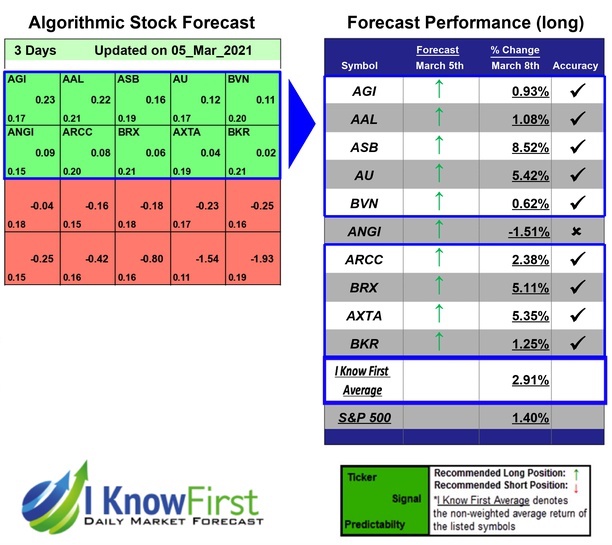

High Volume Low Price Stocks Based on Algo Trading: Returns up to 8.52% in 3 Days

High Volume Low Price Stocks

The High Volume Low Price Stocks Package is designed for investors and analysts who need predictions for stocks currently trading between $5 and $10, and with an average daily trading volume above one million dollars. It includes 20 stocks with bullish and bearish signals and indicates the best shares to buy and sell:

- Low Price High Volume Stocks Top 10 stocks for the long position

- Low Price High Volume Stocks Top 10 stocks for the short position

Package Name: Low Price High Volume Stocks

Recommended Positions: Long

Forecast Length: 3 Days (3/5/21 – 3/8/21)

I Know First Average: 2.91%

For this 3 Days forecast the algorithm had successfully predicted 9 out of 10 movements. ASB was our best stock pick this week a return of 8.52%. Further notable returns came from AU and AXTA at 5.42% and 5.35%, respectively. With these notable trade returns, the package itself registered an average return of 2.91% compared to the S&P 500’s return of 1.4% for the same period.

Associated Banc-Corp (ASB), a bank holding company, provides various banking and nonbanking products and services to individuals and businesses in Wisconsin, Illinois, and Minnesota. Its Corporate and Commercial Specialty segment offers deposit and cash management solutions, such as commercial checking and interest-bearing deposit products, cash vault and night depository services, liquidity solutions, payables and receivables solutions, and information services; and lending solutions, including commercial loans and lines of credit, commercial real estate financing, construction loans, letters of credit, leasing, asset-based lending, and loan syndications. This segment also provides specialized financial services that comprise interest rate risk management, foreign exchange solutions, and commodity hedging services. The company’s Community, Consumer, and Business segment offer checking, credit, debit, and pre-paid cards, online banking and bill pay, and money transfer services; residential mortgages, home equity loans and lines of credit, personal and installment loans, real estate financing, business loans, and business lines of credit; savings, money market deposit accounts, IRA accounts, certificates of deposit, and fixed and variable annuities; full-service, discount, and online investment brokerage; investment advisory services; trust and investment management accounts; and insurance and other related products and services. This segment also offers administration of pension, profit-sharing and other employee benefit plans, fiduciary and corporate agency services, and institutional asset management services. Its Risk Management and Shared Services segment provides corporate risk management, credit administration, finance, treasury, operations, and technology services. Associated Banc-Corp (ASB) was founded in 1964 and is headquartered in Green Bay, Wisconsin.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.