Medicine Stocks Based on Deep Learning: Returns up to 10.38% in 14 Days

Medicine Stocks

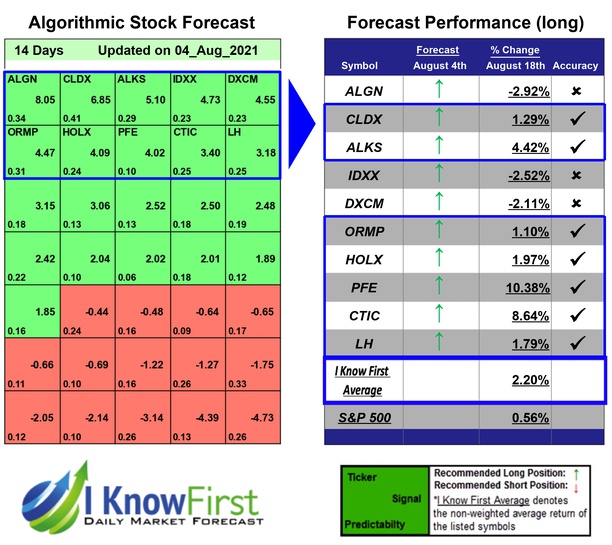

The Medicine Stocks Package is designed for investors and analysts who need predictions for the best stocks to buy in the Medicine Industry. It includes 20 stocks with bullish and bearish signals and indicates the best medicine stocks to trade:

- Top 10 Medicine stocks for the long position

- Top 10 Medicine stocks for the short position

Package Name: Medicine Stocks

Recommended Positions: Long

Forecast Length: 14 Days (8/4/21 – 8/18/21)

I Know First Average: 2.2%

During the 14 Days forecasted period several picks in the Medicine Stocks Package saw significant returns. The algorithm had correctly predicted 7 out 10 returns. The highest trade return came from PFE, at 10.38%. Other notable stocks were CTIC and ALKS with a return of 8.64% and 4.42%. The package had an overall average return of 2.2%, providing investors with a 1.64% premium over the S&P 500’s return of 0.56% during the period.

Pfizer Inc., a biopharmaceutical company, discovers, develops, manufactures, and sells healthcare products worldwide. The company operates through Global Innovative Pharmaceutical (GIP); Global Vaccines, Oncology and Consumer Healthcare (VOC); and Global Established Pharmaceutical (GEP) segments. The GIP segment develops and commercializes medicines for various therapeutic areas, including inflammation/immunology, cardiovascular/metabolic, neuroscience/pain, and rare diseases. The VOC segment develops and commercializes vaccines, as well as products for oncology and consumer healthcare. It provides over-the-counter products comprising dietary supplements under the Centrum, Caltrate, and Emergen-C brands; pain management products under the Advil and ThermaCare brands; gastrointestinal products under the Nexium 24HR/Nexium Control and Preparation H brands; and respiratory and personal care products under the brand names of Robitussin, Advil Cold & Sinus, Advil Sinus Congestion Relief & Pain, Dimetapp, and ChapStick. The GEP segment offers products that have lost marketing exclusivity in various markets; and branded generics, generic sterile injectable products, biosimilars, infusion systems, and other products. The company serves wholesalers, retailers, hospitals, clinics, government agencies, pharmacies, and individual provider offices, as well as centers for disease control and prevention. It has licensing agreements with Cellectis SA and AstraZeneca PLC; and collaborative agreements with Eli Lilly & Company, OPKO Health, Inc., BioRap Technologies LTD., Merck KGaA, and Transgene S.A. Pfizer Inc. was founded in 1849 and is headquartered in New York, New York.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.