HOV Stock Forecast: How Much More can Hovnanian Climb?

This HOV Stock Forecast article was written by Meiru Zhong – Financial Analyst at I Know First.

Highlights

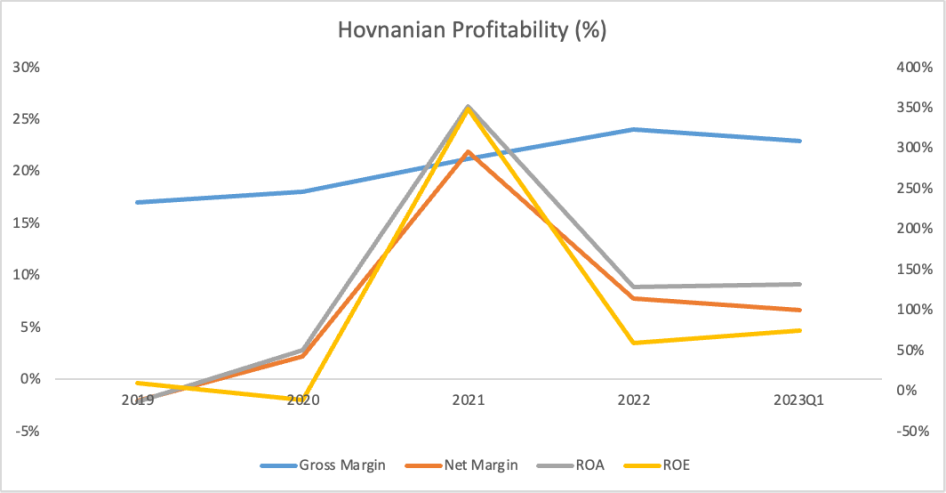

- There is a marked improvement in Hovnanian’s home sales as its ROE has rebounded from the trough, increasing by 15.2% in Q1 2023.

- Although the housing demand is decelerated due to the uncertain economic outlook, the supply-demand mismatch is expected to drive HOV stock price to appreciate.

- HOV attempts to reduce unnecessary costs, increase advertising expenses, offer favorable mortgage rates, and raise community counts to improve performance in 2023.

- DCF values HOV stock price at $97, with 49% upside potential and technical analysis also supports this bullish forecast.

Overview

Hovnanian Enterprises, Inc. (“HOV”) operates a business on two distinct operations: homebuilding (97.2% of the total revenue) and financial services (2.4%). The homebuilding operation includes design, construction, marketing, and sales in six segments (Northeast, Mid-Atlantic, Midwest, Southeast, Southwest, and West). The financial services provide mortgage loans and title services. As one of the largest builders of residential homes, the company sells various types of homes, such as single-family detached homes, attached townhomes and condominiums, urban infill, and active lifestyle homes, in 132 communities in 14 states throughout the U.S. HOV was founded in 1959 by Kevork Hovnanian, incorporated in New Jersey in 1967, and reincorporated in Delaware in 1983. The company, including unconsolidated joint ventures, has delivered more than 355,000 homes over years, with 6,793 homes in the fiscal year 2021.

Dramatic Improvements from the Trough

Hovnanian achieves $515.366 million in revenue and $ in net income in Q1 2023. Its revenue soared during the miserable Covid period and then plummeted when the home crisis happened in 2022. The good news is that there is a marked improvement in home sales, as evidenced by the data shown in the recent first quarter report. It’s noticeable that the company’s ROE has rebounded from the trough, increasing by 15.2%. This growth primarily comes from the homebuilding segment as it contributed the most to the total revenue at 97.2%.

Quarter contracts per community for the first quarter of 2023 were down significantly to 6.1 compared to the last year (14.0) and close to the level in the fiscal year 2019 (6.8) before the Covid. This reduction is primarily a result of fluctuating interest rates and an uncertain macro environment. Although the quarterly trend shows a low number, the monthly one manifests a much more positive picture. Contracts per community have increased from 1.2 in November 2022 to 3.4 in February 2023.

Annual contracts per community, excluding build-for-rent, were 38.9 in 2022, the same as the pre-pandemic level in 2019 but down from 55.2 in 2021. By taking seasonally adjusted and annualized transformation, the monthly basis contracts per community did rapidly decline in May and underwent a trough in September 2022. After that, every month presented an improvement and the recent February saw the figure at 39.4, the smile pattern reflecting a dramatic improvement in the process. Although the cancellation rate as % of gross contracts is still above the normal, which is between 18% and 22%, there is also an improvement sequentially as the figure reduced from 41% in Q4 2022 to 30% in Q1 2023.

Sustainable Growth from Excess Demand

Why the revenue in the homebuilding segment has increased considerably in Q1 2O23? What makes the contract per community raise since September 2022? Will this growth be sustainable? The root of these questions is all about supply and demand in the housing market.

When Covid hit, the surge in housing demand was astonishing, which was fueled by record-low mortgage rates and a shortage of supply of houses for sale. This fever was put out due to rising interest rates since April 2022 as it added more burdens and reduced affordability for investors. The year 2022 became cool for the housing market with home sales declining and prices rising moderately.

Although the demand is falling, it’s not waning. The negative impact brought by skyrocketing mortgage rates is not terrifying that will kill the market. As economic activities are recovering and jobs are ramping up, investors have partially restored their confidence about the future and work-from-home people who wanted to migrate to lower-cost areas or live in a more comfortable place rushed to the home buying market. The housing demand has decelerated a little but is still at a high level.

During the periods recovering from COVID, the housing inventory has increased slightly but is still considerably below pre-pandemic levels at less than half of the historical average of 2.1 Million homes. It won’t be able to meet the current demand owing to a lack of labor and material, as well as general supply chain issues. The excess housing demand is the key to driving the market to thrive and prices to appreciate.

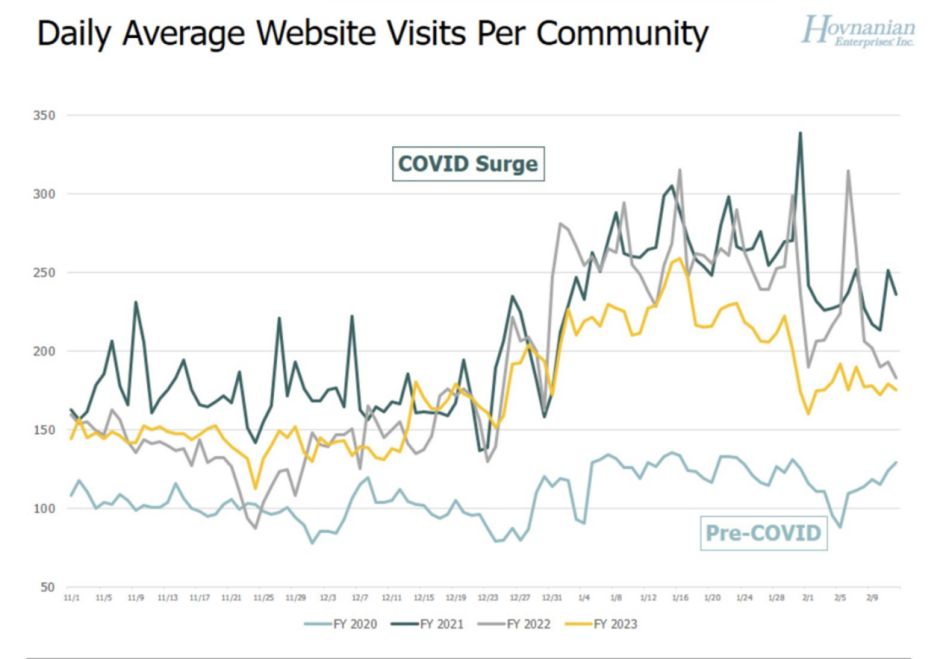

This mismatched demand and supply relationship can be exemplified in Hovnanian’s daily average website visits per community. The FY2023 trendline has shown a much closer to COVID line and it’s obviously better than the pre-covid level. The high-level viewing activity demonstrated the extremely high demand in the housing market.

Given the increased home demand in the spring selling season and insufficient supply, Hovnanian was aggressive in pricing, incentives, and concessions to increase affordability, such as moderately raising prices in 1/3 of communities in the nation in January 2023. Because of the higher inflation and uncertainty about the stability of the economy, the Fed unanimously raised the interest rate in February 2023. It’s surprising to see that the company’s sales in that week were actually the best in that month. This example also tells that the supply-demand mismatch is the source to improve HOV’s performance and fuel its stock price.

Improvements in Leverage But Still a Concern

Although Hovnanian’s debt-to-equity ratio (D/E) has improved from 12.27 in 2021 to 5.69 in 2022 and its debt-to-asset ratio (D/A) was 85%, the company still has high financial leverage and seems to rely more on debt to support its development. Generally, a D/E ratio below 2 is considered good and above that seems risky. It’s good to see HOV takes the advantage of debt financing to expand but the huge risks involved might drag the company down to a financial crisis, or even bankruptcy.

HOV’s coverage ratio has improved during periods, rising from 1.78 in 2019 to 6.70 in 2022. This indicates that the company has the ability to meet its financial obligations and its EBITDA can cover about 6.7 times interest payments. Typically, the coverage ratio above 2 seems good and the company has less risk of default. Combined with three ratios, we can see Hovnanian already sensed the potential financial risks in its balance sheet and took action to improve it by lowering the D/E ratio and rising the coverage rate. Even though the improvements look good, investors still cannot ignore the potential financial risks.

Growth Plan for FY2023

Under the economic turbulence, Hovnanian is concentrating on having sufficient liquidity and flexibility to address unexpected issues and deal with debt risks. The excess liquidity in FY2022 and FY2021 enabled to repurchase of $100.0 million and $180.9 million in aggregate principal of senior secured notes respectively based on the FY2022 10K report. Apart from the focus on liquidity, the company also emphasized investment chances to sustain profitability. It makes strategies to buy new land at a good price, expected to earn appropriate returns, and explores Build For Rent opportunities to add sales volume and increase inventory turnover.

Hovnanian expects improvements in the FY2023 performance as the increased labor will help accelerate the speed of housing construction and mitigate the shortage of home supply. However, the continued pressure from higher inflation and increased mortgage rates prompts the company to take active cost reduction measures, such as negotiating with vendors and partners, as well as dismissing employees. Although HOV tries to reduce unnecessary costs to improve profitability, it decides to increase its advertising expenses and provide favorable mortgage rates as incentives in the spring selling seasons to attract more buyers. The rising SG&A expenses will lower the company’s profits and favorable mortgage rates will decline the revenue from financial services segments.

What’s more, the company reevaluated the business and adjusted from the historical seven segments (Northeast, Mid-Atlantic, Midwest, Southeast, Southwest, West, and financial services) to four sectors (Northeast, Southeast, West, and financial services) as it had exited the Minnesota, North Carolina, and Tampa market, and is currently on the way of exiting the Chicago. Hovnanian still takes aggressive actions by increasing community counts to provide more supply to the markets. It is difficult to predict the ultimate consequences of this set of actions but the company seems to be well-prepared and ready for the challenges.

DCF Values HOV Stock $97

The DCF analysis shows that HOV’s intrinsic stock price should be around $97, which is a 49% upside potential from the price of $65.33 on March 23, 2023. It’s clear that the HOV stock price is deeply undervalued.

The DCF model for HOV stock forecast is built based on the following assumptions:

- The risk-free rate is 3.38% according to the US 10-year Treasury Rate as of March 2023. The risk premium of 5.5% comes from the average market risk premium in the U.S. from Statista.

- Beta 2.79 is calculated based on the slope of the change of monthly HOV stock price and S&P500 price from 2018 to 2023.

- The cost of debt is about 9.7% by taking the weighted average of interest rate from the senior notes and credit facilities in FY 2022.

- The tax rate is assumed the same as the 2022 figure at 3.2%, since the company’s effective tax rate is significantly affected by the deferred tax asset valuation allowance, causing the effective tax rate not to correlate to income before taxes.

- The terminal growth rate is assumed at 1%.

Due to the uncertainties in the macroeconomic environment, it is difficult to accurately predict the impact of relevant risk factors such as epidemics and wars, and the assumption may not be valid. A sensitivity matrix is created to show the impacts on HOV stock forecast by altering WACC (weighted average cost of capital) and terminal growth rate.

Does Technical Analysis Support HOV Stock Forecast for 2023?

HOV’s 15-day moving average line is above the 50-day moving average and 50-day moving average above the 200-day moving average, indicating a recovery sign from the bear. Although the 15-day moving average has flattened for a month, the 50-day and 200-day moving average has shown an upward trend since November 2022, reflecting a bull expectation.

A rectangle pattern was formed under the oscillating markets. A breakout can be expected if the stock price climbs up to $80. If so, the HOV stock price is anticipated to grow to $94.21 in the recent period. For conservative investors, it’s better to invest after the breakout happens and the bullish signal stands.

According to TipRanks, Moving Averages Convergence Divergence (MACD) indicator is 0.21, indicating a Strong Buy. Oscillators also show a Buy signal.

Viewpoints on HOV Stock Forecast from Analysts Community

Based on Yahoo Finance, there were 3 analysts presenting recommendation trends on March 2023, among which 1 recommended Hold, 1 Underperform, and 1 Sell. The recommendation rating is 3 pointing at Hold.

Conclusion

I take a buy-side on HOV stock because the DCF target price is $97, a 49% upside difference from the current price. Although the sales pace for Q1 2023 was down significantly due to economic volatility and rising mortgage rates, its monthly trend shows a positive picture, reflecting its improvements in performance. The company takes active actions to reduce costs and allure the attention of buyers by offering various incentives to grow up its business. Its effective management and the supply-demand mismatch in the housing market are expected to fuel the company’s price, making it soar in the future.

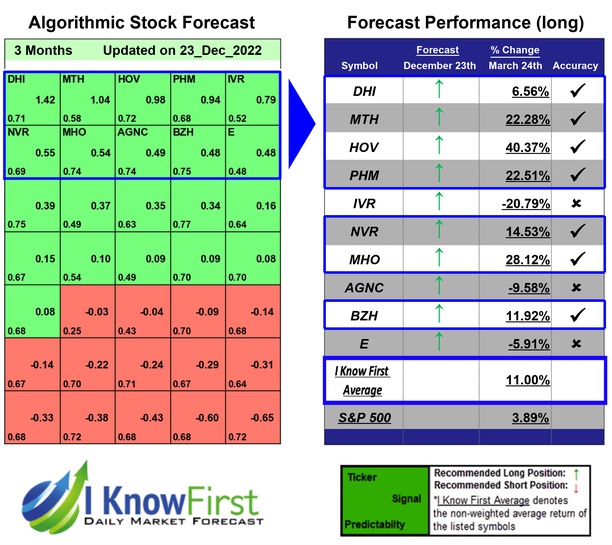

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the HOV stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

Past Success with HOV Stock Forecast

I Know First has been bullish on the HOV stock forecast in the past. On December 23rd, 2022 the I Know First algorithm issued a forecast for HOV stock price and recommended HOV as one of the best home builders stocks to buy. The AI-driven HOV stock prediction was successful on a 3-month time horizon resulting in more than 40.37%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.