Apple Stock Prediction: Why Apple Is Preparing Its Entry In Video Games

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Apple Stock Forecast for 2018

Summary

- Apple is apparently still very interested to make its Apple TV a go-to console for home video gaming.

- Apple recently updated its trademark for Apple TV with a focus on video games and new video game technology.

- This is understandable. The global software/hardware revenue from video games is estimated to reach $165-to-$170 billion in 2018. It could hit $230 billion by 2022.

- Apple’s trademarking act hints it wants to sell its own video games-related peripherals for Apple TV. It might also license its own video games technology to third-party developers.

- I’m a firm believer in the huge opportunities present in the fast-growing video games industry. AAPL, therefore, is a buy.

Apple (AAPL) recently updated its trademark for Apple TV for video games-related hardware and software. Apple spent $16,000 to update this trademark in over 60 countries. Going forward, Tim Cook plans to make Apple TV a legitimate alternative to video game consoles like the PlayStation and Xbox. The global video games industry is now expected to generate revenue of $165-$170 billion dollars this year. Selling video game consoles and controllers can help Apple offset the expected stagnation of iPhone/Mac sales.

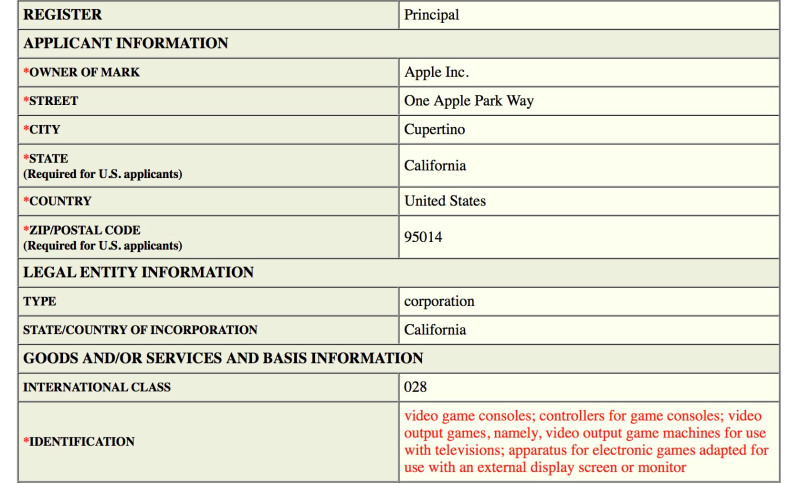

It is easy to conclude that Apple plans to sell its own video games-related hardware. Based on the screenshot published by the USPTO, Apple’s filing specifically listed video game consoles and controllers for video game consoles.

(Source: USPTO)

Let us not forget that Apple now designs its own graphics processing units [GPU]. It has the ability to create a powerful game-centric System-on-Chip using its ARM-based A-series processors. The massive commercial success of Nintendo’s (NTDOY) ARM-based Switch console is great example of what Apple could possibly achieve marketing its own console.

Apple has more than $200 billion in cash reserves it can use to entice game developers to build for its future video games platform. The Nintendo Switch’s success is largely due to the strong support it received from video game developers and publishers.

Further, Apple is actually rich enough to buy Sony and Nintendo. But I don’t think Apple will consider buying those two Japanese companies. Apple’s emerging plan is to gradually elevate Apple TV as an all-in-one entertainment box for video games and video/TV streaming.

The Video Games Industry Is Bigger Than Hollywood

Apple already gets a 30% cut in mobile games revenue ($48 billion generated last year, majority of which processed though the iTunes app store). However, the console gaming industry is still a hefty $27 billion/year industry. Apple doesn’t have any share in this market. The recent trademark filing signaled that Apple also wants its share from the console gaming business.

Apple needs expansion markets to offset its peaking iPhone and iMac sales. The fast-growing video games industry is an easy expansion move for Apple. Apple might even boost the entire stagnating console gaming industry once it launches its own equalizer to the PlayStation, Xbox, and Switch. Apple’s brand power and its legion of loyalists could likely lead to annual sales of at least 5 million units.

There is also higher margin possible in selling video game consoles than on TV boxes. The latest Apple TV 4K retails for just $149. A game-focus Apple TV box could possibly retail for $399 or more. Apple could also sell $99 game controllers and other peripherals.

My fearless forecast is that Apple could possibly operate its own subscription-only cloud gaming service in conjunction with its Worldwide Video platform. Microsoft (MSFT) and Sony (SNE) have healthy subscription-based gaming service for their respective game console customers.

Apple could just rent a global-wide server from Amazon (AMZN) Web Services or Microsoft’s (MSFT) Azure to jumpstart its future $14.99/month cloud gaming service.

My Takeaway

I am a heavy bettor on video games-related companies. Apple’s emerging plan to directly get involved in video games is one more strong reason to go long on its stock. Tim Cook is doing right targeting the $160 billion/year video games industry. I believe Apple could gain better margins in video games than in paid TV/video streaming. Amazon and Netflix (NLFX) are going to be tough rivals for Apple’s WorldWide Video service

Further, in the saturated smartphone business, there are only three companies active in the video games console, Microsoft, Sony, and Nintendo. The ARM-based Switch gaming console proved that developers and gamers want an alternative to the x86-based consoles of Sony and Microsoft.

AAPL is a buy. My recommendation is in line with its bullish near and long-term algorithmic forecasts from I Know First.

Hedge fund activity on AAPL is also very positive. Tipranks’ chart below shows Warren Buffett’s Berkshire Hathaway recently increased its exposure by 23.30%. Going long AAPL now is therefore highly recommended.

(Source: TipRanks)

Past I Know First Forecast Success with AAPL

I Know First’s algorithm has made accurate predictions on AAPL in the past, such as its bullish article published on September 28th, 2017. Since the September 28th, 2018 forecast, AAPL shares increased by 11.61% in line with the I Know First algorithm’s forecast. See chart below.

(Source: Yahoo Finance: AAPL)

This bullish forecast for AAPL was sent to I Know First subscribers on September 28th, 2017. To subscribe today click here.

I Know First Algorithm Heat-map Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm, allowing the user to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.