COF Stock Forecast: Capitalizing on Growth

This COF stock forecast article was written by Anastasia Makuyev, a Quantitative Analyst Intern at I Know First and a Mathematics Student at Hunter College.

Highlights:

- Capital One’s wide array of financial services, spanning from credit cards to digital banking, positions it to tap into varied revenue sources, buffering against market fluctuations.

- Under CEO Rich Fairbank’s tenure, Capital One has demonstrated strategic acumen in its growth and technology investments, hinting at a sustainable upward trajectory.

- The company’s positive stock trends and favorable valuation metrics signal strong investor confidence and financial robustness.

Business Model and Competitive Advantage

Capital One Financial is a renowned name in the U.S. financial sector. It primarily thrives on its credit card business, making it one of the largest issuers in the country. This segment significantly contributes to its revenue through various fees and interest charges on credit balances. The company’s diverse range of credit cards, including cashback, travel rewards, and business cards, is tailored to meet the needs of different customer segments.

Apart from credit cards, Capital One’s robust business model includes consumer and commercial banking, providing checking and savings accounts. They also offer CDs, mortgages, personal loans, commercial loans, and treasury management services. The company’s foray into auto financing further diversifies its revenue streams. They offer loans and lease options for new and used vehicles through partnerships with auto dealerships.

Capital One’s competitive edge lies in its strong brand image, underpinned by effective advertising campaigns and sponsorships of major events. Its diversified product portfolio addresses various financial needs, thereby ensuring multiple revenue sources. A key factor in Capital One’s success is its investment in technology. This has attracted tech-savvy customers and established the company as a leader in the digital banking space.

Management and Leadership

Under the guidance of its CEO and founder, Rich Fairbank, Capital One has navigated the financial sector since 1994. Fairbank’s long tenure is a testament to his commitment and strategic vision for the company. The leadership team reflects a balance of experience and innovation. They have an average tenure of 5.9 years, and the board averages 6.5 years. The management’s strategic decisions in the realms of digital banking and customer-centric products have been pivotal in Capital One’s growth.

Growth Prospects

Analysts predict a steady growth trajectory for Capital One. Earnings and revenue are expected to grow by 5.9% and 9.4% per annum, respectively. This forecast is slightly above the average savings rate but below the overall U.S. market growth rate. Notably, the projected return on equity stands at 9.3% over the next three years. These figures suggest a cautious optimism about Capital One’s future. They underline its potential to maintain a strong position in the financial sector.

Analysts at Yahoo! Finance are currently taking a Buy/Hold stance on COF, and setting a price target of $132.42.

Industry Dynamics

In the competitive landscape of financial services, Capital One holds a significant market capitalization of $50.43 billion. The company has efficiently managed its share count, with a marginal decrease over the past year, reflecting its strategic approach to capital allocation. Important valuation metrics include a trailing PE ratio of 9.92 and a forward PE ratio of 9.62. These position Capital One favorably in the market. The company’s stock has shown remarkable resilience. They have had a 40.90% increase over the past 52 weeks, indicating investor confidence in its business model and growth prospects.

Regulatory and Legal Environment

As a major player in the credit card sector, Capital One navigates a highly regulated landscape, further intensified after the Dodd-Frank Act. The company’s adherence to stringent regulations has not only enhanced its safety profile but also boosted its attractiveness as a viable investment. Despite higher-than-average credit card charge-off rates, Capital One balances this with above-average interest rates and consistent returns on assets. Its strategic focus on high-yield credits gives it an edge over larger banking institutions, demonstrating a keen understanding of the market and regulatory environment.

Conclusion

I take a buy-side on COF stock because Capital One Financial stands out as a robust entity in the financial sector. It is buoyed by its diversified business model, effective management, and clear growth strategies. The company’s focus on technology and high-yield credits, coupled with a commitment to regulatory compliance and shareholder returns, underlines its potential for sustained growth and stability in the dynamic financial landscape.

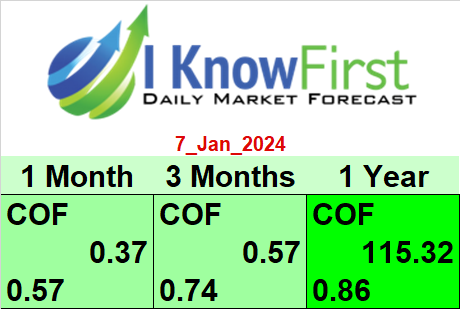

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the COF stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

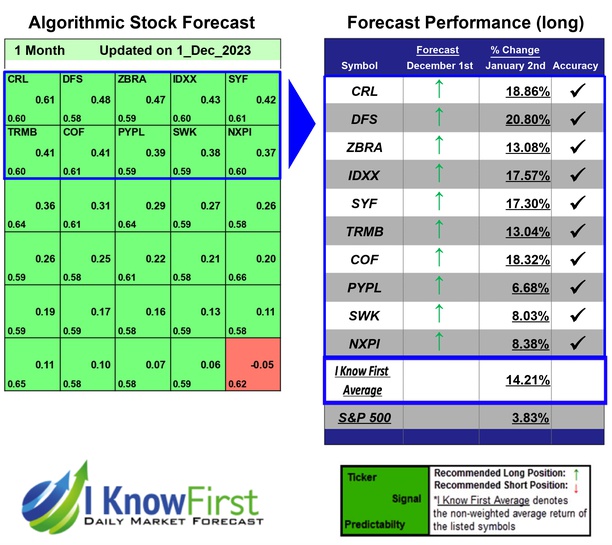

Past Success with COF Stock Forecast

I Know First has been bullish on the COF stock forecast in the past. On December 1, 2022 the I Know First algorithm issued a forecast for COF stock price and recommended COF as one of the best stocks to buy. The AI-driven COF stock prediction was successful on a 1-month time horizon resulting in more than 18.23%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.