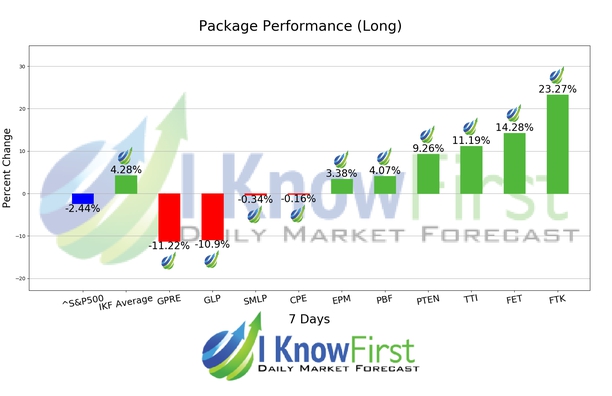

Energy Stocks Based on Data Mining: Returns up to 23.27% in 7 Days

Energy Stocks

The Energy Stocks Package is based on the I Know First algorithm and is designed for investors and analysts who need recommendations for the best performing stocks for the whole Energy Industry. It includes 20 stocks with bullish and bearish signals and indicates the best stocks to buy and sell:

- Top 10 Energy stocks for the long position

- Top 10 Energy stocks for the short position

Package Name: Energy Stocks Forecast

Recommended Positions: Long

Forecast Length: 7 Days (5/5/21 – 5/12/21)

I Know First Average: 4.28%

6 out of 10 stock prices in this forecast for the Energy Stocks Forecast Package moved as predicted by the algorithm. FTK was the highest-earning trade with a return of 23.27% in 7 Days. FET and TTI saw outstanding returns of 14.28% and 11.19%. The package saw an overall yield of 4.28% versus the S&P 500’s return of -2.44% implying a market premium of 6.72%.

Flotek Industries, Inc. (FTK) develops and supplies oilfield products, services, and equipment to the oil, gas, and mining industries in the United States and internationally. The company’s Energy Chemistry Technologies segment designs, develops, manufactures, packages, and markets chemistries under the Complex nano-Fluid brand for use in oil and gas well drilling, cementing, completion, stimulation, and production activities, as well as for use in enhanced and improved oil recovery markets. This segment also constructs and manages automated material handling facilities; and manages loading facilities and blending operations for oilfield services companies. Its Consumer and Industrial Chemistry Technologies segment designs, develops, processes, manufactures, and sells citrus oils for food and beverage companies, fragrance companies, and companies providing household and industrial cleaning products, as well as for use in the oil and gas industry. The company’s Drilling Technologies segment inspects, manufactures, sells, markets, and rents down-hole drilling equipment that are used in energy, mining, and industrial drilling activities through direct and agent-based sales. This segment also rents stabilizers, drill collars, reamers, wipers, jars, shock subs, wireless survey, measurement while drilling tools, Stemulator tools, and mud-motors; and sells mining equipment, cementing accessories, and drilling motor components. Its Production Technologies segment assembles and markets the Petrovalve product line of rod pump components, hydraulic pumping units, electric submersible pumps, gas separators, valves, and services that support natural gas and oil production activities. The company also provides reservoir engineering and modeling services for various hydrocarbon applications. It also serves pressure pumping service, supply chain management, cosmetic, and national and state-owned oil companies. The company is headquartered in Houston, Texas.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.