Himax Stock Forecast: Himax Is The Best Stock To Profit From Virtual & Augmented Reality

![]() Naman Shukla is an Analyst at I Know First. He writes and invests in the stock market. Ranked in the top 8 percentile in TipRanks.com. Featured on SeekingAlpha.com, GuruFocus.com, Valuewalk.com among others.

Naman Shukla is an Analyst at I Know First. He writes and invests in the stock market. Ranked in the top 8 percentile in TipRanks.com. Featured on SeekingAlpha.com, GuruFocus.com, Valuewalk.com among others.

Himax Stock Forecast

Summary:

- There is more to Himax than just virtual reality and augmented reality.

- The company’s core business is growing, which is a good sign.

- Augmented and Virtual Reality markets represent a great opportunity for Himax.

- Although expensive, Himax is a great buy for growth investors.

- I Know First maintains a bullish forecast on Himax.

Himax Technologies (HIMX) is a semiconductor company based in Taiwan which manufactures and design components used in display imaging technology for smartphones, television display, etc.

Himax Technologies has established itself as one of the best virtual reality and augmented reality stocks in the market. That being said, there is much more to Himax than just AR and VR. Granted that both these markets will probably be the strongest growth drivers over the long-term, but there are other reasons to invest in the stock as well.

Robust second quarter and growth

The virtual reality and augmented reality markets are still in their nascent stages of development, and as a result, do not contribute a lot to Himax’s top-line. However, Himax is still reporting strong growth due to its other businesses.

In the most recent quarter, Himax reported earnings per share of $0.12, $0.02 greater than the analysts’ estimates. The company’s revenue came in at $201.1 million, again beating the consensus by $2.49 million. Revenue of roughly $201 million signifies an 11.5 percent sequential growth and 18.8 percent increase year over year growth, which is very impressive.

At present, the company’s business is mainly divided into three segments – large sized panel drivers, small-medium sized panel drivers, and non-driver products. However, the company’s sequential growth was primarily due to the robust sales and increased orders in its small and medium-sized driver IC segment.

With growth from the AR and VR market yet to play out, I think Himax Technologies is a great pick for long-term investors who are looking for growth stocks.

Touch screen display business is not dead yet

Himax Technologies faced several problems in 2015 as the company’s revenue dropped 17.7 percent, and its profits plunged 62.2 percent compared to that in 2014.

Approximately half of the company’s sales come from the small and medium-sized display driver business, such as tablets and smartphones.

However, sales of both have plummeted considerably in the last year. With the decrease of these markets, manufacturers of these products reduced their orders for the components used to create them, which in turn had a negative impact on Himax.

Throughout the prior year, the sale of mobile devices began to move downward mainly due the smartphone upgrade delays by the consumers. One reason for the delay in upgrade cycle is most of the users are waiting to upgrade their smartphones till the price of new smartphone comprising new features drops considerably.

Despite the fact that overall shipments of smartphones are not falling across the globe, competition in this specific segment has contributed to descending pressure on smartphones costs.

However, the revenue generated by small and medium sized business was $90.6 million, a surge of 14 percent sequentially and 9.4 percent year over year. The growth in this segment was primarily driven by smartphone sales, which surged 25 percent year over year as the supply glut of smartphone products in China decreased and the company’s customers launched several new products.

On the other hand, the company’s tablet driver ICs also displayed growth for the first time after several successive quarters of decline.

All the data shared by the company specifies credibility to the recovery of its business as the robust growth will help the company post great results as compared to last year. Furthermore, the guidance for the imminent quarter also confirmed the recovery.

(Source:touchuserinterafce.com)

(Source:touchuserinterafce.com)

Virtual and Augmented Reality

However, with smartphone market nearing its peak, it would be unwise to not talk about Himax’s future growth drivers, that is, Virtual and Augmented Reality market.

As detailed above, the company is observing a healthy rebound in its core display driver business, which accounted for around 78.6 percent of revenue in 2015. However, the rest 21.4 percent of business revenue is evolving as the new trailblazer of growth for the company.

Apart from the display driver, the company’s non-display technology is also showing positive signs of growth. In the case of the non-display driver segment, the company’s offerings consist of timing and touch display controllers, AR and VR, and image sensors.

In the most recent quarter, the company’s non-driver revenue surged 34 percent y-o-y. The company is taking various steps to prolong its operations so as to increase volumes. As an outcome, it is likely that the company will share only single digit growth (around 7% to 9%) in the coming quarter, whereas y-o-y growth is still projected to come in the double digits.

To put the growth VR and AR market into perspective, Niantic recently released its new augmented reality based game, Pokémon Go, which rose to fame at a rapid rate. Pokémon Go users are increasing gradually, and presently there are over 20 million active users. This game is available in AR as well as normal mode and just goes to show the true potential of AR and VR in several industries.

However, VR and AR are still in their infant stage of development but are growing progressively with time. This game is basically a glimpse of AR which signifies that there is lot to come in the imminent years.

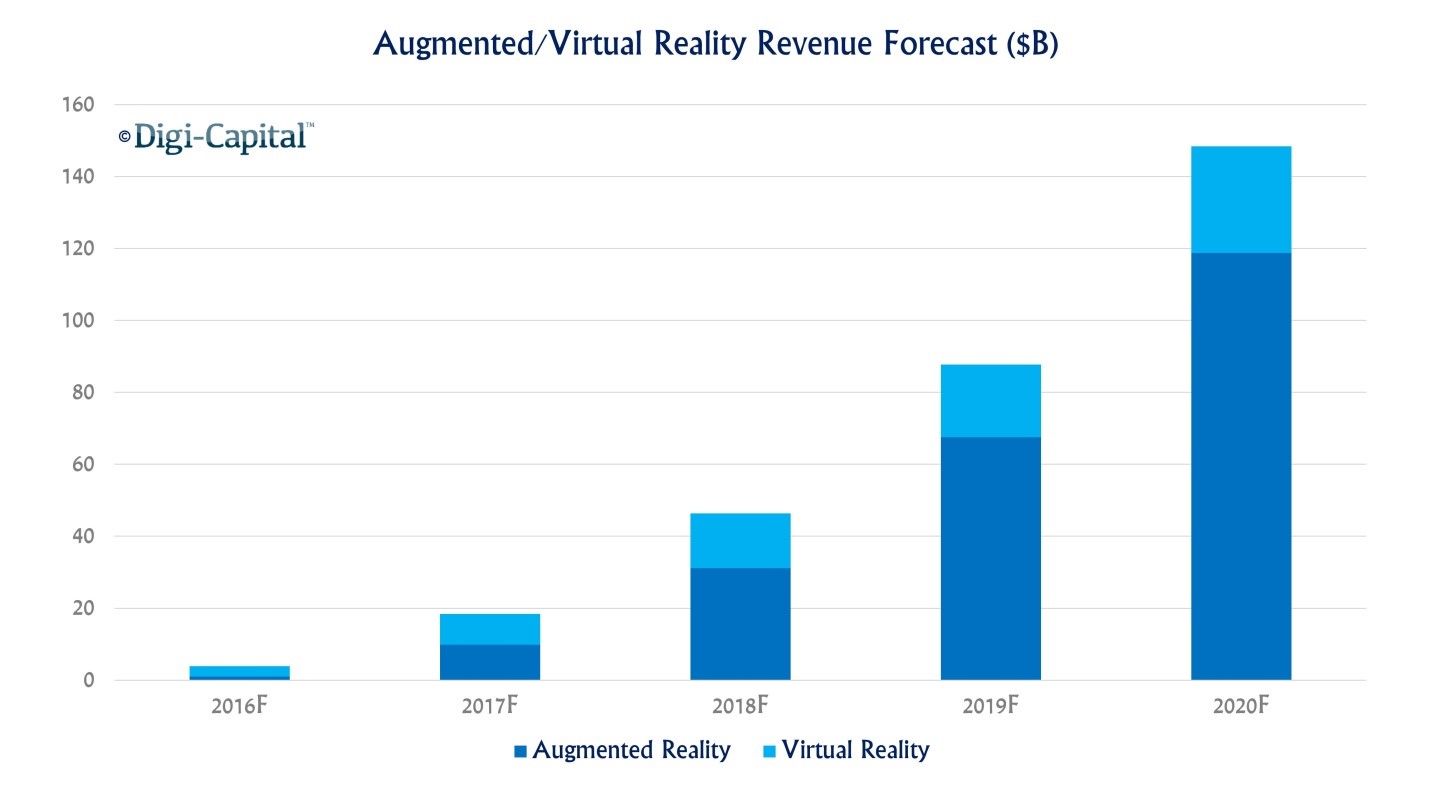

As evident from the image below, the market is expected to grow exponentially. With time, the adoption of VR and AR will become more mainstream, which will ultimately benefit the early movers of the industry like Himax Technologies.

(Source: digi-capital.com)

(Source: digi-capital.com)

Conclusion

In my opinion, Himax Technologies is currently the best play to profit from the AR and VR market. Although at 44 times trailing earnings, the stock may seem expensive, but its potential is huge. Even if the company manages to cater to a small portion of the AR and VR market, it will easily grow into the valuation.

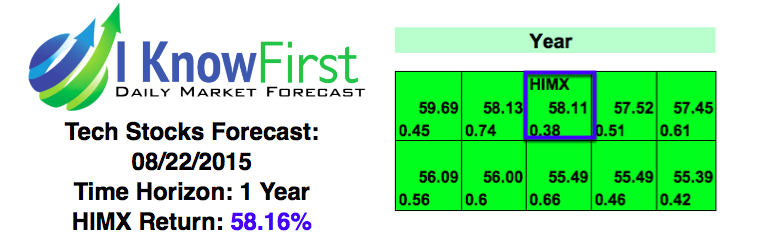

My bullish stance on HIMX is resonated by I Know First’s algorithmic signals. As you can see from the image below, the green 4.57, 7.60, and 242.94 forecast indicates that I Know First’s algorithm expects Himax to perform well in the short as well as long term.

HIMX is up more than 15% since I Know First’s bullish forecast in December 2015.

Past I Know First Forecast Successes with HIMX

I Know First has been bullish on HIMX in the past, as shown below. Since a previous article, published on December 2015, by one of our analysts, the stock has gained 30%. In addition, a Quick Win was recently released, showcasing an increase of 58.16% in HIMX stock price in 1 year.

This bullish forecast for HIMX was sent to current I Know First subscribers on August 22, 2015.