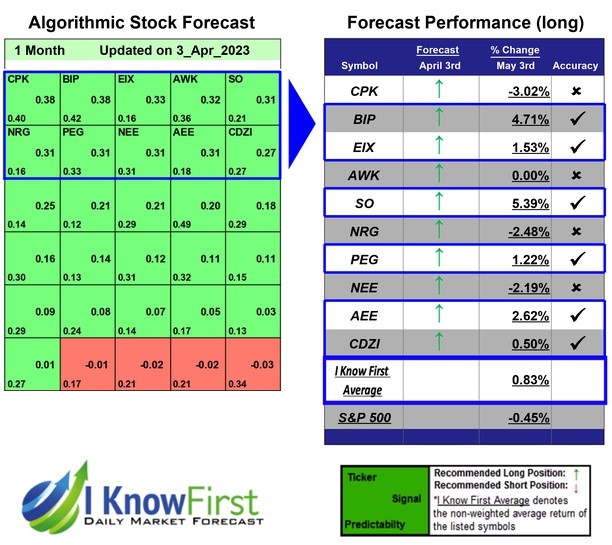

Momentum Stock Trading Based on Algo Trading: Returns up to 5.39% in 1 Month

Momentum Stock Trading

Momentum Stock Trading: This Utilities Stocks forecast is designed for investors and analysts who need predictions of the best utilities stocks to buy for the whole Industry. It includes 10 stocks with bullish and bearish signals and indicates the best utilities stocks to buy:

- Top 10 Utilities stocks for the long position

- Top 10 Utilities stocks for the short position

Package Name: Utilities Stocks

Recommended Positions: Long

Forecast Length: 1 Month (4/3/23 – 5/3/23)

I Know First Average: 0.83%

I Know First’s State of the Art Algorithm accurately forecasted 6 out of 10 trades in this Utilities Stocks Package for the 1 Month time period. The top-performing prediction in this forecast was SO, which registered a return of 5.39%. BIP and AEE saw outstanding returns of 4.71% and 2.62%. The package had an overall average return of 0.83%, providing investors with a premium of 1.28% over the S&P 500’s return of -0.45% during the same period.

The Southern Company, together with its subsidiaries, engages in the generation, transmission, and distribution of electricity through coal, nuclear, oil and gas, and hydro resources in the states of Alabama, Georgia, Florida, and Mississippi. The company also constructs, acquires, owns, and manages generation assets, including renewable energy projects. As of December 31, 2015, it operated 33 hydroelectric generating stations, 31 fossil fuel generating stations, 3 nuclear generating stations, 13 combined cycle/cogeneration stations, 16 solar facilities, 1 wind facility, 1 biomass facility, and 1 landfill gas facility. The company also provides digital wireless communications services with various communication options, including push to talk, cellular service, text messaging, wireless Internet access, and wireless data; and wholesale fiber optic solutions to telecommunication providers in the Southeast. The Southern Company was founded in 1945 and is headquartered in Atlanta, Georgia.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.