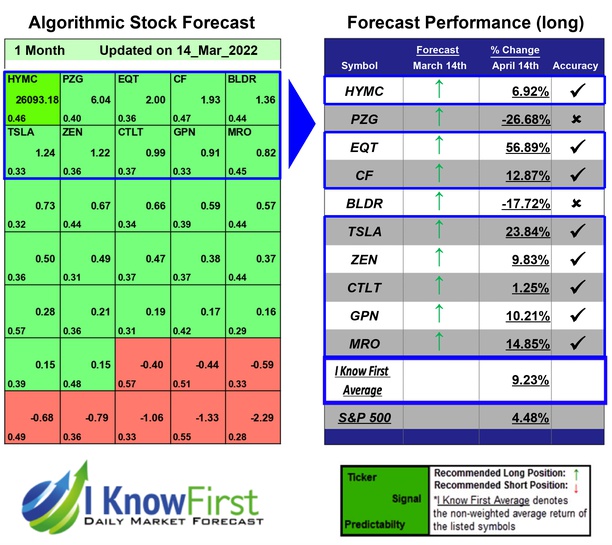

Hedge Fund Stocks Based on Pattern Recognition: Returns up to 56.89% in 1 Month

Hedge Fund Stocks

This Hedge Fund Stocks Package is designed for investors and analysts who need predictions of the best-performing stocks according to I Know First’s stock market algorithm. It includes 20 stocks with bullish and bearish signals and indicates the best stocks to long and short based on artificial intelligence trading strategies:

- Top 10 Hedge Fund stocks for the long position

- Top 10 Hedge Fund stocks for the short position

Package Name: Hedge Fund Stocks

Recommended Positions: Long

Forecast Length: 1 Month (3/14/22 – 4/14/22)

I Know First Average: 9.23%

The algorithm correctly predicted 8 out of 10 the suggested trades in the Hedge Fund Stocks Package for this 1 Month forecast. The top performing prediction from this package was EQT with a return of 56.89%. Other notable stocks were TSLA and MRO with a return of 23.84% and 14.85%. The package had an overall average return of 9.23%, providing investors with a 4.75% premium over the S&P 500’s return of 4.48% during the period.

EQT Corporation (EQT), together with its subsidiaries, operates as an integrated energy company in the United States. It operates through two segments, EQT Production and EQT Midstream. The EQT Production segment explores for, develops, and produces natural gas, natural gas liquids (NGLs), and crude oil primarily in the Appalachian Basin. As of December 31, 2015, it had 10.0 trillion cubic feet of proved natural gas, NGL, and crude oil reserves across approximately 3.4 million gross acres, including approximately 630,000 gross acres in the Marcellus play. The EQT Midstream segment provides natural gas gathering, transmission, and storage services for the company’s produced gas, as well as for independent third parties in the Appalachian Basin. This segment owns or operates approximately 8,250 miles of gathering lines and 177 compressor units with approximately 255,000 horsepower of installed capacity. EQT Corporation (EQT) was founded in 1925 and is headquartered in Pittsburgh, Pennsylvania.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.