Apple Stock Forecast: There’s A $100 Billion Reason To Stay Long Apple

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Apple Stock Forecast: There’s A $100 Billion Reason To Stay Long Apple

Summary:

- Staying long AAPL is safe and smart. Apple has tons of cash and the revenue from its Services segment is growing.

- Apple has allocated $100 billion to share repurchase. With this massive budget for share buyback, AAPL is likely to post a new 52-week high.

- Apple will also increase its dividend payments by 16%

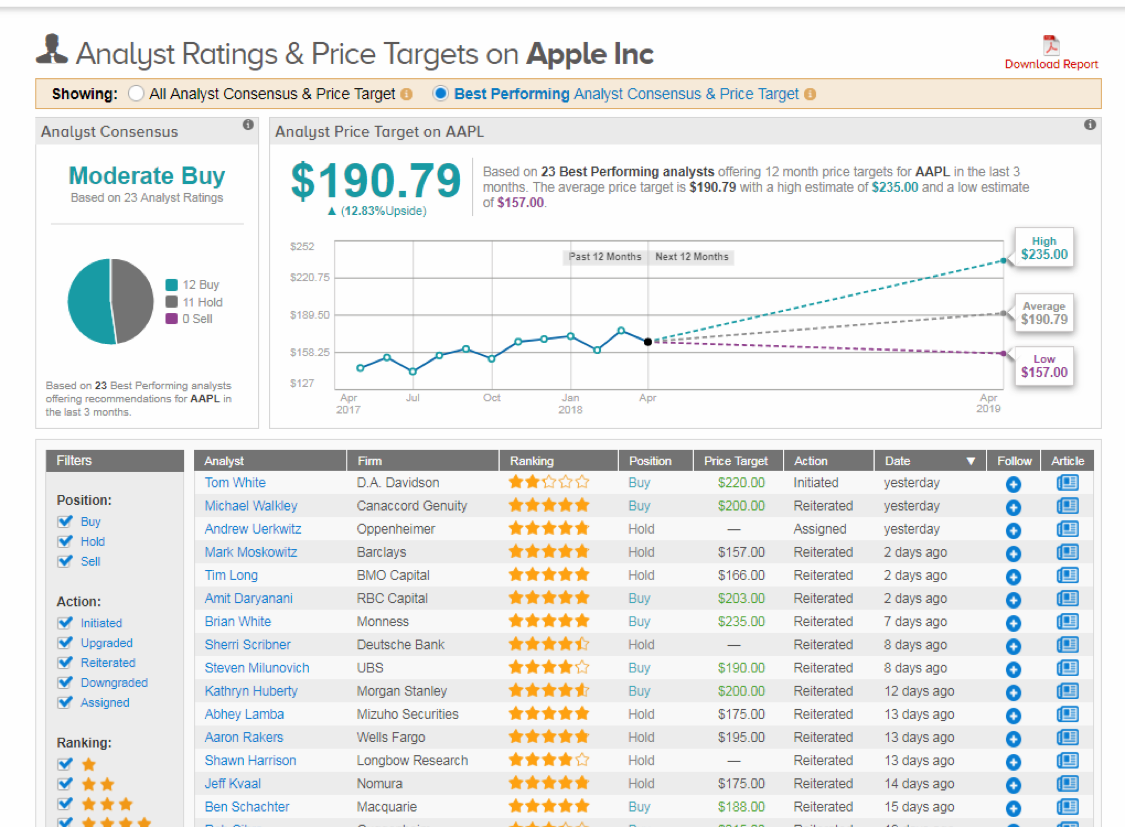

- My 12-month PT for Apple stock is $188. The TipRanks-tracked Wall Street analysts have a median 12-month PT of $190.79 for Apple.

- The iPhone business will remain healthy for many years to come. The very expensive iPhone X remains Apple’s best-selling smartphone this year.

The outstanding March quarter earnings report of Apple (AAPL) reaffirmed my previous buy rating for this company’s stock. In spite of the many skeptics who keep shouting that the iPhone business is stagnating, Apple’s Q2 FY 2018 ER proved that consumers are still loyal to the iPhone brand. Apple’s EPS and revenue beat proved that Wall Street skeptics are wrong to belittle Apple’s juggernaut momentum.

Like the Marvel mythical mutant hero Juggernaut, Apple’s growth momentum is an unstoppable force. Apple can destroy or overcome any obstacle that it encounters.

(Source: Marvel/Apple/Motek Moyen)

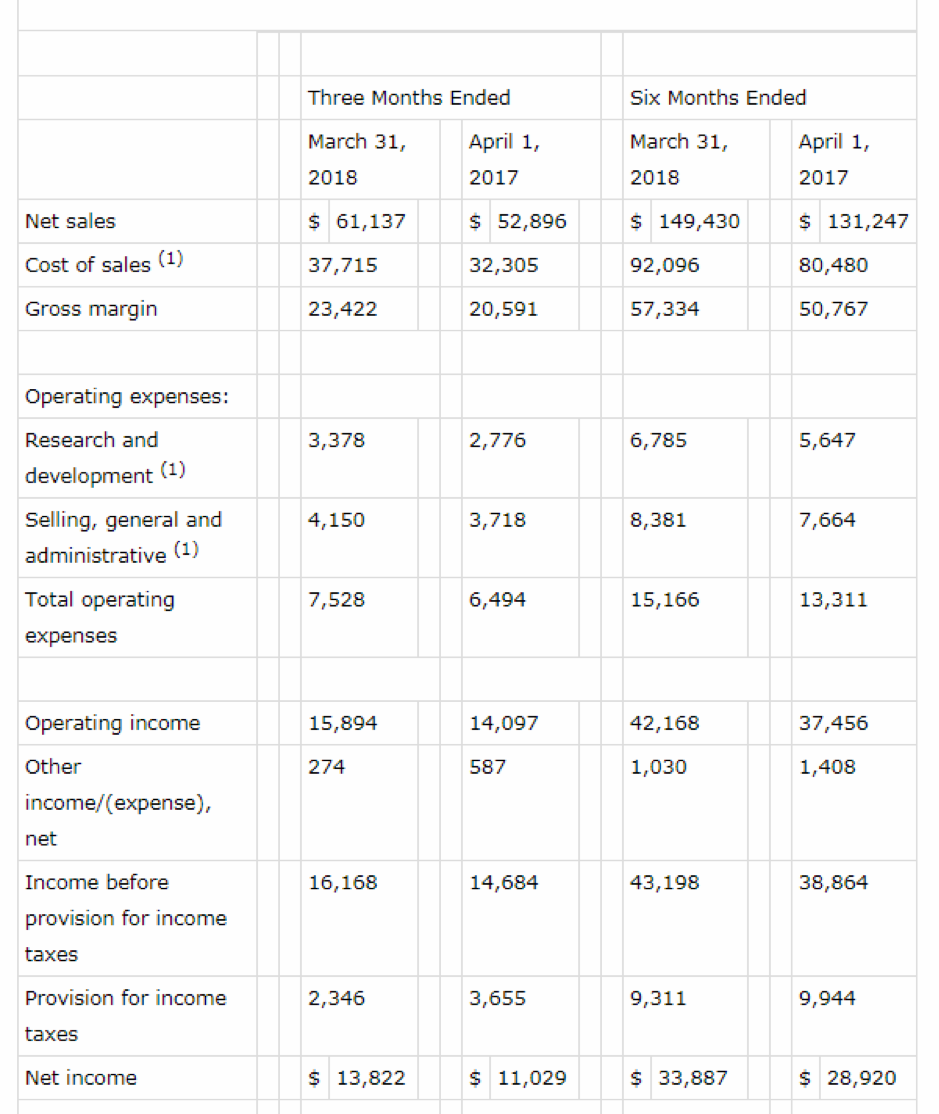

Apple’s Q2 FY 2018 revenue of $61.1 billion is up 16% Year-over-Year [Y/Y]. The earnings per share [EPS] is $2.73, which is 30% Y/Y higher. Apple’s latest quarterly net income of $13.822 billion is notably larger than Q2 FY 2017’s $11.029 billion. More importantly, Apple has allocated $100 billion to share buyback and it approved a 16% increase in dividend payments.

(Source: Apple)

Aside from the fatter dividend payments, the $100 billion share buyback budget could catapult AAPL’s stock price to a new 52-week high. This generous capital return to shareholders will likely help realize my 12-month PT of $188 for AAPL. Twenty-three Wall Street analysts have a median 12-month price target of $190.79 for AAPL.

(Source: TipRanks)

The aggressive share buyback program of current management makes AAPL a safe income-generating long-term investment. Two or three years from now after all the share buyback, AAPL will probably start yielding 3% or more. Warren Buffett’s Berkshire Hathaway recently increased its AAPL stake by 23.30%. Apple now comprised 14.63% of Berkshire Hathaway holdings. The $100 billion share repurchase should make Warren Buffett very happy.

Hedge fund managers have a very positive confidence signal for Apple’s stock. This should inspire small retail investors to heed this clue. More often than not, shadowing the investing choices of hedge fund managers can lead to easy profiteering.

(Source: TipRanks)

It is not only senior citizens like Warren Buffett who like hoarding AAPL shares. As per the persistent survey data of TipRanks, 30% of individual AAPL investors are under the age of 35. Further, individual or small retail investors allocate on average 15.7% of their portfolio to AAPL.

The iPhone Is Still An Infinite Gold Mine

The quarter after the December quarter is usually a low point for iPhone sales. However, Apple still sold 52.2 million iPhones during the first quarter of 2018. This is 2.76% higher than last year’s 50.8 million. Further, Apple again reiterated that its pricey $1,000+++ remains the best-selling model. The iPhone X was the best-selling Apple smartphone in China which helped boost revenue from that country by 21%.

The iPhone accounts for almost 70% of Apple’s revenue. Its resilience and continued success is prima facie evidence that Apple has a cult-like following for the iPhone. Apple can continue to come up with high-margin smartphones and millions of loyalists will keep on buying them. This is the wide moat of Apple, it has hundreds of millions of devoted iPhone, iPad, and Mac loyalists.

In spite of hundreds of available rival products, the iPad still sold 9.1 million units, and the Mac 4.1 million units.

Strong Device Sales Will Further Boost Apple’s Growing Services Segment

The continued healthy quarterly sales of the iPhone, iPad, and Mac computers can increase the already-impressive growth rate of Apple’s Services segment. The Services (iTunes, Apple Music, etc…) segment posted a 31% Y/Y growth this Q2 FY 2018 period. It contributed $9.91 billion, far above the $8.4 billion consensus estimate of Wall Street analysts.

I know that the Services segment is largely propelled by the booming mobile games industry. It should please AAPL shareholders to know that Newzoo’s latest estimate is that the global mobile games industry will generate $70 billion in revenue this year.

The iPhone and the iPad are the favorite gadgets of big spending mobile gamers. Apple has long-term economic benefits from billion-dollar earning iOS games like Candy Crush Saga and Clash Royale. Apple gets 30% cut on every purchases and in-app purchases done the iOS platform.

Conclusion:

AAPL currently trades at $173. However, the $100 billion stock repurchase budget should boost AAPL’s price by at least 5%. My near-term prediction is AAPL will trade near $180 price level before the September launch of new iPhones. By end of 2018 or late January 2019, AAPL should reach my $188 price target.

My bullish endorsement for AAPL is supported by its optimistic one-year algorithmic market trend forecast from I Know First. The 0.7 predictability score for AAPL is saying I Know First’s self-learning Artificial Intelligence has a long history of correctly predicting the one-year market performance of AAPL.

Past I Know First Forecast Success with AAPL

I Know First has made accurate predictions on AAPL in the past, such as its bullish article published on March 27, 2018.

Since the date of the forecast, the Apple stock returned 10.4%.

(Source: Yahoo Finance)

This bullish forecast for AAPL was sent to I Know First subscribers on March 27, 2018

To subscribe today click here.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.