Boeing Stock Analysis: Here Is A Better Way To Fly

This article was written by Mingyue Liu, a financial analyst at I Know First.

Boeing Stock Analysis: Here Is A Better Way To Fly

“The battle for the inch and the battle for the butts-on-seats is—in the end—a battle for the birds in the sky.” (Marisa Garcia)

Summary:

- What to expect for Boeing in the foreseeable future

- Rationale behind the Bullish expectation for BA

Business Description

The Boeing Company (Boeing) is an aerospace company that manufactures commercial and military aircraft and space, defense and security systems. Apart from the aircraft, Boeing develops, designs, manufactures, and integrates weapons, electronic and defense systems, launch systems, advanced information and communication systems, and satellites. The company has a history of over 100 years. Its headquarters are located in Chicago.

Boeing is one of the largest global aircraft manufacturers, the second-largest defense contractor in the world based on 2015 revenue, and the NYSE’s largest Aerospace company by market cap.

Boeing operates in the following five principal segments:

The Commercial Airplanes segment develops, produces and markets commercial jet aircraft and provides related support services, principally to the commercial airline industry worldwide. This segment also offers aviation services support, aircraft modifications, spare parts, training, maintenance documents and technical advice.

Boeing Defense, Space, and Security (BDS) is one of Boeing’s five divisions. Demand for BDS are mainly driven by United States Department of Defense, which accounted for over 60% of BDS 2016 revenues; NASA; international defense markets; civil markets and commercial satellite markets. BDS consists of three capabilities-driven businesses: BMA, N&SS and GS&S.

- Boeing Military Aircraft Segment is engaged in the research, development, production and modification of manned and unmanned military aircraft and weapons systems.

- Network & Space Systems Segment serves demand for strategic defense & intelligence systems and satellite systems. This segment also includes joint venture operations related to United Launch Alliance.

- Global Services & Support Segment provides customers with mission readiness through total support solutions. This segment offers a full spectrum of products and services, including supply chain management and engineering support; maintenance, modification and upgrades for aircraft; and training systems and government services, including pilot and maintenance training.

Boeing Capital Corporation (BCC) is a global provider of financing solutions. It seeks to ensure that Boeing customers have the financing they need to buy and take delivery of their Boeing product and manages overall financing exposure. Airplane industry has been characterized by the duopoly competition between Boeing and Airbus, which is based in Blagnac, France. At the forthcoming Paris Air Show in Le Bourget form June 19 to 25, there is a dogfight to expect between these two leading players.

What To Expect From Boeing

Boeing 737 MAX 10

Boeing is scheduled to officially launch its 737 MAX 10 on the first day of Paris Air Show, which is designed to compete with Airbus’s A321neo. The Boeing 737 MAX 10 would feature a larger engine, stronger wing, adjusted landing gear and a fuselage stretched by 6-7 ft. The stretch and structural upgrades would allow it to add 12-18 seats over the 737 MAX 9, growing single-class capacity to 230 seats and two-class capacity for 185-190 passengers.

However, Airbus seems to be dismissive of Boeing’s launch, “We’re not particularly worried about that airplane going forward,” John Leahy, Airbus’s COO said.

Well, it is true that Airbus could find any reason, if it will, to think less of the 737 MAX 10. Even with its extended capacity, the 737 MAX 10 is still ten passengers less than the Airbus 321neo in single-class configuration, and up to 5 passengers less of the two-class configuration. At least it appears that MAX 10 is not noticeably better than 321neo. However, if you think that customers are only chasing after functionality in airplane industry, chances are you are wrong. Most carriers stick to one specific jet family, and customer loyalty is another important feature of this industry. It was loyal customers like Korean Air that pressed Boeing to develop a larger variant than MAX 9. Besides, the 737 MAX 10 offers basically the same capacity yet with lower fuel consumption and greater range. Overall, it is believed that 737 MAX 10 offers 5% lower cost per seat than its counterpart.

Numbers speak in favor of 737 MAX 10 as well. According to Bloomberg, Boeing is closing in on about $5 billion in orders from two Asian carriers for this aircraft. The Airbus 321neo used to sweep MAX 9 with a margin of nearly 7-to-1. Taking into account the unallocated order of MAX 10, the margin is now approaching 4-to-1. You may think this is still a thorough failure for Boeing, but you need to know that this is even before MAX 10’s launch. Airlines companies are investing simply in the idea of the MAX 10.

No one, even including Boeing itself, is expecting MAX 10 would reverse the advantage of the Airbus 321neo in the existing market. The MAX 10 is more than likely to serve as a bridge to Boeing’s final solution to the middle-of-the-market (MoM) segment, which is believed would define total airplane industry over the next two decades. The MAX 10 is the perfect candidate to narrow the gap with the Airbus 321neo, and prevent loyal customers from turning to Airbus’s spectrum of products and services. This can actually grant Boeing the edge over Airbus in terms of developing new middle-sized airplanes (NMA), because Airbus is very likely to hold back the development of NMA to refine the Airbus 321neo, in the hope win back the market share.

Boeing 737 MAX 10X (Source: Boeing Company)

Boeing 777X

Launched at the 2013 Dubai Airshow, the 777X is what to expect next for Boeing. The 777X will have two variants: the 777-8 and the 777-9. Deliveries are expected to begin in December 2019. The 777X family is Boeing’s answer to the Airbus 350.

The 777X would be both the largest and the most efficient twin-engine jet in the world. The 777-8 will carry a maximum of 375 passengers, and 777-9 will be able to carry up to 425. With its folding wing-tip design, even featured with the huge wingspan, the plane is good for any airports. The plane will burn 20% less per seat of fuel than the previous 777-300ER. Besides, Boeing continues to improve the flight experience of both passengers and pilots. It originally implemented touch-screen to cockpit deck, providing safer and more efficient solution to slight operation. The cabin will be wider, including 15% larger windows, new lighting, and a more comfortable AC system.

Market responded positively to this new jumbo jet family. The national carriers of at least five countries have already put down firm orders, including Lufthansa in Germany, Etihad Airways in UAE, Cathay Pacific in Hong Kong, Emirates in the UAE, Qatar Airways in Qatar and All Nippon Airways in Japan. In total, Boeing currently has orders for over 340 planes.

Concerns may focus on the intense competition among players, and decrease in flight traffic due to the fragility of the political world. It is true that this industry, even with its duopoly feature, is vet competitive. However, there was never a lack of passengers historically. Besides, powered by emerging countries and regions such as China and India, global passenger traffic through April this year has risen 7.9 percent year-on-year, according to the International Air Transport Association. All in all, there are still good reasons to hold positive attitudes towards the future of the airline industry. Boeing, as the leader of this industry, is expected to effectively capture future growth.

Boeing 777-9 (Source: Boeing Company)

Conclusion

I believe there are enough reasons to have faith in Boeing Company, whose technology progress and management improvement have been underappreciated by the market. My reasons are listed as follows:

- Expected success with launching the 737 MAX 10 at the Paris Air Show and the potential in the 777X family, which have been elaborated in the previous section of this article.

- Growth opportunities, such as middle-of-the-market (MoM), can bolster the long-term growth of the company. MoM is a concept that was first introduced by Boeing, which is used to define the market between the high-end of narrow-body aircraft and the low-end of wide-body aircraft. This market is where a total demand for 4,000 jets comes, estimated by Boeing. Market estimates vary, but are approaching to a consensus with Boeing. With the advantageous position ahead of its peers in this niche market, Boeing can hopefully have a bulk of this pizza.

- Lowering of fares and rapid surge of middle-class travel in emerging markets, such as China, provide strong support to demand increase, which has been proved by actual industry data. International Air Transport Association’s research shows that global passenger traffic through April this year has risen 7.9% compared to last year. Under this trend, demand is expected to remain robust.

- Boeing’s achievements in improving productivity making truce with labor union have not been fully appreciated by the market. Productivity can be directly translated into margin improvement, which will provide traction for the company’s financial performance. Peace with labor union diminish the risk of labor strike, which, has been proved by the history, can be devastating to a company.

Source: Deutsche Bank, company reports

Source: Deutsche Bank, company reports - In 2017, the company made a significant change to their compensation metrics. The new model is to focus more on free cash flow generation, EPS, and sales, which are topics that equity investors care the most. This alternation serve better to investors’ interests, which I believe will soon be properly appreciated by investors.

- Another potential growth opportunity would be Trump’s election. Donald Trump, compared with his predecessor, is widely believed to be more aggressive in terms of budget for defense strategy, which can potentially provide unexpected increase in demand for Boeing’s BDS segment.

Our bullish position on BA resonates with I Know First forecast released on June 22, 2017. The predictability increases in the long term, indicating BA is a buy in the long run.

Past I Know First Algorithm Successes With BA

I Know First published an article on June 23, 2015, expressing our bullish expectation on BA. Since then, the stock price has rocketed by over 50%, showing another success of I Know First algorithm in forecasting stock movement.

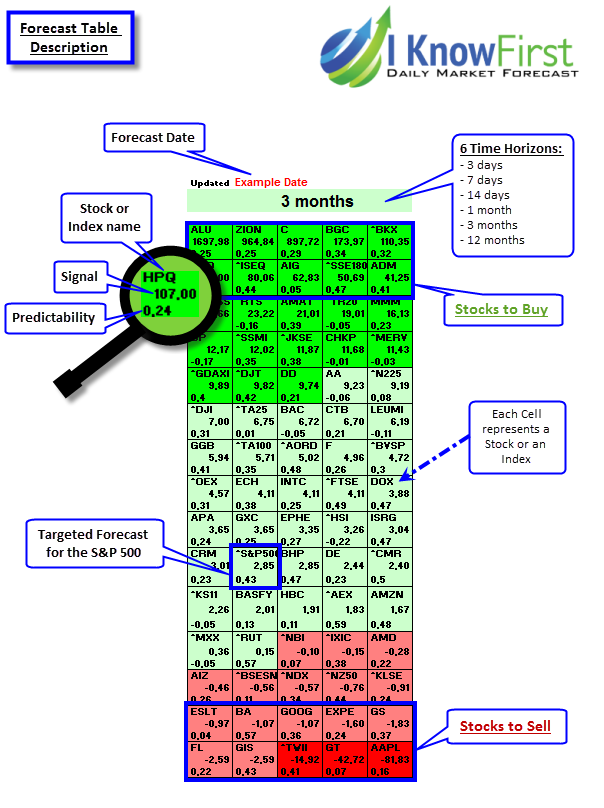

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go. (positive = to go up = Long, negative = to drop = Short position). The signal strength relates to the magnitude of the expected return. We use the signal strength for ranking purposes of the investment opportunities. Predictability is the actual fitness function being optimized every day and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. It allows the user to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.  To subscribe today and receive exclusive AI-based algorithmic predictions, click here.

To subscribe today and receive exclusive AI-based algorithmic predictions, click here.