BIIB Stock Forecast: Biogen Inc. Skyrockets As New Drug Brings Hope For Alzheimer’s Patients

This article was written by Julia Masch, a Financial Analyst at I Know First.

“Alzheimer’s is a disease for which there is no effective treatment whatsoever. To be clear, there is no pharmaceutical agent, no magic pill that a doctor can prescribe that will have any significant effect on the progressive downhill course of this disease”

-Dr. David Permutter

Biogen Headquarters (Source: Bloomberg)

Biogen Headquarters (Source: Bloomberg)

Highlights

- Ban-2401 Brings Hope To Alzheimer’s Patients

- Another Alzheimer’s Drug In The Works: Aducanumab

- Current Bullish I Know First Forecast For BIIB

Phase 2 Success For Beta-Amyloid Antibody BAN-2401

For years, Alzheimer’s researchers have attempted to identify the cause of the neurodegenerative disease to no avail. However, over the past few years, a new hypothesis has gained popularity: amyloid beta and plaque could be the cause of the disease. Yet, this hypothesis is yet to be proven and as more and more drugs targeting amyloid plaque failed, researchers started to doubt whether beta-amyloids were the cause of the disease. However, when Biogen announced that in its phase 2 trial BAN-2401, a beta-amyloid antibody, showed statistically significant results in Alzheimer’s patients while reducing amyloid plaque.

These positive results came after many did not believe the drug was promising. After 12 months, the drug appeared to be unsuccessful. However, when retested at 18 months into the study, it became clear that those taking the highest dosage of the drug had statistically significantly less disease progression than those taking a placebo. Now, Biogen will begin testing the drug in a larger phase 3 trial to determine if it can go to market.

Aducanumab Also Brings Hope

The success of BAN-2401 brings even more good news for Biogen. The company has another drug, Aducanumab, which is also used to target beta-amyloid production. This antibody works by binding with amyloid plaque which prevents the plaque from affecting brain synapses. The BAN-2401 trial reaffirms the efficacy of targeting beta blockers which has encouraged many about the prospects of Aducanumab for combating Alzheimer’s. The drug is currently undergoing phase 3 trials and if it is successful could be extremely lucrative for Biogen. The results are expected to be released in early 2020.

The Market For An Alzheimer’s Drug

Right now there are few Alzheimer’s drugs on the market and even so, these drugs do not target the cause of the disease, but rather the symptoms of it. Additionally, these drugs are not even that effective in easing the struggles associated with Alzheimer’s. Therefore, there is a large gap in the market for a truly effective drug to combat the neurodegenerative disease.

According to the Alzheimer’s Association, Alzheimer’s care costs will be over $250 billion and could even surpass $1 trillion in the United States alone. Thus, an Alzheimer’s drug would not only benefit those suffering from the disease, but would also be extremely lucrative for Biogen. That’s why Aducanamab and BAN-2401 are such important assets for Biogen. Evaluatepharma estimates that Aducanumab’s present value is already over $8 billion.

Biogen’s Backup

In case these drugs fall through, Biogen has a slew of other drugs already in the market and others in the pipeline too. The company has high market penetration with its cancer drug Rituxan. However, it is important to note the patents for this drug expire in 2018. Additionally, Biogen’s Multiple Sclerosis drugs such as Tecfidera have shown strong and stable revenue and sales are expected to be around $4 billion. This drug also provides trong pricing power for the company. On top of that, Biogen is launching Spinraza, a drug for spinal muscular atrophy, which could produce revenue around $2 billion. The pharmaceutical company’s drug Ocrevus was also recently Biogen already has strong profitability and its pipeline Alzheimer’s will only help to increase sales.

Biogen also has strong financials. The company had profits of $1.17 billion for Q1 2018 from revenue of $3.13 billion and they expect even stronger results for Q2. While the company does have debt, the majority of it matures in 2020. Meanwhile, the company’s cash flow will continue to fund its R&D, future repurchases, and new acquisitions.

Stock and Technical Analysis

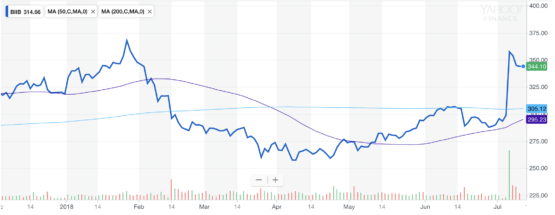

Like most of the healthcare industry, Biogen Inc. was slumping until July 5 when the company which develops and produces therapies for various neurological diseases announced the results of their phase 2 trials on BAN-2401. Immediately, BIIB skyrocketed in after hours trading and by the end of the next day, the stock was up almost 20%. While the stock price decreased a little afterwards as the hype wore off, the jump still brought the price up enough to cover the prior yearly loss the company had accrued and brought the stock to gains of around 8% YTD. While this number may not seem large, one must consider the high stock price- earnings per share YTD are above $25.

Thanks to the jump following the BAN-2401 announcement, Biogen’s stock has surpassed both its 50 day (purple) and 200 simple moving averages (blue) which signifies a bullish trend for the company. While the 200 day SMA is currently above the 50 day SMA which is usually a bearish indicator, however, since the stock just recovered from its slump and the prospects of its Alzheimer’s drugs, I expect the stock to stay steady until more results are released. Therefore, this bearish cross is not the most important factor to consider when deciding whether to buy BIIB.

(Source: Yahoo Finance)

Analyst Recommendations

The majority of analysts are bullish on Biogen’s stock with 21 rating it as either a buy or strong or regular buy. Additionally, the overall consensus is a rating of 3 which also indicates a buy.

(Source: Yahoo Finance)

Current I Know First Bullish Forecast For BIIB

The I Know First machine learning algorithm has a bullish outlook on Biogen Inc. in the long and short run. The strongest signal and predictability are over the one year time horizon.

How to read the I Know First Forecast and Heatmap

How to read the I Know First Forecast and Heatmap

Conclusion

The market for a successful Alzheimer’s drug is enormous and the success of BAN-2401 has brought gravitas to the beta amyloid hypothesis regarding the disease . Biogen has not just one but two drugs that could potential help those struggling with the debilitating disease. While there is the chance these drugs could fail in phase 3, Biogen has a strong slew of drugs already in the market that will allow it to stay profitable. A mostly bullish technical analysis, currently analyst outlooks, and the I Know First self-learning algorithm’s forecasts only strengthen my bullish prediction for Biogen.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

Past I Know First Success With BIIB

On August 31, 2017, the I Know First algorithm assigned a bullish signal of 44.64 to BIIB over a 7 day period as part of the biotech stock package. In accordance with the prediction, the stock gained 6.64% over this time period.

Current I Know First subscribers received this bullish BIIB forecast on August 31, 2017.

Subscribe to I Know First’s Daily Market Forecast