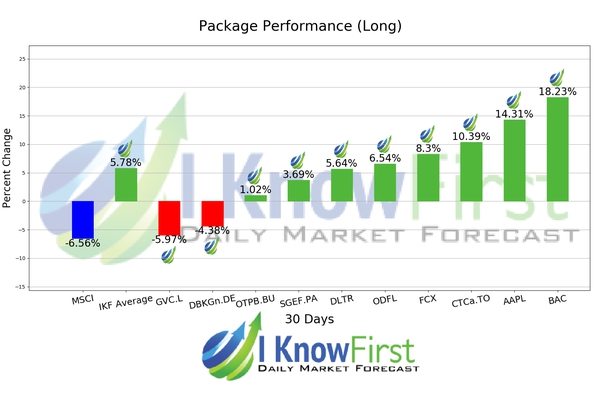

MSCI Stocks Predictions Based on Data Mining: Returns up to 18.23% in 1 Month

MSCI Stocks Predictions

This forecast is part of MSCI Stocks Universe Package and it is designed for investors and analysts who need predictions for MSCI ACWI stocks currently trading on Eastern stock markets, such as Japan, Singapore and Hong Kong. This forecast is part of the MSCI Eastern Stocks Subpackage, one of I Know First’s algorithmic trading tools. The MSCI Stocks Unvierse is based on MSCI ACWI Index (part of the Modern Index Strategy) and captures all sources of equity returns in 23 developed and 24 emerging markets.

- Top 10 MSCI Eastern stocks for the long position

- Top 10 MSCI Eastern stocks for the short position

Package Name: MSCI Stocks Universe – Eastern Markets

Recommended Positions: Long

Forecast Length: 1 Month (7/10/2020 – 8/11/2020)

I Know First Average: 5.78%

8 out of 10 stock prices in this forecast for the MSCI Stocks Universe – Eastern Markets Package moved as predicted by the algorithm. BAC was our best stock pick this week a return of 18.23%. AAPL and CTCa.TO followed with returns of 14.31% and 10.39% for the 1 Month period. The package had an overall average return of 5.78%, providing investors with a 12.34% premium over the MSCI return of -6.56% during the period.

Bank of America Corporation (BAC), through its subsidiaries, provides banking and financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide. It operates through five segments: Consumer Banking, Global Wealth & Investment Management, Global Banking, Global Markets, and Legacy Assets & Servicing. The Consumer Banking segment offers traditional and money market savings accounts, CDs and IRAs, noninterest- and interest-bearing checking accounts, and investment accounts and products, as well as credit and debit cards, residential mortgages and home equity loans, and direct and indirect loans. This segment provides its products and services through approximately 4,700 financial centers, 16,000 ATMs, call centers, and online and mobile platforms. The Global Wealth & Investment Management segment offers investment management, brokerage, banking, and retirement products, as well as wealth management and customized solutions. The Global Banking segment provides lending products and services, including commercial loans, leases, commitment facilities, trade finance, real estate lending, and asset-based lending; treasury solutions, such as treasury management, foreign exchange, and short-term investing options; working capital management solutions; and debt and equity underwriting and distribution, and merger-related and other advisory services. The Global Markets segment offers market-making, financing, securities clearing, settlement, and custody services, as well as risk management, foreign exchange, fixed-income, and mortgage-related products. The Legacy Assets & Servicing segment engages in mortgage servicing activities related to residential first mortgage and home equity loans; and managing legacy exposures related to mortgage origination, sales, and servicing. Bank of America Corporation (BAC) was founded in 1874 and is based in Charlotte, North Carolina.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.