Netflix Stock Prediction: Netflix’s Growth Is Helped By Carriers Offering Unlimited Video Streaming

![]() The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Netflix Stock Prediction

- T-Mobile is the first major U.S. carrier to offer unlimited video streaming from Netflix to mobile device users.

- Other carriers might also follow suit and offer unlimited Netflix streaming to their mobile subscribers.

- This carrier-backed move to make mobile video streaming free of data cap limits should encourage more Americans to binge on their Netflix usage.

- Netflix has Strong Buy signals from technical indicators. Algorithmic forecasts are also favorable for Netflix.

Netflix (NLFX) saw its stock more than double in price (+130% YTD) this year. However, I still see further upside potential for NFLX once more investors realize the long-term impact of T-Mobile’s (TMUS) decision to offer unlimited mobile video streaming from Netflix, HBO, and Hulu.

Instead of charging its mobile subscribers for excess data usage due from video streaming, T-Mobile plans to offer free unlimited video streaming. This is a brilliant move by T-Mobile because it will definitely attract subscribers. Consequently, Netflix’s subscription growth might see a steep uptrend once more major carriers imitate the move of T-Mobile.

Netflix, as the biggest premium subscription-only streaming video service provider in America, is the top beneficiary when Americans can use their phones and tablets to binge on movies and TV shows. The future of the streaming video industry really belongs to the mobile device sector.

T-Mobile’s move is very favorable to Netflix because the unlimited free streaming offer excludes Alphabet’s (GOOGL) and Facebook’s (FB) video streaming services. Alphabet has recently launched its ads-free $9.99/month YouTube Red subscription service.

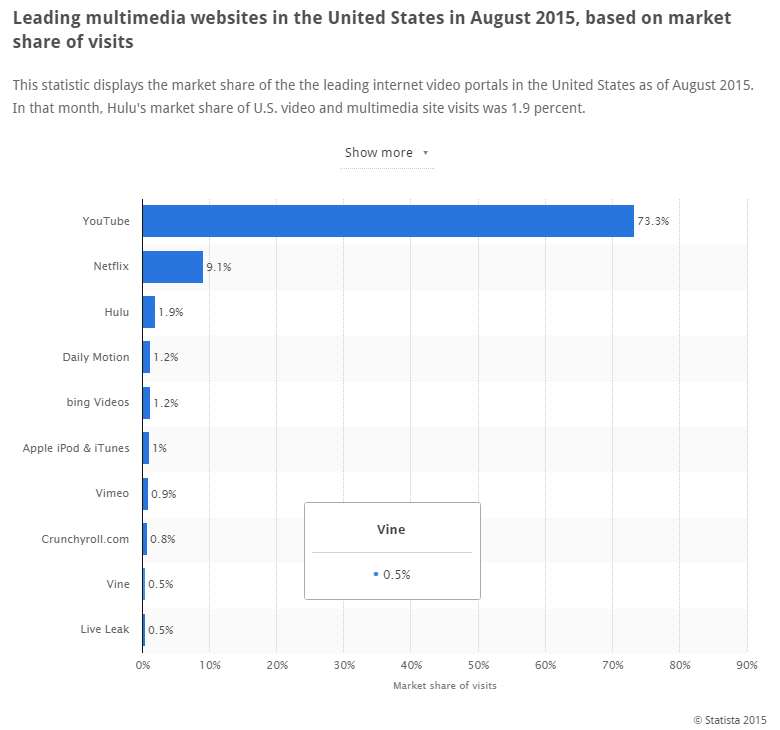

The exclusion of YouTube means YouTube Red subscribers are not going to benefit from T-Mobile’s new campaign. Americans actually have a great love for the free-to-stream YouTube. It’s far more popular than Netflix in terms of overall web traffic usage in America.

Netflix’s future growth prospect is a little stronger when a U.S. carrier ignore the net neutrality rule to favor Netflix content over the streaming video services of Alphabet and Facebook.

Mobile Is The Future Of On-Demand Premium Video Streaming

Cisco already predicted last year that video content will account for 84% of internet traffic in the U.S. We also know that the combined sales of smartphones and tablet are now growing faster than sales of laptops, desktop PCs, and TV sets. It’s therefore justified to presume that T-Mobile’s move is only a reflection of the shift toward more mobile video content consumption.

The current system now is that U.S. mobile postpaid and prepaid subscribers are still not really using their phones or tablets to really maximize the benefit of having a Netflix subscriptions. This is because of the data usage cap limit imposed by wireless carriers.

Now that T-Mobile is breaking free from the usual data cap limit policy on video streaming, Netflix’s mobile app could experience a serious surge in usage. T-Mobile’s offer of unlimited video streaming but in reduced resolution (up to DVD quality 720p only instead of the full 1080p (1920×1080) full HD quality is not really a deal breaker.

After all, the majority of phones today have display sizes less than 6-inches. Even a 480p streamed video will still look good on a 4.7-inch iPhone 6s. The reduced resolution caveat of T-Mobile was necessary. It will help its network lessen the additional bandwidth burden of more people binge viewing streaming videos from Netflix.

Building A Portfolio of Original Shows

More original content from Netflix should also help it ahead of its rivals like Hulu. By coming up with original content like House of Cards and Orange Is The New Black, Netflix saves money by not paying licensing fees to Hollywood content owners. Unlike third-party content, original shows could also really remain exclusive to Netflix.

Almost a third of current subscribers also love Netflix because of its original shows. Reed Hastings, founder of Netflix, said more original content could also inspire subscribers to pay more. Hastings made it very clear that original shows is important for Netflix’s future. Building a franchise out of successful original TV shows that could go beyond third and fourth seasons is a compelling long-term proposition.

Netflix’s move to help produce a $50 million movie is one more reason why investors should consider the possibility that Netflix could become a serious rival to Hollywood studios in the future. Netflix already said last July that it will produce original feature films.

The alleged $60 million payment to produce Brad Pitt’s War Machine movie is a strong hint that Netflix is serious in becoming an original TV show and film content producer.

My Takeaway

Brave investors should still bet on Netflix because of the impending shift toward unlimited mobile video streaming. Netflix is the clear leader in the multi-billion U.S. on-demand video streaming business. Other carriers will eventually have to match the unlimited video streaming offer of T-Mobile. Not doing so could force their current subscribers to defect to T-Mobile.

The importance of indulging Netflix users is essential to wireless carriers – Netflix touts 43.18 million subscribers in America. This is far greater than the 9 million subscribers of second-ranked Hulu. Carriers who wish to secure the loyalty of their mobile subscribers could do so by also making sure their Netflix-using clients are not hampered by expensive mobile data charges.

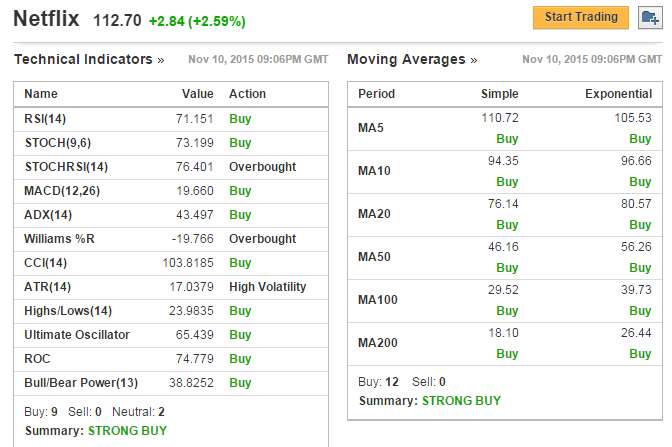

My Buy recommendation is also supported by the short-term and long-term technical indicators of NFLX are also still screaming Strong Buy signals.

(Source: Investing.com)

The algorithmic forecasts for NFLX are also favorable. I Know First Research’s machine-learning algorithm obviously likes the favorable market developments that are helping Netflix continue its momentum. The 14-day, 1-Month, and 3-Month algorithmic forecasts of NFLX are all positive.

This indicates that the stock still has probability to go higher in price. I also like it that the prediction score and predictability rating are also highest on the 90-day algorithmic forecast calculation.

I Know First supplies financial services, mainly through stock forecasts via their predictive algorithm. The algorithm incorporates a 15-year database, and utilizes it to predict the flow of money across 2000 markets. The self-learning algorithm uses artificial intelligence, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets.

The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

I Know First has had success predicting the movement of Netflix’s stock price in the past. In this one-year forecast from November 7th, Netflix had a strong bullish signal strength of 230 and a predictability indicator of 0.54. In accordance with the algorithm’s prediction, the stock price increased 105 % during that time.

Moreover, I Know First also published bullish Seeking Alpha article last year.