ZOM Stock Forecast: Since January 2021, ZOM’s Shares Have Risen More Than 711%

This ZOM Stock Forecast article was written by Viktoriya Voronchuk – Financial Analyst intern

This ZOM Stock Forecast article was written by Viktoriya Voronchuk – Financial Analyst intern

Highlights

- Since January 2021, ZOM’s shares have risen by 711%

- ZOM’s is expected to become profitable in the next 3 years

- DCF supports $1.68 ZOM stock forecast for 2021

Overview

Zomedica Corp., a development stage veterinary diagnostic and pharmaceutical company, engages in the discovery, development, and commercialization of pharmaceuticals for the companion pet. Its lead drug product candidate is ZM-007, an oral suspension formulation of metronidazole for the treatment of acute diarrhea in small dog breeds and puppies. The company is also developing ZM-012, a tablet formulation of metronidazole targeting the treatment of acute diarrhea in dogs; ZM-006, a transdermal gel formulation of methimazole targeting hyperthyroidism in cats; and ZM-011, a transdermal gel formulation of fluoxetine for the treatment of feline behavioral disorders, such as inappropriate urination. The company was formerly known as Zomedica Pharmaceuticals Corp. and changed its name to Zomedica Corp. in October 2020. Zomedica Corp. was founded in 2015 and is headquartered in Ann Arbor, Michigan.

The figure above shows that currently the short-term moving average crosses above the long-term moving average from January 2021, indicating a buy signal. Since January 2021, the company’s share has risen by 711%.

Big Bet on Truforma: Since January 2021, ZOM’s Shares Have Risen More Than 700%

Domestic animals have been a part of human life for several centuries now. No matter what role these animals play in our lives, they shower their love and loyalty on us. According to the American Pet Products Association, U.S. consumers spent an estimated $99 billion on their pets in 2020. Pet owners in the United States generally pay for diagnostics and therapeutics for their companion animals out-of-pocket. According to statistics from the North American Pet Health Insurance Association, only about 2.0 million dogs and cats in the United States and Canada were covered by an insurance plan in 2018. Well, veterinary diagnostic and pharmaceutical companies play an increasing role in our pets’ lives every year. Furthermore, one of these companies is Zomedica Corp.

What is the main reason for the more than 700% jump in share prices? Zomedica launches Truforma, the first commercial product, and thus a pathway to revenue and eventual profitability.

Truforma is a toaster-sized device that runs tests to detect thyroid and adrenal diseases in dogs and cats. Zomedica tests provide accurate on-site results in less than 20 minutes. The company will release Truforma and three tests in a limited geographic area from the end of March 2021. Next, the company’s goal is to add two tests and expand its geographic coverage.

According to biospace.com, the companion animal diagnostics market is projected to reach $5 billion by 2025 from $1.8 billion in 2020, at a Compounded Annual Growth Rate, or CAGR of 9.8%. The growth in this market is driven by the rising companion animal population, increasing demand for pet insurance, and the number of veterinary practitioners in developed countries. With this growth, the company’s platform’s demand gives Zomedica a positive outlook on the odds against competitors such as Healthineers AG (OTC: SMMNY) and IDEXX Laboratories (NASDAQ: IDXX).

Now let us take a look at the liquidity and profitability of the company. The company has boosted liquidity through financing activities. In the first nine months of last year, Zomedica’s proceeds from share sales totaled more than $56 million. ZOM’s short-term assets exceed its short-term and long-term liabilities by $60.9 million and $61.8 million. ZOM’s is expected to become profitable in the next 3 years due to Truforma. According to simplywall.st, ZOM’s debt to equity ratio is considered satisfactory.

Why would Zomedica invest in its distributors? Distributors play a vital role in smoothly connecting manufacturers and customers. They can expedite response times, enhance a company’s reach, and even create value-added packages that complement a company’s product offering or scope. Zomedica has exclusive distribution agreements with Qorvo, Seraph, Celsee, and Miller Veterinary Supply. Of the recent important agreements, we should mention Miller Veterinary Supply. Zomedica announced that it had signed an agreement with Miller Veterinary Supply to distribute Truforma. Miller, one of the fastest-growing veterinary businesses, was founded in 1920 and is currently the oldest wholesale distributor of veterinary products in the United States.

ZOM Stock Forecast: ZOM Is More Volatile Than 90% of US Stocks In The Past Three Months

Well, we have looked at the company’s attractiveness, but what about the risks? ZOM is more volatile than 90% of US stocks in the past three months and is currently losing money. Research and development costs were down 22% in 2020. The decline is primarily due to the focus on Truforma. Any disappointment in Truforma’s sales could seriously undermine Zomedica’s stock price. At the moment, this is the only potential product of the company. It all depends on the acceptance of this new product by veterinarians. However, in my opinion, the company is betting too much on just one platform.

Only if the Truforma platform is successfully implemented can we expect more profitable growth in the future. This means that investors who believed in Zomedica from the very beginning can benefit in the future.

DCF Supports $1.68 ZOM Stock Forecast For 2021

The forecast is based on average data from previous years, the direction of the company’s policy, and the specifics of the development of this sector of the economy for the coming years. The strategic focus is on the final development and commercialization of the Truforma diagnostic biosensor platform and the first five assays for the detection of adrenal and thyroid disorders in cats and dogs.

Truforma platform, which is protected by 70 patents and several more exclusive rights, could become ubiquitous across the 35,000 U.S. vet clinics. The Truforma platform uses Bulk Acoustic Wave (BAW) technology developed by Qorvo (NASDAQ: QRVO) to provide a non-optical, non-fluorescence detection system for use in the point of care. BAW technology, which is also used in cell phones and the world’s most advanced radars and communications systems, is extremely reliable and accurate technology. The U.S. veterinary diagnostics market is consistently growing at 9.8% per year. By 2025, then, the market will measure north of $5 billion. I guess that ZOM stock profoundly penetrates the market and gives Zomedica a 50% share of that $5 billion market, primarily due to the success of the Truforma platform and implying $1900 million in revenues. According to the DCF analysis results, ZOM’s stock target price will decrease by 0.38 and will be around $1.68.

Also, the company has four drug product candidates. The lead drug product candidate is ZM-007, targeting acute diarrhea treatment in small dog breeds and puppies. The second drug product candidate is ZM-012, targeting the treatment of acute diarrhea in dogs. Metronidazole tablets are currently only available in human genetics, most commonly known as Flagyl.

The third drug product candidate is ZM-006, targeting the chronic treatment of hyperthyroidism in cats. Hyperthyroidism is one of the most commonly diagnosed endocrine disorders in middle-aged to older cats. Moreover, the fourth drug product candidate is ZM-011, a gel formulation of fluoxetine, most commonly known as Prozac, its human pharmaceutical brand name. According to Zomedica, Fluoxetine in pill or compounded form is frequently prescribed by veterinarians to treat feline behavioral disorders such as inappropriate urination. If these drugs will be successfully implemented, they can take a large share in the veterinary diagnostics market and bring significant revenue to the company.

I consider that the company’s success will be short-term, as the stakes on only one platform are too high. Despite the strong distribution links and its superiority in this product over other companies, the share price will decline. Therefore, I would refrain from buying shares of this company for the long term.

Conclusion

The short-term signal, along with a general good trend, is positive and I can conclude that the current level may hold a buying opportunity as there is a fair chance for Zomedica Pharmaceuticals Corp stock to perform well in the short-term. The SWOT analysis shows that despite ZOM is loss-making currently, the company has exclusive distribution agreements, is expecting to become profitable in the next 3 years due to Truforma. However, in my opinion, the company is betting too much on just one platform. In my opinion, the company is betting too much on just one platform. According to the DCF analysis results, ZOM’s stock target price will decrease by 0.38 and will be around $1.68. Therefore, I consider it the right choice at these current levels for short-term investments, but as for long-term investments I prefer to take the hold-side on ZOM’s stock.

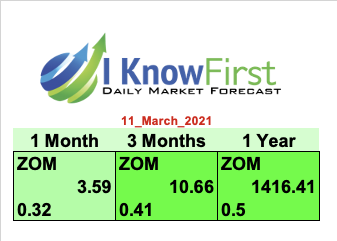

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the ZOM stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

Past Success With ZOM Stock Forecast

I Know First has been bullish on the ZOM stock forecast in the past. On January 31, 2021, the I Know First algorithm issued forecast for ZOM stock price and recommended ZOM as one of the best consumer stocks to buy. The AI-driven Ocugen stock prediction was successful on 14 days time horizons resulting in more than a 179.35%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.