MSCI Indexes Predictions Based on Machine Learning: Returns up to 75.81% in 3 Months

MSCI Indexes Predictions

This MSCI Indexes Predictions forecast is part of MSCI Stocks Universe Package and it is designed for investors and analysts who need predictions for MSCI ACWI stocks currently trading on Western stock markets, such as Germany, France and the USA. This forecast is part of the MSCI Western Stocks Subpackage, one of I Know First’s algorithmic trading tools. The MSCI Stocks Universe is based on MSCI ACWI Index (part of the Modern Index Strategy) and captures all sources of equity returns in 23 developed and 24 emerging markets.

- Top 10 MSCI Western stocks for the long position

- Top 10 MSCI Western stocks for the short position

Package Name: MSCI Stocks Universe – Western Markets

Recommended Positions: Long

Forecast Length: 3 Months (11/22/20 – 2/22/21)

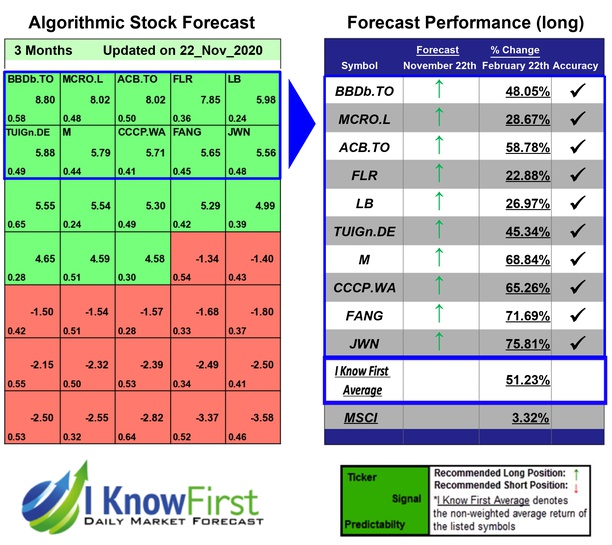

I Know First Average: 51.23%

In this 3 Months forecast for the MSCI Stocks Universe – Western Markets Package, there were many high performing trades and the algorithm correctly predicted 10 out 10 trades. The greatest return came from JWN at 75.81%. Additional high returns came from FANG and M, at 71.69% and 68.84% respectively. The package had an overall average return of 51.23%, providing investors with a 47.91% premium over the MSCI return of 3.32% during the period.

Nordstrom, Inc. (JWN), a fashion specialty retailer, offers apparel, shoes, cosmetics, and accessories for men, women, and children in the United States and Canada. It operates through two segments, Retail and Credit. The Retail segment offers a selection of brand name and private label merchandise through various channels, including Nordstrom branded full-line stores and online store at Nordstrom.com; Nordstrom Rack stores; Nordstromrack.com and HauteLook; and other retail channels, including Trunk Club showrooms and TrunkClub.com, Jeffrey boutiques, and clearance store that operates under the name Last Chance. The Credit segment operates Nordstrom fsb, a federal savings bank, which provides a private label credit card, two Nordstrom VISA credit cards, and a debit card. Its credit and debit cards feature a shopping-based loyalty program. As of October 21, 2016, the company operated 346 stores in 40 states, including 123 full-line stores in the United States and Canada; 213 Nordstrom Rack stores; 2 Jeffrey boutiques; and 2 clearance stores. Nordstrom, Inc. (JWN) also sells its products through catalogs. The company was founded in 1901 and is based in Seattle, Washington.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.