AMC Stock Forecast: How Stock Instability Leads to Invaluable Price

This AMC stock forecast article was written by Nicole Shammay – Analyst at I Know First.

This AMC stock forecast article was written by Nicole Shammay – Analyst at I Know First.

Highlights:

- AMC rejects proposal to authorize 25 million more shares

- Soaring prices lead to “easy money” amongst investors

- AMC deserves a one-year target price range of $50-$60

Overview:

AMC Entertainment Holdings, Inc. (Nasdaq: AMC) is an American movie theatre that operates in both the U.S and International markets. The company licenses first-run films from independent distributors on a film-by-film and theatre-by-theatre basis. AMC is also the most significant movie theatre chain globally, as it was founded in 1920 and has since acquired other cinema brands such as Odean Cinemas and UCI Cinemas. The COVID-19 pandemic proved difficult for the company as they experienced significant financial downturns, but now with restrictions slowly subsiding, AMC has been experiencing an extreme zigzag path.

Shareholders Reject Transformative Proposal and Omit Much-Needed Capital

Though AMC is probably one of the most surprising stocks of 2021, upon a closer analysis of their financials, one can recognize the dire situation the company might be in. Given the streaming revolution, the pandemic propelled AMC into billions of dollars of debt and created massive uncertainty regarding the post-pandemic need for movie theaters. Some argue that the stock is doing well, given that it is up 2,350% this year.

On July 6, the company filed an SEC document that outlined a plan to sell another 25 million shares without shareholder approval. This would increase the number of shares by almost 5% since the company currently holds 513,330,000 shares. But the goal was foregone when CEO Adam Aron discarded the project, saying too many shareholders did not want to dilute their portions. This could be for various reasons; however, this could be explained by the idea that they do not believe the company will generate enough return with this potential capital to compensate for an increased number of shares in the future. This move would have helped the company in several ways. The approval would have raised approximately $1.25 billion for the company at a time when they need cash. AMC is struggling with over $5.4 billion in debt and another $4.9 billion in lease liabilities. These liabilities are nerve-racking and could potentially have massive implications in the long run – especially given their inability to be profitable during the pandemic. The company also loses the opportunity to use the additional capital to buy other bankrupt cinemas. This would enable the company to acquire more equity sales, which would require the capital they are missing because of the shareholder’s inability to dilute their shares. In other words, to buy other cinemas, they need money. And this money could be made by cutting the shares; however, the shareholders are not willing to do this. By acquiring other cinemas, AMC can increase its attendance numbers. With the pandemic limiting indoor seating, more studios would enable more movie-goers. And as restrictions subside as more people get vaccinated, acquiring the theaters now would bring in more revenue in the long run.

However, it is worth noting that the investment in new cinemas could be higher than the benefit from the cash flow growth. The release of Disneys’ Black Widow this past weekend also reveals the reality of cinemas. Though the generation of $80 million at the domestic box office came from the movie release, this only seems like “record” numbers if one is only looking at post-pandemic ticket sales. This turnout rate would otherwise be considered modest. And, studios realize that releasing films directly to streaming platforms enabled them to keep a significant portion of the revenues instead of theatrical releases where revenue is split. The income a cinema would make for a movie release post-pandemic is much lower than pre-pandemic. And, the new average revenue might not be sustainable, especially against streaming services. Thus, long-term investors should understand that the cinematic industry is nowhere near was pre-pandemic and that the new standard might be too low.

Movie Theater Stock Skyrockets, Yet Investors Remain on Edge

When investors investigate various stocks, one crucial factor is the performance over many periods. A stock that is slowly increasing or slowly decreasing is easier to understand than a stock with massive highs and dangerous lows, such as the AMC stock. For example, in early June, the AMC stock skyrocketed out of nowhere 127%. And back in January, the percent change in shares grew 300%. These sudden surges are indeed confusing and beg the question as to why?

Forbes names the Reddit forum “WallStreetBets” as the culprit because retail investors are rallying on the internet for dying stocks. We saw this with GME and BB as well. Though many believe in these ideas and invest in these stocks, one should recognize the underlying business. When a stock shoots up so fast without a recognizable reason, they are bound to pummel back down. Yet many investors see these soaring numbers and invest based on “easy money.”

Bullish Signs Through Financials

For the third time since mid-May, AMC has closed under the short-term 10-day simple moving average as shown by the purple line. Thus, the trend is down, and the price is decreasing in the long run. Furthermore, the 50-day moving average as shown by the green line also proves the AMC stocks unpredictability. As shown below, the stock price trails significantly from the rear-view mirror. This is undoubtedly a worrisome development for bullish investors, and it may attract short-term sellers. And, the stock has also subverted its 21-day exponential moving average, as shown by the yellow line, hinting that the AMC stock might be in for a dreadful retreat.

Another sign to consider is the Earnings Per Share Rating, which is at 22 on a scale of 1 to 99. The EPS ratings provide context regarding the companies profit growth compared to other publicly traded companies in the IBD database. With AMC only receiving a rating of 22, we can see how its fluctuating stock price might not indicate its actual value again.

One should also note a few standout line items from AMC’s balance sheet and income statement from the last quarter. The Net Interest Expense is -$163,800,000, which means the company paid more interest on their loans than they received on their investments. This indicates one aspect of the company’s financials which proves they are not creating enough revenue. Another line item that should be discussed is total revenue which is $449,200,000. In their forward-looking statement, they discussed how not meeting anticipated revenue projections severely impacts various aspects of the company, such as their general and international economic, political and other risks. It also puts limitations on the availability of capital and decreases its ability to refinance its indebtedness.

Furthermore, one should distinguish their operating income for the last year as it was posted as -1,808,000. A negative operating income indicates an operating loss. Their cost of goods sold and operating expenses are greater than their sales. They are not receiving any operating profit, which suggests abnormal operations. This again hints that the company will likely require supplementary funding to remain functional.

AMC also has $813,100,000 in cash and cash equivalents. This is 73.76% lower than that of the Communication Services sector and much greater than the Entertainment industry. Lastly, the company has negative Total Equity of $-2,287,000,000. Thus, AMC is severely at risk, and it is also a major red flag to lenders and investors as it reveals the true net worth of the company.

Due to the extreme variability of the stock within the past few months, it is challenging to assume how this stock will be manipulated in 6 months. Thus, many would be uncomfortable owning such a fluctuating stock. A stock that started at just $2 a share and shot to an all-time high of 72.62 on June 2 with no special announcement or release is not a stock that will remain successful.

The pandemic has certainly put several strains on the AMC Entertainment Holdings Inc. Stock. It has also made forecasting the future of the stock difficult. But there are a few takeaways we can derive. The first is that the refusal of shareholders to issue new shares creates a threat to the company’s financial stability. But it is also important to underline that if a company wants to give such amounts of new shares, it means that the company is in a catastrophic financial situation. In other words, AMC has exhausted all other opportunities to attract new loans. Though the current recovery after the pandemic has been arduous, the rate of income growth will help the company to overcome some of the current financial difficulties. Particularly, growth from new releases, lower restrictions, and society’s excitement for normal life in the coming year.

Conclusion

I recommend the AMC stock as a buy in the next year. It is reasonable to expect future growth on a one-year horizon, given its current trend from the past few months and enthusiasm for pre-pandemic activities. As the company starts expanding again with the dwindling covid restrictions, it is reasonable to expect high growth on a one-year horizon. I am confident that AMC will climb in one year, especially given how new releases such as Black Widow have impacted stock prices. I am optimistic that AMC will climb in one year. My estimate of the stock target prices ranges from $50-$60.

That being said, I do not believe that the AMC stock will continue to grow on a three or five-year horizon. As post-pandemic restrictions subside, society is excited about activities we could not do for a long time, such as watching movies at cinemas. And, new movies are bringing in revenue, but not nearly as much as our pre-pandemic numbers have recorded. Understanding that these averages might never return is harmful in the longer run. Furthermore, with streaming becoming the new norm, I am not hesitant to believe production companies might want to sell to streaming rather than cinemas first. I certainly do not think cinemas will fully disintegrate for good, but I see streaming ultimately prevailing.

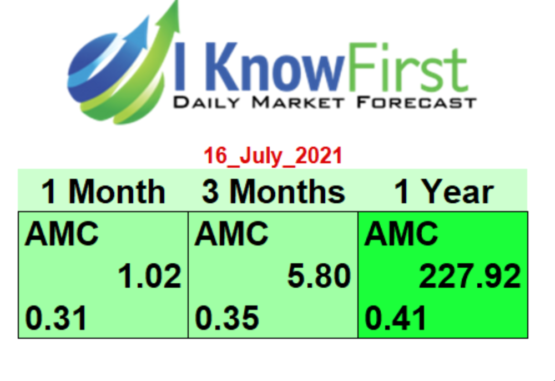

The I Know First AI forecast also agrees as shown by the image above which enforces a confident score of 596.92.

Past Success With Stock Forecast

I Know First has been bullish on the AMC stock forecast in the past. On May 30th, 2021 the I Know First algorithm issued a forecast for AMC stock price and recommended AMC as one of the best consumer stocks to buy. The AI-driven AMC stock prediction was successful on a 1-month time horizon resulting in more than 117.00%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.