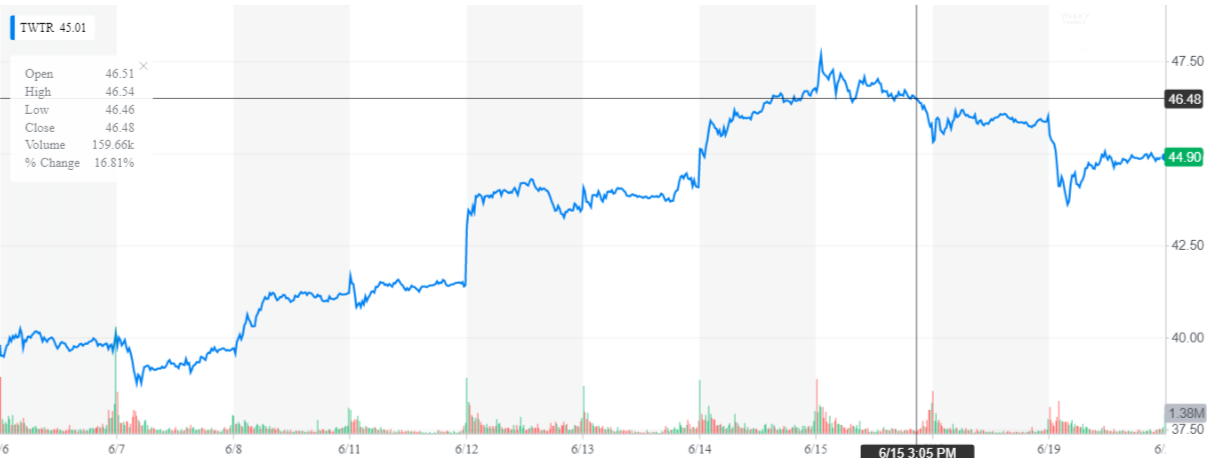

Quick Win by the Algorithm: Twitter, Inc. (NYSE: TWTR) Returns up to 16.61% in 7 Days

“The great thing about social media was how it gave a voice to voiceless people” -Jon Ronson

(Source: Public Domain Photos)

Twitter operates a platform for expression and conversation between the public world. The company offers various products and services for users, advertisers, developers and data partners. Such products and services include Periscope, Twitter, Promoted Tweets, Promoted Accounts, and Promoted Trends. Incorporated in 2007, the company currently has 336 million monthly active members.

On June 17th, I Know First gave a bullish 7 day forecast for TWTR. Since then, Twitter has seen a return of 16.61%.

(Source: Yahoo Finance)

Why did Twitter see a 16.61% return since the forecast? These various reasons include the S&P 500 including TWTR in its index, the announcement of $1 billion convertible bonds, and an increase in target price.

The S&P 500 Learns How to Tweet

Coming as a shock to investors, on June 6th it was announced that the S&P 500 would include TWTR in the index before trading starts on the 7th. Following this news, TWTR was up more than 5%. This was great news for Twitter because now mutual funds and ETFs who track the S&P 500 must now purchase mass shares of Twitter in order to weigh their portfolio properly.

More Bonds Mean More Money

On June 7th, Twitter announced a $1 billion principle amount of $.025 convertible bonds due in 2024. The company fully expects to bring in around $989 million from the notes after discounts and expenses settle in. Investors were happy and looking forward to future expenditures that this income will provide. The money will also be used to pay back previous bonds that expire in 2019. TWTR increased by 0.8% to a three year high after the announcement.

Analyst’s Confidence in TWTR’s Future

Following this, on June 12th a JP Morgan analyst said Twitter’s stock target was $50 per share, an increase from the previous $39 a share. The analyst stated “We are raising our estimates on TWTR shares as we believe advertising momentum is strengthening, particularly among large marketers,”. Investors rallied behind this forecast and shares rose by 5.5%.

Next, Twitter’s shares jumped by 6% on June 14th. Investors were still riding on the momentum of the previous week’s news and are confident in Q2 earnings. According to Zacks Consensus, Q2 is looking bright for Twitter: EPS is expected to rise 112.5% to $0.17 and revenue is projected to increase by 20% to $2.93 billion.

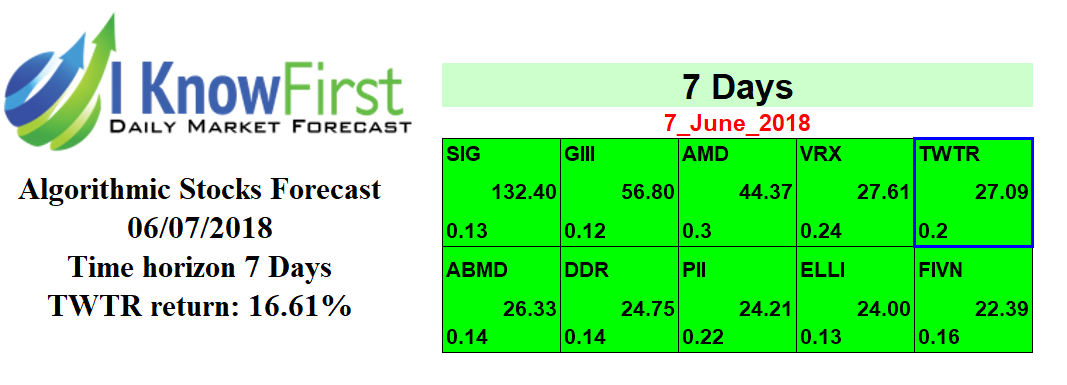

On June 7th, I Know First gave a bullish 7 day forecast for Twitter, Inc. (NASDAQ: TWTR). The Forecast shows a signal of 27.09 and a predictability of .2. In agreement with the forecast, TWTR has returned 16.61% over the 7 day period, demonstrating the accuracy of the I Know First Algorithm.

Current I Know First subscribers received this bullish TWTR forecast on June 7, 2018

To subscribe today click here.