CRON Stock Forecast: Building a Global Platform in Cannabis Industry

This CRON stock forecast article was written by Yutong Li – Analyst at I Know First, Master’s candidate at Brandeis University.

This CRON stock forecast article was written by Yutong Li – Analyst at I Know First, Master’s candidate at Brandeis University.

Highlight:

- CRON’s stock has grown by 25.5% since July 2020

- CRON has strong financial performance with a 3-year-revenue-growth-rate of 94.8 and a cash-to-debt ratio of 132.4, outperforming 96.38% and 88% of its companies in the industry

- Despite price drop in recent months, CRON still has a good long-term outlook with opportunities in the global cannabis industry, and the target price for CRON will hit $11 for the upcoming year

Overview of Cronos Group

Cronos Group Inc. is an innovative global cannabinoid company with international production and distribution across five continents. The company was founded in 2012 and is based in Toronto, Canada. It manufactures, markets, and distributes hemp-derived supplements and cosmetic products through e-commerce, retail, and hospitality partner channels. It also sells cannabis and cannabis products, including dried cannabis, pre-rolls, and cannabis extracts through wholesale and direct-to-client channels. Besides, Cronos Group’s portfolio includes PEACE NATURALS™, a global wellness platform, two adult-use brands, COVE™ and Spinach™, and three hemp-derived CBD brands, Lord Jones™, Happy Dance™, and PEACE+™. Cronos Group is striving to become the leading cannabinoid company with industry-leading innovation, a winning culture, and brands that connect consumers.

Achieving Full Potentials in The Booming Cannabis Market

As a leading cannabinoid company in the industry, Cronos Group has seized many opportunities for its growth and has obtained an outstanding rise in its revenue. From Cronos Group’s Q-10 form, the net revenue in 2021Q1 is $12.6 million, more than the net revenue of $8.4 million in the previous year period by 49.6%. Now, let’s take a closer look at this revenue increase, understand the driving factors and figure out opportunities ahead that are beneficial to Cronos.

One crucial incentive for this climbing growth is the legalization of cannabis in the United States. Even though the status of marijuana is still illegal at a federal level, many states have legalized it for both medical and recreational purposes. In June 2021, four states including Connecticut, New Mexico, New York, and Virginia, just passed legislation to allow the use of marijuana for recreational use. As legalization efforts continue, this can potentially accelerate the company’s growth in the US market.

One other driving factor for Cronos Group’s revenue increase is the expansion of Israel’s medical cannabis market. In October 2020, Cronos Group announced the launch of its leading medical brand PEACE NATURALS™ in Israel. This action has brought high-quality medical products to more patients and generated great returns for the company, and thereby we can see this expansion in Israel’s market as another promising opportunity for the company’s future sales and global presence.

In addition, another reason for Cronos Group’s growth is the increasing preference for cannabis 2.0 products in Canada since the new products provided higher margins than the traditional products. As edible and ingestible cannabis products became legal in Canada in 2019, this cannabis 2.0 product section has gone through a boost in sales and customer demand.

Therefore, as Figure 1 has shown, all factors we discussed including the cannabis legalization updates in the US, the expansion of the Israeli medical market, as well as the adult-use cannabis flower market in Canada have all contributed to Cronos Group’s revenue climb. More specifically, this increase was attributed to a $2.5 million revenue rise in Israel, $1.5 million in Canada, and $265 thousand in the United States. Additionally, from Figure 2, we can notice that the cannabis flower sector is taking a large part of this increase due to more demand in both medical and recreational cannabis uses.

(Figure 1: Net Revenue by Geographic Regions)

(Figure 2: Net Revenue by Segments)

Furthermore, while the breakout of COVID-19 has led to concerns and threats to many industries around the world, the cannabis industry seems to adjust to this uncertainty quickly and experienced overall thriving growth. According to BDSA, global cannabis sales have reached nearly $21.3 billion in 2020, exceedingly higher than the sales of $14.4 billion in 2019 by 47.9%. This growth in the past year is probably due to the fact that more people purchased cannabis and stocked up during the lockdown, and many cannabis businesses have made adjustments to stay operational. More importantly, this potential market flourish is also expected to persist in future years as of the factors we mentioned. From the chart below, global cannabis sales are forecasted to reach $56.9 billion in 2026.

In a nutshell, we can find that Cronos Group has strived to expand its operations globally and has obtained remarkable revenue last year. Moreover, given all the encouraging opportunities we mentioned worldwide, we can be optimistic to project a good outlook for Cronos Group and look forward to an increase in their global presence.

CRON and Its Competition

Now, we can evaluate Cronos Group’s financial performance and see why it is positioned for massive growth in the cannabis manufacturers industry. Here, we can select several comparable companies of Cronos and the overall industry financial performance to illustrate some unique qualities that Cronos possesses. These companies contain Global Tech Industries Group Inc (USD, OTCMKTS: GTII), Aurora Cannabis Inc (USD, NASDAQ: ACB), Curaleaf Holdings Inc (CAD, CNSX: CURA), Knight Therapeutics Inc (CAD, TSE: GUD), and Columbia Care Inc (CAD, CNSX: CCHW).

According to GuruFocus, Cronos Group has a 3-year-revenue-growth-rate of 94.8, ranked better than 96.38% of companies in the industry, suggesting the company’s fast revenue growth and future potential. Moreover, Cronos Group’s cash-to-debt ratio of 132.4 is exceedingly higher than all peers we chose and the industry benchmark. This ratio is also greater than 88% of companies in the industry, which indicates that CRON is in a strong financial position. Plus, we can see that the company has a cash holding of more than $1 billion that takes up 54.5% of its total asset. So, the company has enough amount of available cash that can be used for its future development. This can also represent the company’s large assets value and contribute to a higher share price valuation of the stock.

(Figure 3: Cash-to-Debt Ratio)

Cronos Group also has a current equity-to-asset ratio of 0.84, higher than all its rivals’ values as well as the industry benchmark as shown in Figure 4. This ratio is ranked higher than 86% of companies in the drug manufacturers industry, indicating a reasonable amount of Cronos Groups’ assets owned by investors as opposed to debt and a good long-term solvency position.

(Figure 4: Equity-to-Asset Ratio)

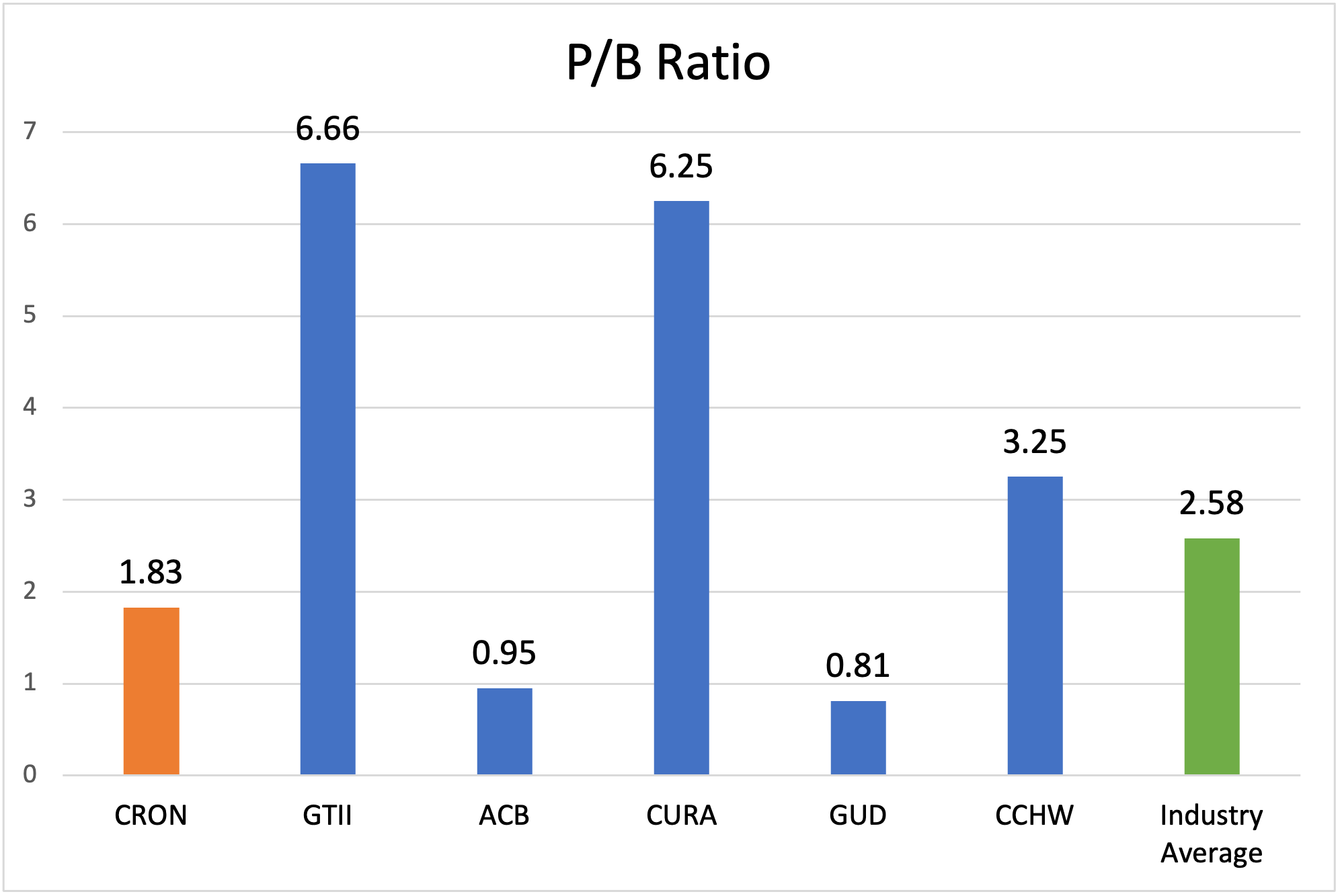

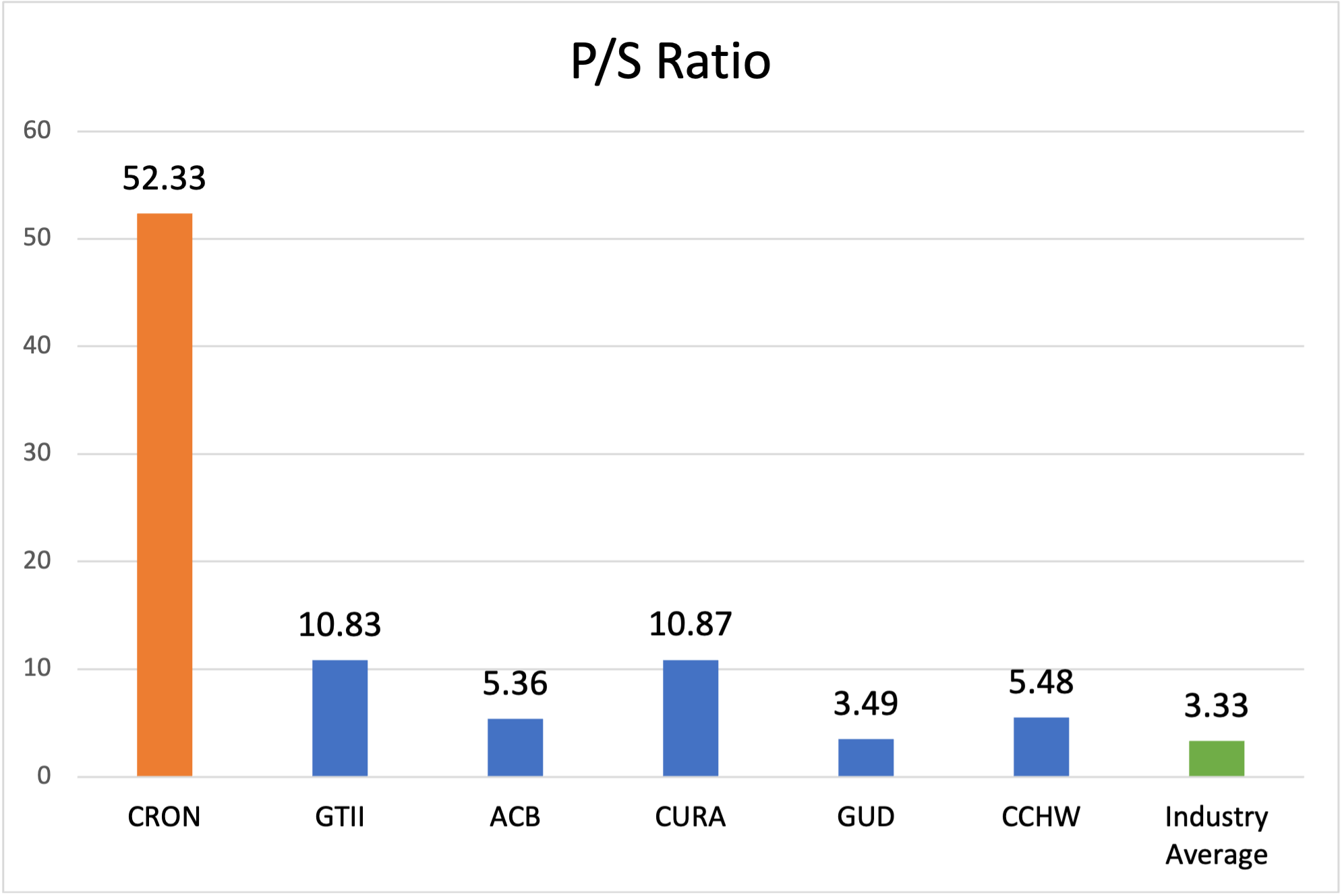

In addition, CRON has a good P/B ratio of 1.83, slightly lower than the industry average by 0.75. However, its P/S ratio of 52.33 is way higher than the industry benchmark and its peers. Although CRON seems to be overvalued given this P/S ratio, it should still be considered as a good investment since its large cash holding is one key factor contributing to this high stock valuation based on what we just discussed above.

(Figure 5: Valuation Ratios)

CRON’s Targeted Stock Price Hit $11 in 2022

From the above chart, we can see that the current CRON stock price since July 7th, 2021 has gone under its three moving averages (the purple line is MA-50, the pink line is MA-100, and the blue line is MA-200) and bounced in between its support and resistance levels of $6.96 and $9.22. And CRON’s last closing price of $7.67 is around the midway point between the support and resistance levels.

From a long-term view, CRON has an overall increasing price level as shown in the above chart. Even though this 1-year stock price trend doesn’t seem very impressive and shows a lot of volatility, Cronos Group is still positioned for massive growth due to its strong financial performance as a leading company in the industry. As we discussed, there are also many opportunities ahead in the global cannabis market, and all these can be helpful in unlocking the full potential of Cronos in the near future. Therefore, my target price for CRON in 2022 will bounce back and hit $11 with a return of 43.4% and can go higher depending on the company’s global network building and its product development.

Conclusion

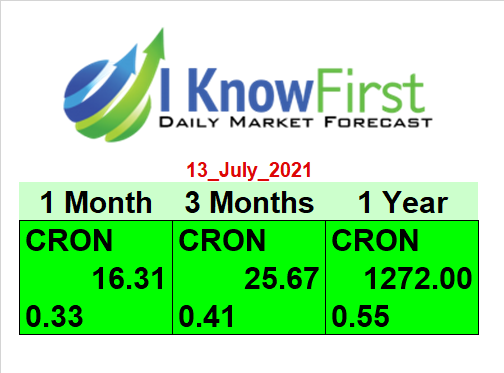

Despite the price drop in recent months, CRON stock still appears attractive from a long-term perspective. Cronos Group has been striving to build a global platform and takes pride in leading the cannabis industry internationally. Its rising revenue is an optimistic result making it a step closer to this goal. In addition, there are also many opportunities ahead in the cannabis industry, including the legalization of cannabis in the US, the expanding medical cannabis market in Israel, and innovative cannabis 2.0 products in Canada. Along with Cronos Group’s strong financial performance, CRON stock should be considered a worthy investment in the long term. From I Know First’s forecast above, CRON stock has high signals for all the long-term forecasted horizons from 1 month to 1 year, which serves as a sign for its potential growth. More notably, we can see an extremely strong 1-year signal of 1272.00, indicating again a strong-buy position of CRON as a long-term investment.

Past Success with CRON Forecast by I Know First

On February 14th, 2021, I Know First’s Options Package on a 3-month forecasted period has successfully predicted 9 out of 10 trades and generated great returns. CRON stock forecast was one among the top 10 recommended call options for investors that have obtained a notable return of 77.57%, which outperformed the S&P 500 benchmark (11.25%) and provided a market premium of 66.32%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.