HZNP Stock Forecast: Are Biomedical Value Stocks Worthy of Attention?

This “HZNP Stock Forecast: Are biomedical value stocks worthy of attention?” article was written by Zhou He – Financial Analyst at I Know First.

Highlights

- AMGN acquired HZNP for $28 billion in cash on Dec 12.

- Tepezza has year-to-date sales of $1.5 billion and Krystexxa has more than $500 million.

- HZNP currently has $9.03 billion in total assets and a debt ratio of 0.28.

Overview

Horizon Therapeutics Public Limited Company (NYSE: HZNP) was established in 2005 and is headquartered in Dublin, Ireland, with additional offices in Deerfield, IL; Chicago, IL; Lake Forest, IL; South San Francisco, CA; Thursburg; Rockville, Maryland; and Mannheim, Germany. HZNP is a biotechnology company focused on the discovery, development, and commercialization of medicines to address the critical needs of people affected by rare, autoimmune, and serious inflammatory diseases. The company is divided into Orphan and Inflammation segments. Its portfolio includes 12 medicines for rare diseases, gout, ophthalmology, and inflammation. It sells TEPEZZA (teprotumumab-trow) for intravenous infusion; KRYSTEXXA (polyethylene glycol injection) for intravenous infusion; RAVICTI (glycerol phenylbutyrate) oral solution, among others. The company was formerly known as Horizon Pharma Public Limited Company and changed its name to Horizon Therapeutics Public Limited Company in May 2019.

What’s Affecting the HZNP Stock’s Float

Recently, the surge in HZNP stock has caught people’s attention. The reason is that potential offers from the three major pharmaceutical giants AMGN, JNJ, and SNY are being considered. HZNP shares soared 27.3% to 100.29. Amgen shares rose 1.6 percent to 286.40, while Sanofi fell 1.1 percent to close at 45.35. Johnson & Johnson shares rose 1.1 percent to 178. AMGN acquired HZNP for $28 billion in cash on Dec. 12, building a rare disease drug franchise with the help of key acquisitions. The deal, priced at $116.50 per share, could cause a slight stir in Peninsula’s biotech real estate lineup, as Horizon doubled its South San Francisco space earlier this year and Amgen The company moved to a new location in South San Francisco this fall.

The biotech offers several treatments for rare diseases, and Horizon’s $3 billion acquisition of Gaithersburg, Maryland-based Viela Bio Inc added blockbuster drugs Tepezza (for thyroid eye disease) and Krystexxa (for chronic gout), including Tepezza for thyroid eye disease. That made Horizon best known for Krystexxa for severe gout and Uplizna for an inflammatory disease affecting the optic nerve and spinal cord. Tepezza has year-to-date sales of $1.5 billion and Krystexxa has more than $500 million. In the September quarter, Tepezza sales plummeted 20% to $490.9 million. But it beat expectations of $486.7 million. Tepezza sales fell due to supply chain challenges during the pandemic. But the company reiterated that it expects Tepezza sales to grow in the mid-teens this year. Horizon expects the drug to generate peak annual global sales of $4 billion. Total sales also topped estimates, coming in at $925.5 million. Adjusted profit of $1.25 per share topped estimates from HZNP equity analysts.

Horizon generated $3.7 billion in revenue and posted a $574 million profit over the past 12 months, for a net margin of 16%, down from 32% in the third quarter of 2021. The decrease in profit margin was mainly due to higher expenses. The company also posted a free cash flow of $1.3 billion over the past year. Today, Horizon has a market cap of more than $22 billion. Long-term debt was $2.55 billion, current debt was $16 million, and total debt was $2.57 billion. Adjusted for $2.13 billion in cash equivalents, the company had net debt of $434.61 million. HZNP currently has $9.03 billion in total assets and a debt ratio of 0.28. Compared with the increase in the ratio in the second quarter, the advantage is that enterprises’ production and operation funds have increased, and the sources of funds for enterprises have increased. However, the cost of capital has increased, interest expenses have increased, and corporate risks have increased. Let’s see what trends the nine-month ended reports show.

(Figure 1 – The Revenue Structure, Nine Months Ended on September 30 for 2021 – 2022)

For new and old investors, making full use of the stock market and investing with peace of mind is a common goal. Unlike growth or momentum investors, value investors are all about finding quality stocks at reasonable prices and discovering which companies are trading below their true value before the broader market rises. The Value Style Score uses ratios such as P/E, Price to Book, Price/Sales, and Price/Cash Flow to help pick the most attractive and discounted stocks. As a strong-value stock, should we pay attention to HZNP Stock?

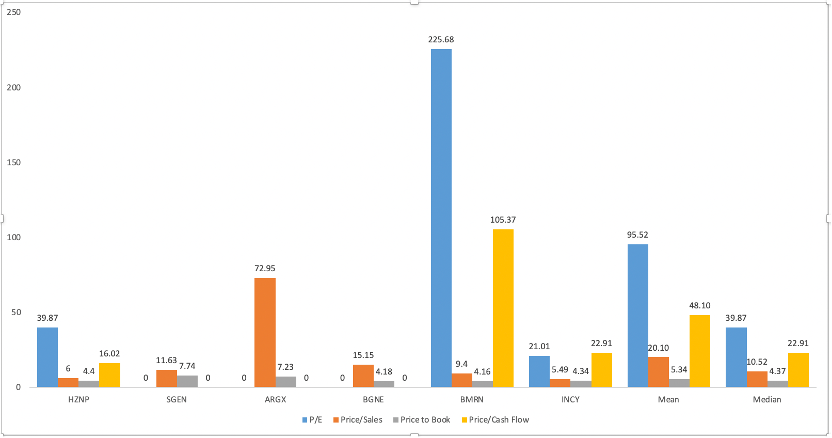

Horizon Therapeutics stock is trading at a P/E ratio of 39.87. HZNP has a Price to book ratio of 4.4, a price/cash flow ratio of 16.02x, and a price/sales ratio of 6x. Let’s look at the next comparable companies: HZNP, SGEN, ARGX, BGNE, BMRN, and INCY. According to Figure 2, the HZNP P/E ratio is lower than the Average and Median values across comparable companies.

(Figure2: P/E etc Ratio)

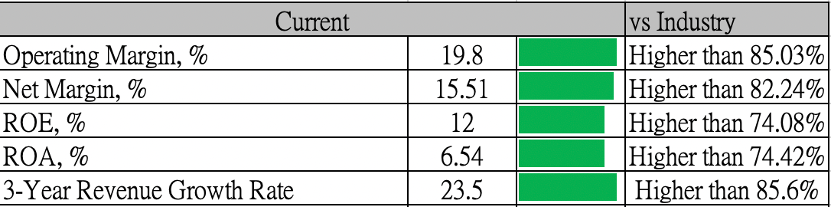

Let us look at HZNP’s performance across the Drug Manufacturers Industry. According to GuruFocus, HZNP is one of the most profitable companies in the industry. HZNP’s Revenue Growth Rate is the highest at 23.5 is better than 85.6% of companies in the industry. The Net Margin of 15.51% is higher than 82.24% of companies in the industry. ROA of 6.54% is better than 74.42% of companies. The Operating Margin of 19.8% is higher than 85.03% of companies in the industry. ROE is better than 74.08% of companies in the industry.

(Figure 3: HZNP vs Drug Manufacturers industry in TTM)

Let’s look at the company credit test and financial positions.

The Altman Z-score, which determines the result of a credit test, stays near the bored of the Grey and Safe zones. At the same time, HZNP looks interesting in terms of the Piotroski F-Score. Piotroski F-score is a number between 0 and 9 that is used to assess the soundness of a company’s financial position. A score of 6 may indicate that the company’s financial situation is a very healthy situation.

12 analysts perform the Yahoo Finance coverage for the company: 3 take the strong buy position. 7 takes the buy position, and 2 takes the hold position. The recommendation Rating is 2.4. The analysts’ community puts the average target price for the stock at $111.5 while it is traded at $112.36.

Conclusion

At a time when most biopharma research companies are operating at a loss, Horizon provides investors with a steady stream of revenue and solid quarterly EPS profits. HZNP has become an attractive acquisition target for large biopharma companies because of its strong portfolio of orphan drugs. This potential gives Horizon solid backing. So I believe HZNP stock can generate a positive return for its shareholders in the future.

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the HZNP stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

Past Success with HZNP Stock Forecast

I Know First has been bullish on the HZNP stock forecast in the past. On November 10th, 2022 the I Know First algorithm issued a forecast for HZNP stock price and recommended HZNP as one of the best stocks to buy. The AI-driven HZNP stock prediction was successful on a 1-month time horizon resulting in more than 29.79%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.

D.R. HORTONDHIDHI STOCK FORECASTStock Analysisstock forecastZhou He