stock price right now is undervalued and it’s a good time to buy in.

The DCF model is built based on the following assumptions:

- The risk-free rate is 3.69% according to the US 10-year zero coupon bond as of November 2022. The risk premium of 4.5% comes from the average figure on the Finbox.

- Beta 1.38 is calculated based on the slope of the change of monthly SAIA stock price and S&P500 price from 2018 to 2022.

- The cost of debt is calculated as a weighted average interest expense of 3.7%, finance lease discount rate of 3.55%, and operating lease discount rate of 4.5%, concluding at 3.8%.

- The tax rate is the effective tax rate derived from the 10-K by averaging the 2020 and 2021 figures.

- The terminal growth rate is assumed as the weighted average of the US economic growth rate of 3% and the company’s perpetuity growth rate of 7.5% from Finbox.

Due to the uncertainties in the macroeconomic environment, it is difficult to accurately predict the impact of relevant risk factors such as epidemics and wars, and the assumption may not be valid. A sensitivity matrix is created to show the impacts on SAIA’s intrinsic stock price by altering WACC (weighted average cost of capital) and terminal growth rate.

Viewpoints from Analysts’ Community

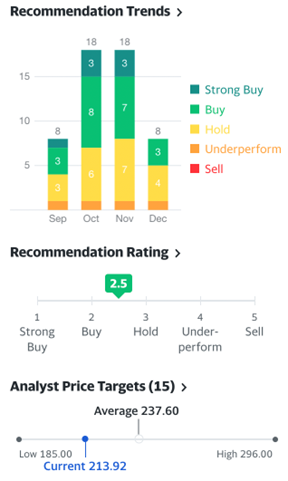

Based on Yahoo Finance, there were 8 analysts presenting recommendation trends on December 2022, among which 3 recommended Buy, 4 Hold, and 1 Underperform. The recommendation rating is 2.5 between Buy and Hold. The average price target from 15 analysts is around $237.6 within the lowest $185 and the highest $296 price range.

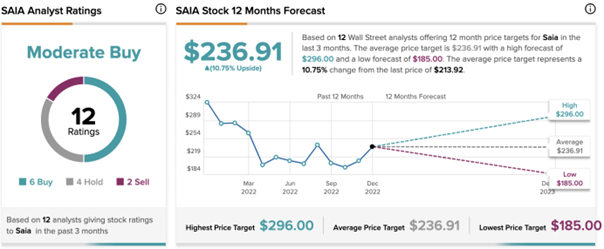

From TIPRANKS, there are 6 Buy, 4 Hold, and 2 Sell from 12 analysts’ ratings in the last 3 months. The expected stock price is $236.91 within the lowest $185 and the highest $296 price range.

Technical Analysis supports the Current Trend

SAIA’s 200-day moving average has still maintained an upward trend. The 15-day moving average line has turned up and might cross the 50-day moving average. Besides, the MACD line has risen to zero line and tangled with the signal line. Although SAIA stock price has a downtrend, it is losing bearish momentum, signaling the price might go up in the future.

For conservative investors, it’s good to wait for a 15-day moving average to cross the 50-day moving average and the MACD to cross zero and the signal line to confirm the buy signal. For active investors, the chart gives us a good sign and it’s a choice to buy, confirming our fundamental analysis and DCF forecasting results.

Conclusion

I take a buy-side on SAIA stock because the DCF target price is $250, a 17% upside difference from the current price. Nowadays, the company is actively taking action to maximize profits and sustain the growth trend. Its strong fundamentals support its further development in volatile times.

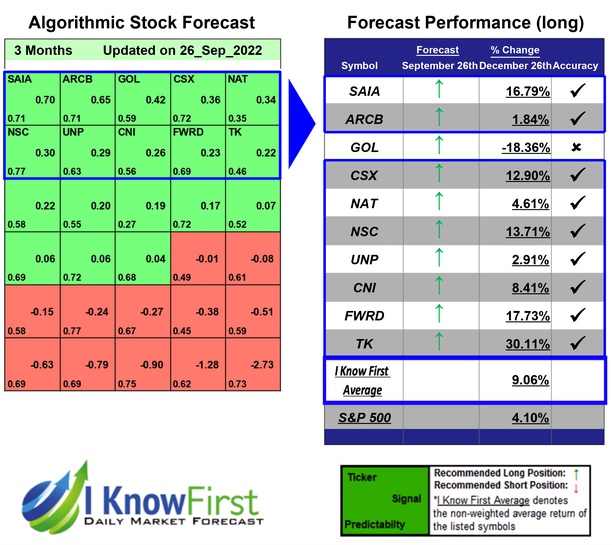

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the SAIA stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

Past Success with SAIA Stock Forecast

I Know First has been bullish on the SAIA stock forecast in the past. On September 26th, 2022 the I Know First algorithm issued a forecast for SAIA stock price and recommended SAIA as one of the best transportation stocks to buy. The AI-driven SAIA stock prediction was successful on a 3-month time horizon resulting in more than 16.79%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.