Gilead Stock Forecast: Biotech for the Market Win

![]() Gina Guinasso is a Financial Analyst at I Know First. She graduated from Arizona State University with a bachelor’s degree in Real Estate and University of San Francisco with a Master of Science in Financial Analysis.

Gina Guinasso is a Financial Analyst at I Know First. She graduated from Arizona State University with a bachelor’s degree in Real Estate and University of San Francisco with a Master of Science in Financial Analysis.

Gilead Stock Forecast

The I Know First’s algorithm has predicted the Gilead Stock Forecast as a buy (long position) for upcoming time periods. Gilead Sciences, Inc. (GILD) is a research-based biopharmaceutical company that discovers, develops, and commercializes therapeutics to advance the care of patients suffering from life-threatening diseases. The Company’s primary areas of focus include HIV/AIDS, liver disease and serious cardiovascular and respiratory conditions. Gilead is based out of Foster City, CA.

The I Know First’s algorithm has predicted the Gilead Stock Forecast as a buy (long position) for upcoming time periods. Gilead Sciences, Inc. (GILD) is a research-based biopharmaceutical company that discovers, develops, and commercializes therapeutics to advance the care of patients suffering from life-threatening diseases. The Company’s primary areas of focus include HIV/AIDS, liver disease and serious cardiovascular and respiratory conditions. Gilead is based out of Foster City, CA.

Considering Gilead’s strong financial situation and their focus on business growth, research and development, and reaching more patients globally, this article takes a deeper look at why the I Know First’s algorithms predicted a strong buy.

Coaching Biotech Company to Continued Victory for Shareholders:

CEO John Milligan is leading Gilead to continued success. Originally he was hired as the 32nd employee, a research scientist in 1990. Since joining Gilead right after a postdoctoral fellowship at the University of California at San Francisco, he rose through the career ladder and in March 2016 became the CEO. As the previous CEO’s second-in-command for eight years, Milligan received a lot of credit for the company’s recent hightened growth from investors. He has the enthusiasm of a newly hired employee.

Milligan visions Gilead to exceed as a key player in cancer development sector. He plans to expand services and products for liver diseases and inflammatory disorders also. He looks for what will be cutting –edge technology for the future and if he like to be involved. He is eager to continue to use his leadership talent and take Gilead up to the next level, continuing to watch the company grow by leaps and bounds.

New Developments:

With $21.3 billion in cash and short-term equivalents accessible, Gilead has tremendous potential for a verity of spending and working on several new projects and developments. Milligan believes Gilead is ready to grow and will be expanding business its development. The company wants to take on larger deals and at a more frequent rate.

Gilead, who only currently only has one approved cancer drug, Zydelig, has started to display signs of a future potential oncology platform. In recent years this area has captured the imagination of physicians and investors who have engineered T-cell therapies for cancer. The treatments involve removing patients’ immune cells, genetically engineering them to recognize the tumors, and restoring them to the patient.

Milligan is investing in making breakthroughs for nonalcoholic steatohepatitis, which is a fatty liver disease known as NASH. It affects more than 6 million patients in the U.S., according to the National Institutes of Health. Gilead confirmed they have four experimental compounds targeted toward NASH. One of them is an early-stage drug bought in April 2016 for $400 million. This was the first deal to be signed under Milligan’s tenure. While the disease is relatively new to physicians, there is great potential for new product and services to be developed. The Gilead team will still have a significant amount of work researching and developing the product, analyzing what it could mean for patients. They will remain determined to put as much work that is needed since it will be part of improving patient outcomes.

In inflammatory disease, Gilead has high hopes on the drug filgotinib, developed in partnership with Belgian biotech firm Galapagos NV and currently being tested against rheumatoid arthritis and Crohn’s disease.

Stock Information:

On Monday July 25, 2016 after the stock market close, Gilead said that it had $3.08 in earnings per share (EPS) on $7.78 billion in revenue. In the same period of last year, 2015 GILD posted EPS of $3.15 and $8.24 billion in revenue. HIV and other antiviral product sales were $3.1 billion, compared to $2.7 billion for the same period in 2015 primarily due to increases in sales of tenofovir alafenamide (TAF) based products. Sales of HCV products Harvoni, Sovaldi and Epclusa totaled $4.0 billion, versus $4.9 billion from last year.

Management raised its forecast for research and development spending, but projected to lower SG&A expenses. It also said that it expected a greater impact on EPS from acquisition-related and up-front collaboration costs and stock-based compensation. In addition, it expects share repurchases in 2H16 to be lower than in 1H due to increased research and development spending.

The stock currently has Price to Sales (P/S) value of 3.66 where Price to Book (P/B) value stands at 8.97.GILD is currently showing ROA (Return on Assets) value of 36.6% where ROE (Return on Equity) is 105.7%. Return on equity (ROE) measures the rate of return on the ownership interest (shareholders’ equity) of the common stock owners. It measures a firm’s efficiency at generating profits from every unit of shareholders’ equity (also known as net assets or assets minus liabilities).

Marketplace:

Gilead rose to prominence on the strength of its HIV franchise. The company still claims a dominant position in the HIV drug market, with its big sellers of Truvada, Atripla, and Stribild. While Gilead continues to make billions from its HIV drugs, hepatitis C drugs Harvoni and Sovaldi generate well over half of the biotech’s total revenue. Gilead had successfully developed molecules of drugs but now they are facing duplicates by competitors. Sales growth for the two HCV drugs have been extremely high. That growth has helped put Gilead in an enviable financial position: The company sits on a cash stockpile of over $8 billion. It lowered a bit when Gilead rewarded shareholders by paying a dividend. Another important thing Gilead has done with its money has been to buy back shares. During the first quarter of 2016 alone, the company purchased $8 billion of its stock. Gilead’s board authorized another $12 billion share buyback earlier this year. Gilead Sciences Inc (GILD) has a price to earnings ratio of 7.4 versus Healthcare sector average of 40.79.

The company thinks that it has only serves less than 10% of an estimated 6.6 million HCV patients in the U.S and five major European countries, which leads many people to believe that there is room for growth in the antiviral space, and many analysts are very bullish on the biotech that has a remarkable record of performance. There is great potential for entering the remainder 90% of patients that use HCV products. Gilead has a large portion of the market share, compared to competitors.

Gilead Discounted Cash Flow USD is in Millions (unless DPS):

Emphasizing the company’s strong financials, and long-term outlook, a discounted cash flow (DCF) model yields an interesting valuation by projecting future growth to dividends per share and actualizing it back into the present value.

Gilead’s revenue growth has been impressive, and we believe the momentum will keep growing in the upcoming time periods. As shown below, the calculations using the August 1st, 2016 price of $79.49 per share, the discounted cash flow analysis confirms I Know First’s prediction that Gilead will have stable growth and an increase in return on stock in the next few years.

The Gordon Growth Model aids in determining the true value of a stock with a constant growth rate. The calculation is shown in the table below:

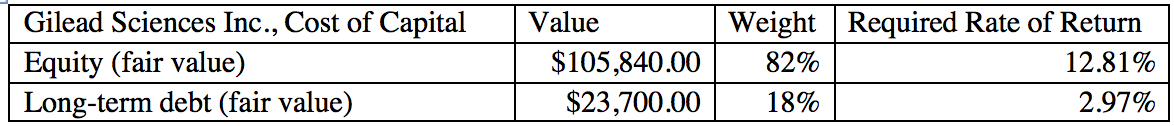

The Required Rate of Return is the amount needed by an investor to allow Gilead to use their money for financing, paying investors compensation for the risk of loaning money. The Weight Average Cost of Capital Model (WACC) is the cost to a company for financing both their debt and equity. It is given as a value when multiplying the cost of each source by its corresponding weight and adding the cost of debt to the cost of equity. The WACC is generally accepted as the discount rate. The table below shows Gilead’s WACC. Both calculations are shown in the tables below:

Using Dividends per Share and the Gordon Growth Model, we are able to project future dividend growth per share and the terminal value. As shown in the table below, current stock price is below its true value. As the intrinsic value of the share price is $88.57, above the current price, our discounted cash flow indicates the Gilead stock is undervalued, the stock is worth more than the price level where it is currently being sold. This indicates a good investment opportunity as the stock price valuation anticipates appreciation.

Forecast:

I Know First supplies financial services, mainly through stock forecasts based on a predictive that incorporates a 15-year database and utilizes it to predict the flow of money across 2000 markets. The self-learning algorithm uses artificial intelligence, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets.

The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

Conclusion:

On July 24th, 2016, I Know First had a bullish signal for Gilead in the Biotech Stock forecast for the one-month, three-month, and one-year time periods as confirmed by our closer analysis of the company and calculations from the discounted cashflow modeling.