Best Hedge Fund Stocks Based on Algo Trading: Returns up to 6.8% in 3 Days

Best Hedge Fund Stocks

This Hedge Fund Stocks Package is designed for investors and analysts who need predictions of the best-performing stocks according to I Know First’s stock market algorithm. It includes 20 stocks with bullish and bearish signals and indicates the best stocks to long and short based on artificial intelligence trading strategies:

- Top 10 Hedge Fund stocks for the long position

- Top 10 Hedge Fund stocks for the short position

Package Name: Hedge Fund Stocks

Recommended Positions: Long

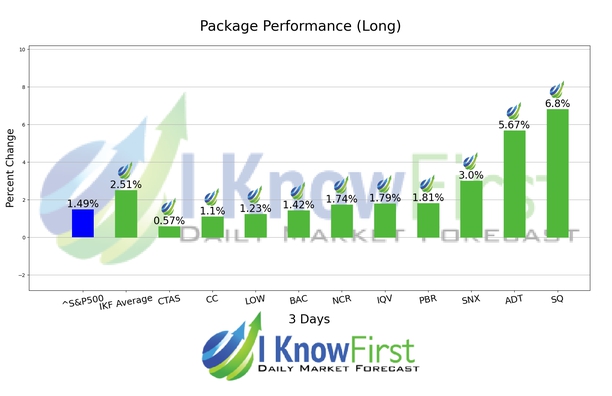

Forecast Length: 3 Days (4/2/21 – 4/7/21)

I Know First Average: 2.51%

During the 3 Days forecasted period several picks in the Hedge Fund Stocks Package saw significant returns. The algorithm had correctly predicted 10 out 10 returns. SQ was our best stock pick this week a return of 6.8%. The suggested trades for ADT and SNX also had notable 3 Days yields of 5.67% and 3.0%, respectively. The package saw an overall yield of 2.51% versus the S&P 500’s return of 1.49% implying a market premium of 1.02%.

Square, Inc. (SQ) develops and provides payment processing, point-of-sale (POS), financial, and marketing services worldwide. It provides Square Register, a POS software application for iOS and Android, which enables sellers across a range of business types to itemize products or services for faster checkout; Square Analytics that shows its sellers how their businesses are performing; Instant Deposit service that sends funds from a sale immediately to a seller’s bank account; and Square Reader for magnetic stripe cards, EMV chip cards, and NFC, which connects wirelessly to mobile devices. The company also offers Square Stand that transforms an iPad into a POS terminal; Square Invoices and Square Online Store for processing payments; Square Cash, a peer-to-peer payments service; and Square Appointments, a POS services. In addition, its products include gift cards, employee management, payroll, and other software and data services. Further, the company provides Square Capital, a financial service product, which provides merchant cash advances to pre-qualified sellers; Square Customer Engagement, a marketing service product; and Caviar, a food delivery service. The company’s customers include retail, services, food, and leisure industries. It serves sellers of various sizes, ranging from a single vendor at a farmers’ market to multinational businesses. Square, Inc. (SQ) was founded in 2009 and is headquartered in San Francisco, California.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.