Alibaba Stock Forecast: BABA Brings Bright Future

This article was written by Julia Masch, a Financial Analyst at I Know First.

Alibaba Stock Forecast: BABA Brings Bright Future

“We will continue to invest in strategic business opportunities and innovation to sustain our competitive advantage and for long term growth.”

-Daniel Zhang, Chief Executive Officer of Alibaba Group

Highlights

- Macroeconomic trend effects on Alibaba

- Ever rising revenue

- Current I Know First bullish forecast for BABA

Alibaba (NYSE: BABA) has had an interesting year with many highs and lows, but it ended on a relatively stable year with gains of 3.76% over the past 12 months. A large reason for this minimal growth is concerns over the trade war and a macro trend of reluctance towards Chinese tech stocks as tariffs continue to be enacted.

Q1 2019

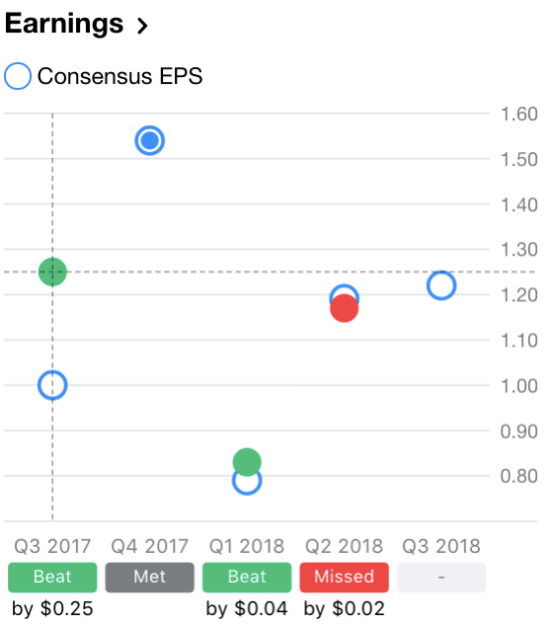

However, on August 23, 2018, Alibaba released its Q1 2019 FY earnings report. Initially, stocks slumped over 3% when earnings did not meet analyst expectations, but the Chinese tech giant’s stock has since recovered as investors recognize the long term growth initiatives and investments Alibaba is implementing. In the preceding month, analysts had already lowered their price targets for BABA as a result of the escalating trade war. Even so, Alibaba reported earnings of $1.17, which still missed the average analyst earnings target of $1.19.

(Source: Yahoo Finance)

Tighter Margins and Investing In The Future

This fiscal quarter gross margin was only 11%, much lower than last year’s 29.2%. This quarter’s tighter margins resulted in smaller earnings for the company. This was the lowest gross margin for the company since its listing on the stock exchange in 2013. Alibaba’s margins tends to be well above 20%.

Alibaba has had a track record of meeting or exceeding consensus EPS in the past. However, this quarter’s weaker results are more indicative of the hit to Chinese technology companies as the trade war escalates. Additionally, the plummet in earnings can also be attributed to a one time charge from distributing stock-based compensation to its employee because of the jump in value of Ant Financial, one of Alibaba’s affiliates. Without this one time expenditure, BABA says its net income would have risen YoY.

(Source: Pixr8)

The tighter margins are also partially due to increased investment by Alibaba. In April, BABA acquired Ele.me, a food delivery company. Moreover, in May, Alibaba amongst other companies invested a whopping $1.4 billion in ZTO Express, another express-delivery company, for a 10% stake. The investments do not end there either; Alibaba invested another $2.2 billion in Chinese outdoor advertiser Focus Media as it works to expand its advertisements beyond only online platforms; Alibaba Health invested in the owner of over 1,000 pharmacies in China, Guizhou Ensure Chain; and more across different areas including cloud computing, new retail categories, and enhanced logistics. The Chinese tech giants hope these investments and acquisitions will diversify the revenue mix and investment profile.

Ever Rising Revenue

Despite the lower earnings Alibaba exhibited, revenue grew 61.4% YoY to $11.76 billion. Over the last two fiscal years, revenue in each quarter has grown over 50% from the same quarter in the preceding year. This kind of growth is phenomenal for the already giant tech company which already has a whopping 552 million active annual customers. Behemoths like Alibaba often have slower growth, but BABA shows no signs of stopping.

Alibaba’s core e-commerce segment revenue increased. This portion of Alibaba’s business includes its marketplaces in retail and wholesale in China and internationally. China commerce retail business alone increased 47% YoY to RMB 69.2 billion or $10.5 billion and made up 67% of total commerce revenue. While the greater Chinese economy slowing because of trade tensions, the growth in this area is extremely significant. Long term macro trends show an increasing shopping appetite in China, particularly in the middle class and this is clearly exemplified by the numbers and Alibaba’s phenomenal sales in China. Alibaba currently has the largest market share in e commerce in China and will benefit immensely from these trends.

(Source: Wikimedia Commons)

Additionally, cloud computing will continue to grow its influence in the company’s total revenue. This segment, which consists of BABA’s suite of cloud services, grew 93% to RMB 4.7 billion or $710 million. This increase was a result of more paying customers and higher value-added services. Alibaba’s cloud services are dominant in China already, but are beginning to gain traction in North America and internationally, particularly in India. Eventually, if cloud computing continues to grow at the quick rate it has been, it could make up significant portions of Alibaba’s revenue.

The combination of strong core e-commerce business, investment in media and entertainment, and an emphasis on cloud computing have great potential for the upcoming quarters.

BABA Stock Analysis

Alibaba’s Forward P/E is merely 22.82 compared to an industry average around ~30, signifying Alibaba is trading at a discount in comparison to many of its competitors.

(Source: Yahoo Finance)

Additionally, BABA’s Relative Strength Index (RSI) is in the normal sold and is currently neither overbought or oversold. However, the RSI is approaching the lower end of this spectrum and if it dips below 30 could indicate a trend reversal and positive momentum for Alibaba.

Examining the MACD, we can see a bullish outlook as the MACD (purple) is above the signal (orange). This is known as a crossover and demonstrates that BABA will likely experience upwards momentum.

Analyst Recommendations

Analysts are currently extremely bullish on BABA with all but one giving the Chinese tech stock either a buy or strong buy rating. The remaining analyst was less excited about Alibaba with a more neutral hold rating. These analyst ratings show a positive outlook for Alibaba.

(Source: Yahoo Finance)

Current I Know First Bullish Forecast For BABA

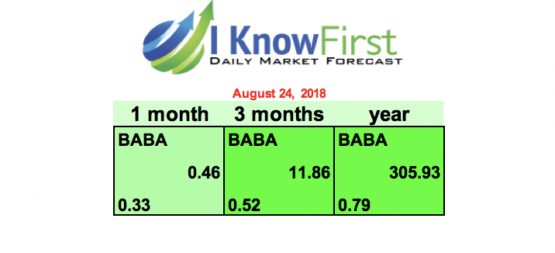

Currently, the I Know First self-learning algorithm is bullish on BABA. The largest signal is over the one year time horizon with a predicted positive movement and extremely strong signal of 305.93 with an also high predictability indicator of .79.

How to read the I Know First Forecast and Heatmap

Conclusion

Despite an initial scare when quarterly earnings were released, Alibaba has a bright future ahead. While trade tensions have been escalating and are still worth considering, other macro trends such as the increasing consumerism in the Chinese middle class will help to neutralize the overall impact on Alibaba.

Alibaba also has strong growth which is exemplified by its increasing revenue. While the earnings are not phenomenal and missed estimates, this is attributable to the trade war, a one time payment, and increased investment in the future of the company. The cloud computing and e commerce segments will continue to thrive while new investments diversify the revenue of Alibaba. The I Know First algorithm only solidifies my positive outlook for Alibaba.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.