Bitcoin Forecast: Is Bitcoin Heading Towards Bubble Territory?

This article was written by David Borenstein, a Financial Analyst at I Know First, enrolled in the double major in Economics and Business undergraduate program at the Interdisciplinary Centre, Herzliya.

“Markets can remain irrational for longer than you can remain solvent”

-John Maynard Keynes

Summary:

- Latest Successes of Bitcoin

- Heading Towards Bubble Territory?

- Cryptocurrencies are the Future

- I Know First Algorithm Forecast on Bitcoin

Cryptocurrencies are digital currencies were encryption techniques are used to regulate the generation of units of currency and verify the transfer of funds, operating independently of a central bank. The most common and first decentralised cryptocurrency is Bitcoin. Bitcoin is a form of internet currency that uses multiple APIs, or application programming interfaces, and blockchain technology as a basis.

Latest Successes of Bitcoin

In the past six months Bitcoin has broken all previous records and has had a hike up 331.11%, exceeding the $10.000 mark a week ago. At the start of the year Bitcoin was predicted to reach the $5000 mark, but it has exceeded all expectations and has debunked sceptical theories. Although sceptics were wronged at first, many of their theories are reflected in the current movement of Bitcoin.

Heading Towards Bubble Territory?

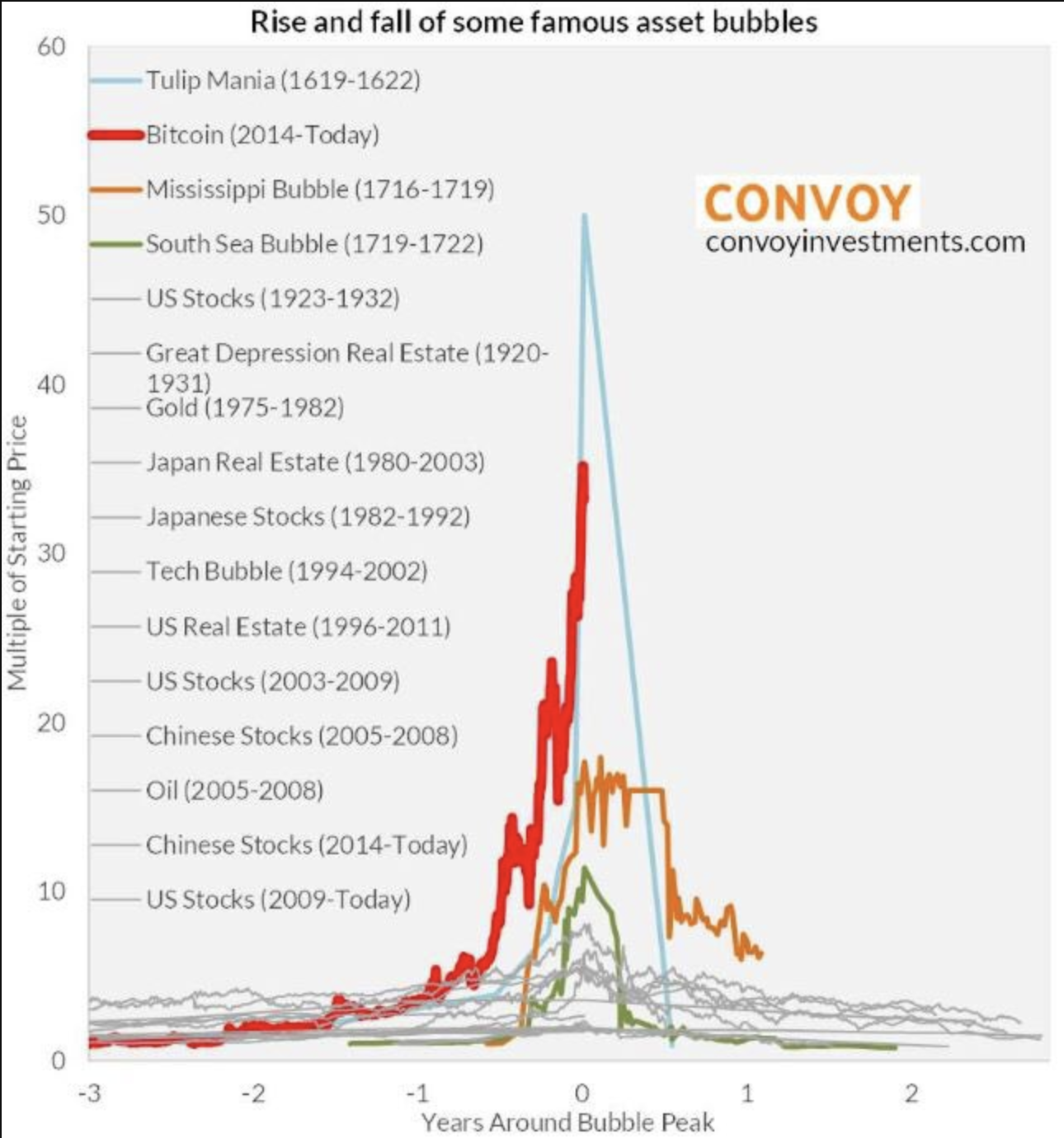

The main theory that skeptics like Warren Buffet and Joseph Stiglitz are going by, is that the current behavior of the Bitcoin highly resonates with attributes of a bubble. A bubble that is close to popping. Comparing the trend of the Bitcoin to historical market booms, will clearly illustrate the point many skeptics are making. Ian Bezek who shares similar insights in his article said that “this is already the biggest move in an asset class in 395 years, trailing only Dutch Tulips back in the 1600s”.

Image from Convoy Investment Newsletter, featured in MarketWatch Article .

Are Cryptocurrencies the Future?

Some people think so, including TechCrunch Founder Michael Arrington who has announced that he is raising $100 million for a hedge fund that will buy and hold cryptocurrency assets while making investments in token sales and equity. Distributions, fees and Investments will be made in XRP, which is known to be the quickest cryptocurrency in regards to transaction times. He thinks that $300 billion cryptocurrency market reflects a start of a greater ecosystem of assets and predicts that this market will be in the trillions next year. The finite supply of Bitcoins will increase demand for Bitcoins when nearing the point where miners are close to the 21 million.

The I Know First algorithm predicts bearish behaviour in the intermediate and long time frame backed by a high predictability. In the Short term, the algorithm also predicts a bearish trend, which is somewhat reflected by the sudden drops in price recorded last week after the Bitcoin reached the $10,000 mark.

How to read I Know First Forecast:

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm, allowing the user to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above in order to fill confident about/trust the signal.

To read more about how to read the I Know First forecast visit: https://iknowfirst.com/stock-market-prediction

The I Know First algorithm predicts bearish behaviour in the intermediate and long time frame backed by a high predictability.

In the Short term, the algorithm also predicts a bearish trend, which is somewhat reflected by the sudden drops in price recorded last week after the Bitcoin reached the $19,000 mark.

The Purpose of cryptocurrencies is to present a free-floating alternative to currencies controlled and monitored by central banks, making it accessible and usable by people in their everyday life. Although approximately 100,000 stores and large corporations accept Bitcoin and similar cryptocurrencies as means of payment, it is not very common and people see cryptocurrencies rather as an investment opportunity. The only major application of Bitcoin as means of payment, is the black market. Many illegal products available in the deep web use Bitcoin as payment due to its untraceable nature. Governments could start to implement laws, hindering the usage of Bitcoin due its affiliation with illegal transactions, which could hinder people invested in Bitcoin to access their assets. The future of cryptocurrencies is unclear, and many see it as a sinking ship.

Shorting Bitcoin

People believing that Bitcoin is destined to fail can now bet on that the ship will actually sink. Nasdaq has announced that as of 18th of December of this year, CME group and CBOE Global Markets will start trading of Bitcoin futures. The Alternative to future options like margin trading, prediction markets and binary options trading, are still to primitive and risky through the current providers. Shorting bares a risk no matter who provides the service but currently the Bitcoin futures provided by CME and CBOE are the way to go. The crucial thing with shorting is to wait for the right moment, and currently the best indicator for this would be negative momentum, pointing towards a peak.

Conclusion:

Bitcoin may have been a smart investment 5 years ago, and many lucky investors seem to think so, but personally I would have not invested even then. Similar to today, back then uncertainty about Bitcoin was high and lack of knowledge about Bitcoin even greater. No one could have foreseen that Bitcoin would develop so explosively, not even their creators. The idea of a free-floating digital currency in a world where free markets and globalisation is amicable, sounds great at first, but the lack of knowledge we have to fully grasp this idea hinders us from fully embracing this technology and its benefits into our society. Cryptocurrencies have to be proven to work in our financial system and our economy but I currently think that bitcoin is like a trend, hyped up by the media and “experts” incentivising the everyday worker to invest in this “new gold”. This Hype around Bitcoin will disappear like every other trend, and this hype will hurt its potential to benefit our future societies. I think that Cryptocurrencies are the future, but the market for Bitcoin specifically, imitates bubble like behaviour, and although the algorithm predicts a bullish future, I see Bitcoin failing.

Past I Know First Success with Bitcoin

I Know First’s algorithm has previously predicted the price movement for Bitcoin such as in this forecast from November 14th, 2017 to December 14th, 2017. The forecast showed a bullish signal of 22.34 and a predictability of 0.39. For the month, the Bitcoin/USD price achieved a return of 153.77% with it starting at $6,605 and now sitting in the $17,000 range.

To subscribe today and receive exclusive AI-based algorithmic predictions, click here.

It is possible to join to the daily bitcoin & Cyptocurrency forecast here