MU Stock Predictions: Micron Can Still Hit A New 52-week High This Year, Maybe $43

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

MU Stock Predictions

Summary:

- Micron’s stock posted a new 52-week high price of $38.46 on September 28.

- The big beat on Q4 ER numbers last September 26 is fueling a bull rush for Micron. I am betting MU can hit $42 before 2017 ends.

- The short supply and high prices for DRAM and NAND will persist to 2018. Micron therefore has more upside potential. DRAM accounts for 66% of Micron. NAND is 30% of revenue.

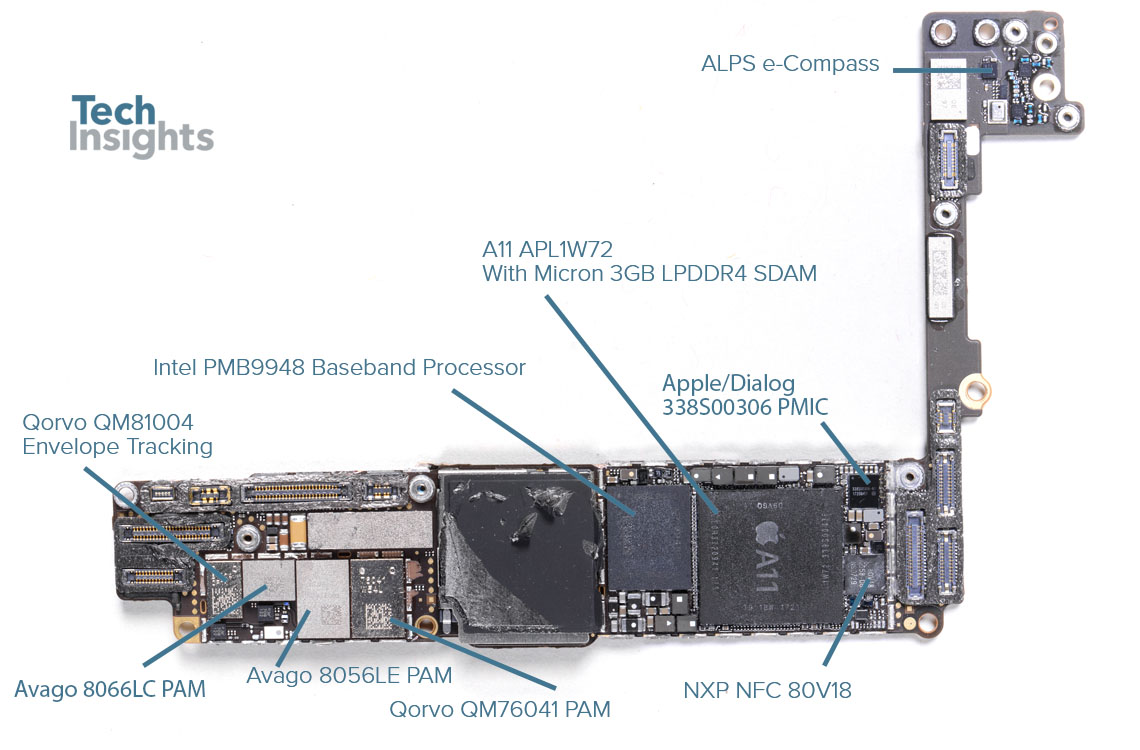

- An iPhone 8 Plus teardown confirmed that Apple is still using Micron mobile DRAM.

- Micron is also a beneficiary of the high prices and tight supply of discrete GPUs caused by crypto-currency mining.

If you went long Micron (MU) this week before it reported its Q4 FY2017 earnings last September 26, you would have gained at least 8% in capital appreciation. The big beat on both EPS and revenue is boosting Micron’s stock. MU posted a new 52-week high of $38.46 yesterday. This underappreciated tech stock is getting more respect.

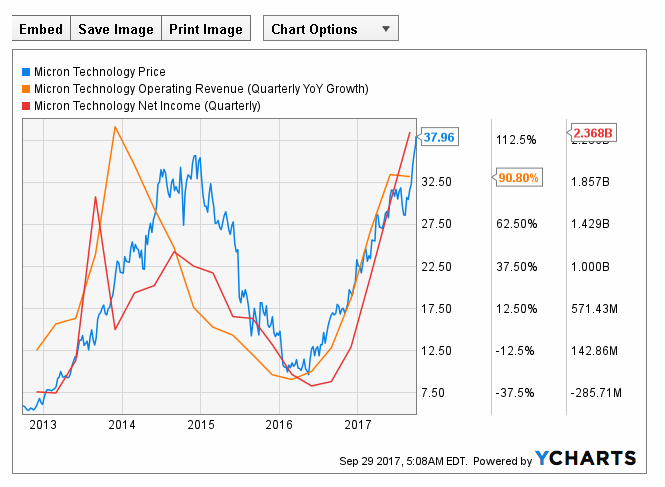

Micron finished its FY 2017 business period with net sales of $20.32 billion, 64% Y/Y higher than FY 2016’s $12.40 billion. Micron’s FY 2016 net income was only $273 million. For fiscal year 2017, Micron had a net income of $5.65 billion, a 2,000% Y/Y increase.

However, I am still betting that MU will achieve another 52-week high before 2017 ends. The persistent undersupply in DRAM and NAND will continue until 2018. Micron therefore is in a blissful, profitable situation right now. Buying more MU shares is justified.

The high prices for DRAM and NAND are favorable catalysts for its stock. Investors accordingly reward MU’s stock when its memory and storage products are doing well.

Micron stock’s one-year return is already 117%. MU has outperformed its DRAM and NAND rival, Samsung over the last 12 months. However, I insist that Micron deserves a higher stock price due to its undervaluation compared to its peers in the semiconductor industry.

(Source: Google Finance)

The industry trend is favorable to Micron and yet investors aren’t still giving this company’s stock fair valuation. CapitalCube’s charts below illustrates why MU is still set for more upside. Micron’s stock has lower P/E, P/B, P/S, and Price/EBITDA ratios than the median ratios of its industry peers.

(Source: CapitalCube)

My Fearless Forecast

I opine that MU can probably hit $43 before December 31. The upcoming Black Friday/Christmas shopping events are going to force server board/video cards/PC/phone/tablet manufacturers to buy DRAM and NAND products at any price. DRAM and NAND components are necessary to keep key electronic products in full production rate.

Micron can set any reasonable price for its PC and mobile DRAM/NAND products and customers will snap them up. Finviz’s chart below says my 90-day price target of $43 for Micron is lower than Wall Street’s consensus price target for MU, which is $44.69. Finviz’s data is prior to MU’s Q4 2017 earnings report.

Other Wall Street analysts have raised their PTs for Micron to as high as $54. The general expert sentiment is favorable toward my 90-day $43 PT for Micron. Analysis of the weekly and technical indicators and moving averages of MU are also endorsing a buy. I am therefore highly confident about my bullish bet that MU can hit a new 52-week high before this calendar year ends.

(Source: Investing.com)

Micron Benefits From The $150 billion Cryptocurrency Mining Industry

It’s been discussed before that Micron benefits from sales of smartphones, tablets, desktop PCs, laptops, and server racks for the datacenter industry. TechInsight’s teardown of the iPhone 8 Plus confirmed that Apple is still sourcing its mobile DRAM from Micron. Micron’s mobile DRAM business will continue to flourish as long as Apple is a customer.

Here’s another tailwind that’s boosting Micron’s DRAM sales. The $150 billion cryptocurrency industry is also a bonanza for Micron. Micron supplies the embedded DRAM component of GPUs (Graphics Processing Units) made by Nvidia (NVDA). Like DRAM/NAND components, retail GPU products are also experiencing persistent shortage and high prices.

This is because of Ethereum cryptocurrency miners. Unlike Bitcoin, Ethereum is a GPU-only mineable cryptocurrency. As long as Ether’s price trades above $250, miners will keep the pressure on Nvidia to produce more GTX 1070 and GTX 1060 GPUs. Nvidia is likely willing to pay any price that Micron asks for its GPU DRAM to keep GeForce video cards’ at optimal production rate.

Micron’s GDDR5X GPU RAM is essential to gaming, workstation, datacenter/AI GPU acceleration, and cryptocurrency mining.

Conclusion

I believe Micron’s rivals Samsung and SK Hynix will keep their DRAM and NAND production rate reasonable enough to maintain the current high prices. Intentional control of how much supply is available is a valid business strategy. Like oil, flooding the market with too much DRAM and NAND products will bring down the price tags.

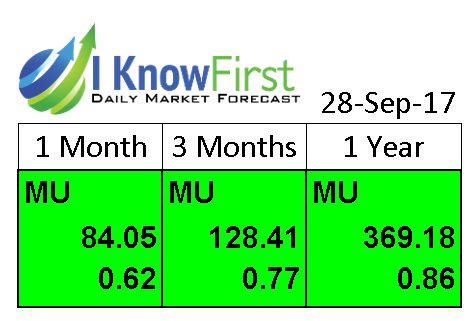

My buy rating for MU is strongly backed by its very bullish algorithmic forecasts from I Know First. MU’s 3-month market trend forecast is above +100, which is favorable for my 90-day $43 PT. I Know First’s accuracy rate for correctly predicting the 90-day trend movement of Micron is very high, 0.77.

Past I Know First Forecast Success with MU

I Know First’s algorithm has made accurate predictions on MU in the past, such as its bullish article published on September 2nd, 2016. In the article, it explains that Micron’s stock currently touts strong buy signals from the algorithmic forecasts of I Know First. The 1-month, 3-months, and one-year algorithmic forecasts of Micron are all very high. The predictability factors of the 3-month and 1-year forecasts are also above 0.5. The probability is therefore favorable that Micron stock will eventually hit $20 before 2016 ends. In the one year prediction from September 2nd, 2016 to September 2nd, 2017, MU shares increased by 95.21% in line with the I Know First algorithm’s forecast. See chart below.

(Source: Yahoo Finance: MU)

This bullish forecast for MU was sent to I Know First subscribers on September 2nd, 2016. To subscribe today click here.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.