Apple Stock Predictions: Apple’s Gamble To Sell Cheaper iPhones Is A Long-term Winner

![]() The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Apple Stock Predictions

The new $399 iPhone SE expands the total addressable market for Apple-made phones.

The new $399 iPhone SE expands the total addressable market for Apple-made phones.- The iPhone SE is intended for price-sensitive customers. It is perfect for emerging markets.

- The 4-inch iPhone SE touts the same A9 processor, 2GB RAM, and 12MP iSight rear camera of the $649 iPhone 6S.

- I expect the iPhone SE to sell 20-30 million units/year.

- I Know First is currently bullish on Apple.

I like it very much that Apple (AAPL) is abandoning its high-end-only approach to its iPhone strategy. The $399 iPhone SE move is similar to the company’s 2012 release of the smaller, cheaper iPad Mini. Just like the smaller iPad, the new 4-inch iPhone will play a very significant role in Apple’s future. Without the iPad Mini’s presence in the market, Apple would have long lost its crown as the top vendor of tablets.

(Source: Apple)

The iPhone SE is prima facie evidence that Apple also wants to be a major player in the mid-range smartphone market. Aside from Apple loyalists who demanded a new 4-inch iPhone, there is the bigger market segment of price-sensitive customers. Long-term growth of Apple is a lot better when it can also better monetize the sub-$400 smartphone sector.

An iPhone For Less Affluent People

The old technique of selling discounted 3-year old iPhone 4s/5s handsets is a losing solution against the flood of $300 Android phones (which are equipped with the latest CPUs and GPUs). Apple needed a new affordable iPhone to grow beyond its high-end-only customer base. The iPhone’s potential in North America and Europe is stagnating.

The emerging markets of China, Asia, Africa, and Latin America are Apple’s new growth markets. Consequently, only a more competitively-priced iPhone can help turn the tide against the tsunami of cheaper Android phones. Apple cannot hope to increase its 1% market share in India with $650 iPhones.

Better Value-for-Money

The smaller iPhone SE has the same 2GB RAM and A9 dual-core processor of the flagship iPhone 6s. This should make it a tempting alternative to the sub-$400 Android phones from Xiaomi, Huawei, Google (GOOGL), and Lenovo (LNVGY). By coming with a more affordable new iPhone, Apple could steal more customers away from Xiaomi, Lenovo, and Huawei.

(Source: Google)

Performance/price ratio, not screen display size, is still the most important consideration for informed smartphone customers. As long as the 4-inch iPhone SE can play the latest games and stream full HD 1080 movies, it is a potent equalizer to any 5-inch Android phone from Xiaomi or Huawei.

Using the same latest-generation A9 dual-core processor and 2GB of RAM inside a $399 handset makes the iPhone SE perform like a flagship smartphone. For example, the upcoming Xiaomi Mi5 uses the latest quad-core Snapdragon 820 from Qualcomm (QCOM). The flagship Samsung Galaxy S7 has the octa-core Exynos 8890 SoC.

However, based on single-core performance, the iPhone SE’s A9 dual-core processor outperforms the Exynos 8890 and Snapdragon 820. The iPhone SE offers the best value-for-money proposition for discerning customers. It is not surprising that China, an important growth market for iPhone sales, has allegedly already posted 3.4 million pre-orders for the iPhone SE last month.

I believe that the people who made those 3.4 million pre-orders are mostly first-time buyers of Apple-branded phones. They are not the same crowd that already owned the iPhone 6/6 Plus. China is just one country that hinted that there are millions of willing buyers for reasonably-priced iPhones.

More importantly, a lower-priced iPhone also encourages the interest of wireless carriers to subsidize them for their postpaid plans. A $399 iPhone SE certainly requires a lower subsidy cost than a $650 iPhone 6s. The full potential contribution of the iPhone SE will come once carriers around the world make it their top offering for their postpaid plans.

Even $399 iPhones Are Profitable

(Source: Google)

The issue of lower margins from the new 4-inch iPhone is also of little handicap. The estimated Bill of Materials cost of the $399 iPhone SE is only $160. After calculating the marketing/distribution/shipping costs, Apple obviously still gets a margin of over $180 for each iPhone SE it sells.

Let us not also forget that Apple increases the number of iTunes App/Music Store customers with each sale of the iPhone SE. Apple gets a 30% cut for every $1 spent on app purchases. Mobile sales of games, apps, music and movies from iTunes were estimated to be more than $21 billion last year.

A person who can afford the $399 iPhone SE is highly likely to become a repeat customer of Apple’s app store.

Conclusion

It is worth going long on AAPL right now while it trades below $110. The dissemination of more affordable iPhones has far-reaching benefits. The bigger number of people (compared to the limited number of upper-middle-class people) who can only afford $400 phones presents a multi-billion dollar market.

With enough advertising budget and wide support from carriers, I see the iPhone SE generating annual sales of 20-30 million units. The lower hardware margins on cheaper iPhones can also be offset by higher volume of unit sales.

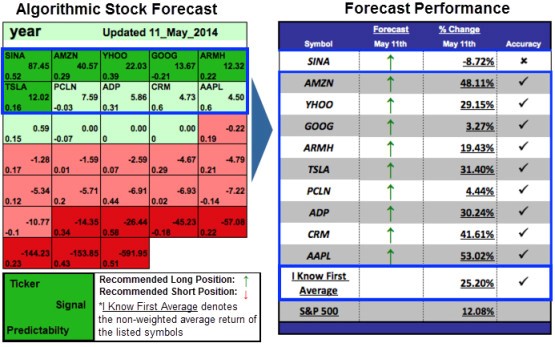

My bullish rating for AAPL is in line with the extremely positive long-term algorithmic signal of I Know First Algorithm. Apple’s stock has a whopping +629.00 one-year signal from I Know First. It means this blue chip stock has tremendous upside potential right now.

In the past I Know First Successfully predicted the stock movement for Apple. In this forecast from the 15th of July 2015. It had a signal of 4.50 and predictability of 0.6 bringing after a one-year return of 53.02%. The Algorithm correctly predicted 9 out of 10 stocks in the forecast and brought returns greater than 25%.

The new $399 iPhone SE expands the total addressable market for Apple-made phones.

The new $399 iPhone SE expands the total addressable market for Apple-made phones.