Momentum Stocks Based on AI: Returns up to 17.9% in 7 Days

Momentum Stocks

The Momentum Stocks Package is designed for investors and analysts who need predictions for stocks currently at their 52-week high price level. It includes 20 stocks with bullish and bearish signals and indicates the best shares to buy and sell:

- 52 Weeks High Top 10 stocks for the long position

- 52 Weeks High Top 10 stocks for the short position

![]()

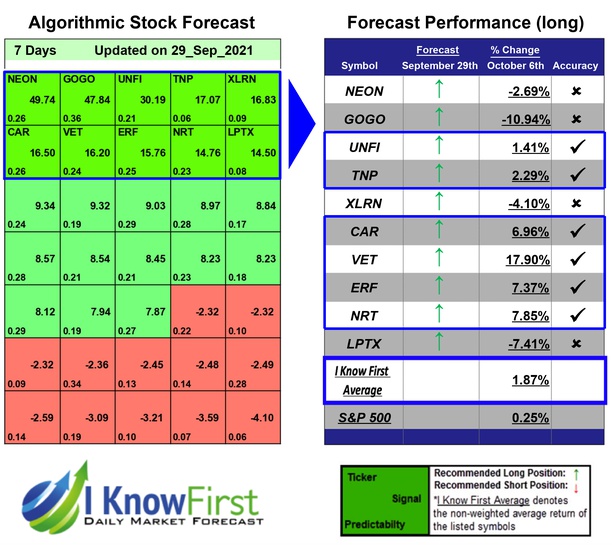

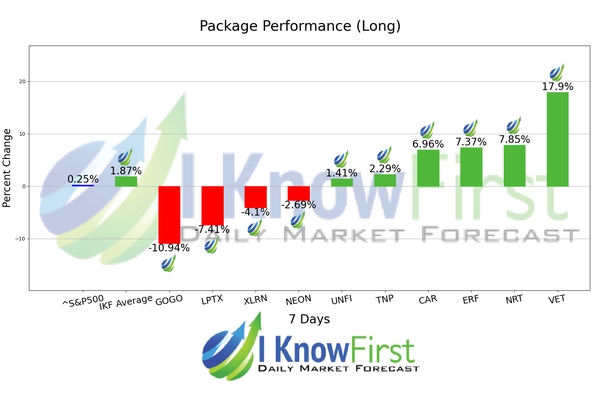

Package Name: 52 Week High Stocks

Recommended Positions: Long

Forecast Length: 7 Days (9/29/21 – 10/6/21)

I Know First Average: 1.87%

During the 7 Days forecasted period several picks in the 52 Week High Stocks Package saw significant returns. The algorithm had correctly predicted 6 out 10 returns. The highest trade return came from VET, at 17.9%. Additional high returns came from NRT and ERF, at 7.85% and 7.37% respectively. The 52 Week High Stocks package had an overall average return of 1.87%, providing investors with a premium of 1.62% over the S&P 500’s return of 0.25%.

Vermilion Energy Inc. (VET) acquires, explores, develops, and produces crude oil and natural gas in North America, Europe, and Australia. As of December 31, 2015, it owned 71% interest in 326,500 net acres of developed land and 88% interest in 537,000 net acres of undeveloped land, as well as 464 net producing natural gas wells and 453 net producing oil wells in Canada; and 96% interest in 208,900 net acres of developed land and 100% interest in 374,600 net acres of undeveloped land in the Aquitaine and Paris Basins, as well as 337 net producing oil wells in France. The company also owned 55% interest in 814,600 net acres of land, as well as 35 net producing gas wells in the Netherlands; 7,800 net acres of developed and 153,400 net acres of undeveloped land, and 4 net producing gas wells in Germany; and 90,700 net acres of land and 4 net producing oil wells in the United States. In addition, it holds 18.5% interest in the offshore Corrib gas field situated in Ireland; and 100% interest in the Wandoo block, which consists of 59,600 acres located in Australia. Further, the company has 71,163 barrels of oil equivalent (Mboe) of total proved reserves and 121,717 Mboe of proved plus probable reserves located in Canada; 42,027 Mboe of total proved reserves and 63,612 Mboe of proved plus probable reserves situated in France; 8,122 Mboe of total proved reserves and 16,320 Mboe of proved plus probable reserves located in the Netherlands; 5,250 Mboe of total proved reserves and 8,250 Mboe of proved plus probable reserves situated in Germany; 17,637 Mboe of total proved reserves and 25,538 Mboe of proved plus probable reserves located in Ireland; 13,765 Mboe of total proved reserves and 17,465 Mboe of proved plus probable reserves located in Australia; and 2,742 Mboe of total proved reserves and 7,988 Mboe of proved plus probable reserves located in the United States. The company was founded in 1994 and is headquartered in Calgary, Canada.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.