Best Financial Stocks Based on Deep-Learning: Returns up to 50.82% in 3 Days

Best Financial Stocks

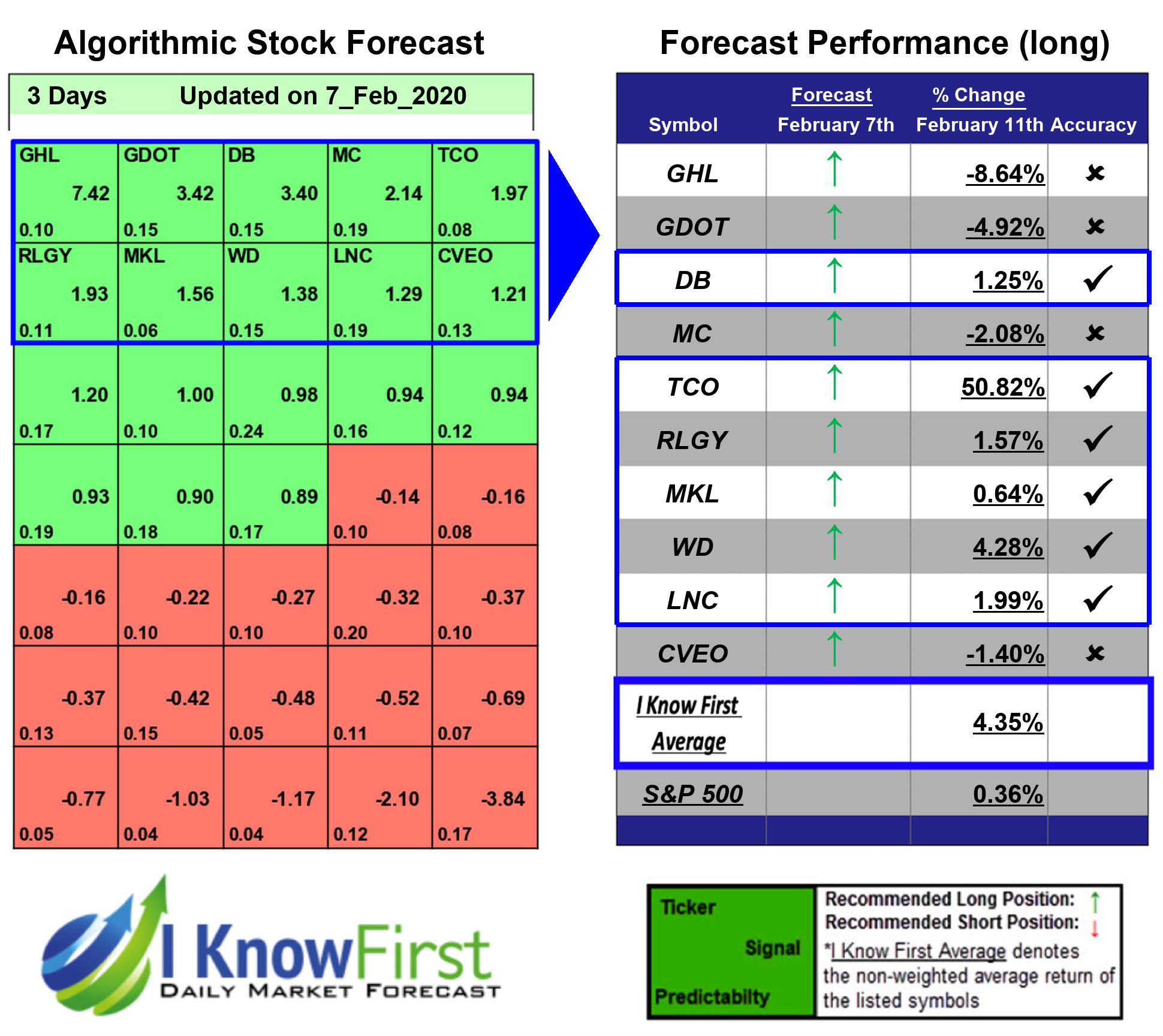

This forecast is designed for investors and analysts who need predictions of Bank Stocks (see Bank Stocks Package). It includes 20 stocks with bullish and bearish signals and indicates the best financial stocks to buy:

- Top 10 Bank stocks for the long position

- Top 10 Bank stocks for the short position

Package Name: Bank Stock Forecast

Recommended Positions: Long

Forecast Length: 3 Days (2/7/2020 – 2/11/2020)

I Know First Average: 4.35%

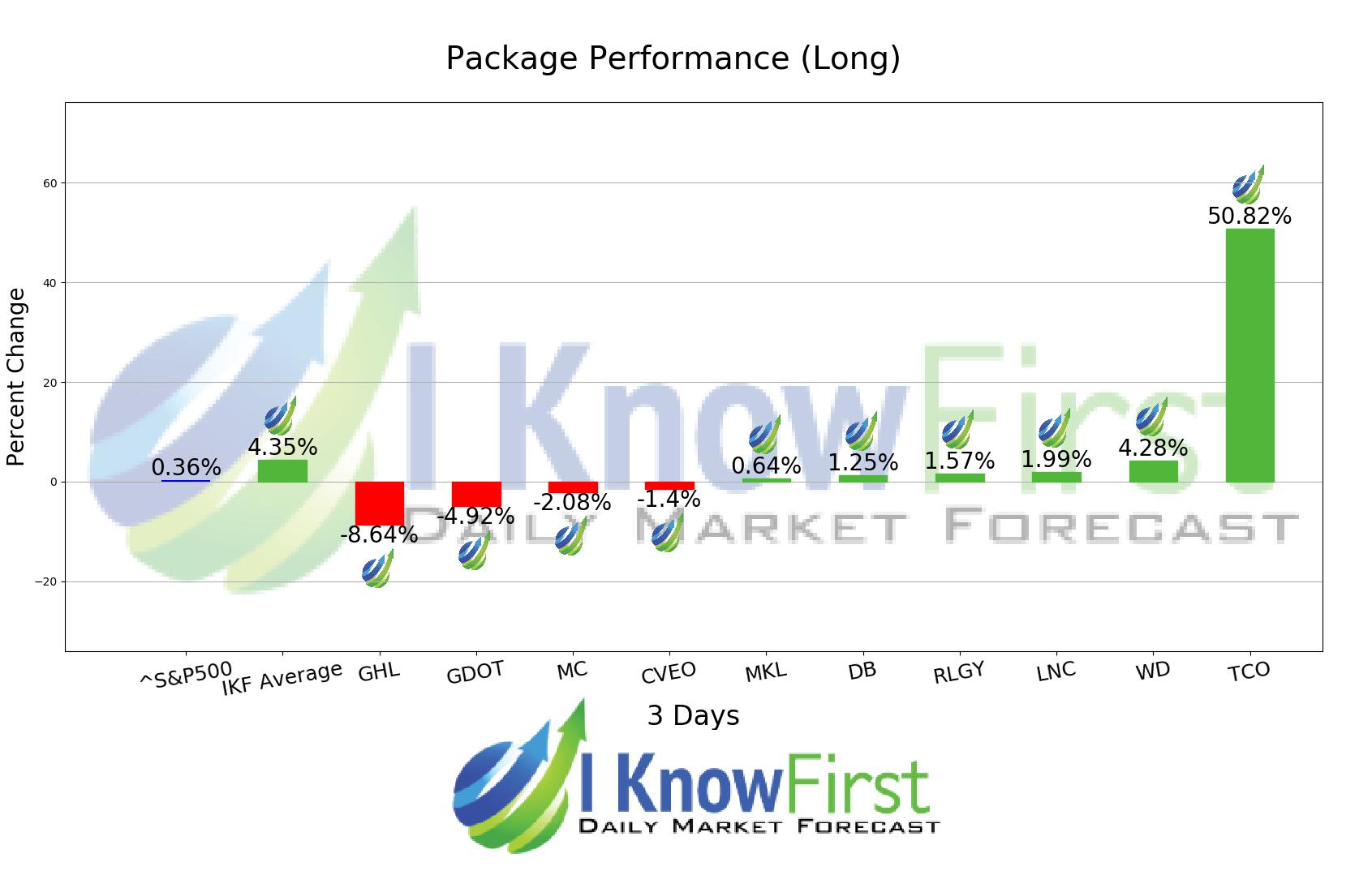

Several predictions in this 3 Days forecast saw significant returns. The algorithm had correctly predicted 6 out 10 stock movements. TCO was the highest-earning trade with a return of 50.82% in 3 Days. WD and LNC followed with returns of 4.28% and 1.99% for the 3 Days period. The Bank Stock Forecast package had an overall average return of 4.35%, providing investors with a premium of 3.99% over the S&P 500’s return of 0.36%.

Taubman Centers, Inc. (TCO) operates as a real estate investment trust. As of June 30, 2005, the company owned a 63% managing general partner’s interest in The Taubman Realty Group Limited Partnership (the operating partnership). The operating partnership engages in the ownership, management, leasing, acquisition, development, and expansion of regional retail shopping centers and interests therein. As of August 23, 2007, it owned and/or managed 23 urban and suburban shopping centers in 11 states the United States. These centers are located in metropolitan areas, including New York City, Los Angeles, San Francisco, Denver, Detroit, Phoenix, Miami, Dallas, Tampa, Orlando, and Washington, D.C. The operating partnership also owns certain regional retail shopping center development projects, as well as approximately 99% of The Taubman Company LLC, which manages the shopping centers and provides other services to the operating partnership and to the company. Taubman Centers qualifies as a REIT under the Internal Revenue Code. As a REIT, the company would not be subjected to federal income tax to the extent it distributes at least 90% of its taxable income to its shareholders. Taubman Centers was founded in 1950 by A. Alfred Taubman and is headquartered in Bloomfield Hills, Michigan.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.