AI In Forex Trading: Money Loves Smart Tech

This article was written by the I Know First Research Team.

This article was written by the I Know First Research Team.While much has already been said about the ways the booming artificial intelligence technology is helping investors working with the classical financial instruments, like stocks and ETFs. But there is more to AI in finance than that, and today, we will take a look at another major area for implementation of AI – namely, the use of AI in forex trading.

Forex 101: Betting On The Pips

Before we delve all the way into all the excitement of AI meeting the vibrant, if not volatile, world of forex trading, let us first go over the basics of this trade.

In essence, forex trading mimics traditional investment in the sense that both can be viewed as making a bet. An investor shorting a shock is making the bet that it is about to go on a nosedive, allowing them to profit off the difference between the price at which the stocks were sold initially versus the price at which they were bought back later, while a long position is a bet on a stock going up. Similarly, a forex trader makes a bet that a certain national currency is set to do well vis-à-vis another one, meaning that it’s longing o’clock, or vice versa, which calls for going short on it.

The keywords to note are “vis-à-vis another one”, because this is where we can also touch upon the difference between investing in stocks and forex trading. As an investor, you can pick one stock among thousands and roll with it, but as a forex trader, your bet must always include two choices, albeit from a pool that is way smaller. The first one is your pick of the base currency, which is the currency you are buying or selling, and the other one is the selection of the quote currency – the currency that you will pay for it in.

How well the currency is doing against the other is normally measured in pips, one pip being the lowest unit a given exchange rate can change in. Since rates are cut off at the 4th digit after the comma, a one pip change represents a 0.0001 change in the rate upwards or downwards. This probably sounds quite abstract, and indeed, the actual value of one pip fluctuation depends on the currency pair you are looking at as well as the volume of your transactions. The three standard lots here are 1 000, meaning that you cannot dish out less than 1000 units of your quote currency in any transaction, 10 000 and 100 000, the latter being mostly the volume of choice for institutional investors. For those dealing in smaller lots, the win or loss from a 1-pip movement is significantly lower than for those trading in hundreds of thousands.

More Basics: Spread And Leverage

Now that we know what the pips are, it’s time to look at how they are used in the actual trading, and here, we will see that forex dealers quote their buy and sell rates in trading. In a quote for any currency pair (just as a nod to the details, as far as the title of any pair is concerned, the base currency normally comes first and the quote currency comes second), you will see two figures: bid and ask.

Bid would be what the dealer is willing to offer for a lot in base currency (in other words, how much quote currency you can get if you sell a lot in base currency). Ask, in its turn, is how much the dealer wants for a lot in base currency. These rates are normally quoted in pips and normally differ by a few pips, with the ask price normally being higher than the bid price. This difference, the spread, is effectively the profit that the dealer makes off the transaction, which, of course, also differs in concrete terms from pair to pair and lot to lot.

As we already noted, both traders and the dealers can profit more from larger transactions, those done in bigger lots, and that is why many forex brokers are happy to offer their customers some major leverage – or, in other words, allow them to punch above their weight by lending them their own capital to invest into currencies. For example, some brokers would allow you to open a $10 000 position when you only have $1 000 on your account, which means you could make more money off the deal.

This is, however, very much a double-edged sword, because if the market does not swing the way you expect it, your losses will also be magnified. For many beginner traders, this meant that their dreams of a fortune made quickly and effortlessly were crashed as they found that the very tool they were hoping to use to get from rags to riches turned against them.

A Volatile Market

In times past, many a ship has been driven astray by the changing tides of the high seas; in times modern, the same can be said about many a forex trader, who tried to pick up this exciting sphere only to find themselves stranded after failing to keep up with the market. Currency rates depend both on the health of any given economy, which can often be quite hard to forecast in a world as interconnected as ours, and on the global geopolitics.

Of course, some of the most popular currencies, like the mighty dollar and euro, are known and loved for being more stable, both backed by strong and transparent economies behind them. In fact, with the case with the dollar, what we talk about is a component of all the major pairs out there, with USD being part of the 7 major pairs that account for around 80% of the forex trading. Other majors, besides euro, include the British pound and the Swiss frank. Some traders, depending on who you ask, would also see the Australian dollar, the Canadian dollar and the New Zealand dollar as majors, while others put them in minors. But even the major majors, so to say, for all their strength and popularity, are prone to fluctuations, and for those dealing with massive lots, even a 2-pip slump can mean thousands in losses.

Those with a taste for the unorthodox may instead opt for exotic pairs. These traditionally include a major paired with the national currency of an emerging economy, be it the Hong Kong dollar or Turkish lira, or Thailand baht, or Mexican peso. When dealing with these pairs, traders will have to deal with bigger spreads, a lower trading volume and a lack of liquidity that is not a problem for someone holding large amounts of currencies with higher demand. Thus, the exotic pairings are not the best choice for beginners.

All this considered, it is easy to see why forex trading can be a downright exhausting, albeit, potentially, a rewarding endeavor. A seasoned trader has to monitor a whole variety of factors and spend a lot of time glued to the screen, reading the latest news and crunching the numbers to see how well a given economy can be expected to perform in the next quarter. Mass media sensationalism, over-reliance on leverage and other psychological traps our mind sets up for itself can easily come into play, making the trader over-extend in hopes of gains that never happen or preventing them from exiting a gambit that is already clearly lost.

But while all this may not sound too promising so far, the world of high tech has a solution that can come in as a boon for both beginner and experienced traders… And this is where we come to the rise of AI.

AI In Forex Trading: Machines Learning To Make Money

The recent years have seen the AI industry boom as the artificial intelligence became virtually omnipresent. The technology has been a real boon for many industries, including the financial sector, which saw many of its trades and dogmas disrupted by the arrival of a whole variety of fintech startups. And, thankfully, forex trading is one of the areas that can and do benefit from this new high-tech age.

Currently, it feels like many of the initiatives in using AI in forex trading remain behind the shut doors of banks and other large enterprises that have the resources and manpower necessary to train a sophisticated predictive AI. The first results are already there: for example, last year, Nikkei announced that its proprietary AI has been able to beat humans in forecasting the dynamics for the dollar/yen pair. The company, however, warned that the performance may not be as outstanding in times of increased volatility.

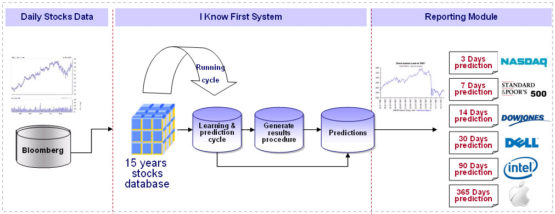

There are, however, those who seek to make AI-driven forex trading available to a broader public – and among the leaders in this sphere is the Israeli-based company with an ambitious name I Know First. The company has trained a proprietary AI which models the dynamics for dozens of currency pairs, utilizing both historical data and fresh market updates, and picks out the best pairings for long and short positions. Its output is delivered as an easy to read heatmap featuring two digital indicators: signal, which is a measure of how well the pair is expected to perform against the rest of the pairs on the forecast, and predictability, which is a Pearson correlation between the past forecasts and actual exchange rate movements.

The system picks out the stocks with the best indicator readings, allowing traders to decrease their risks by placing their bets on the most predictable assets. This helps to reduce the human bias in trading, changing emotion for clean mathematics, and makes trading significantly more accessible to people with a limited understanding of the inner workings of the forex market. Since the algorithm is able to deliver forecasts for different time horizons, from 3 to 365 days, the users are free to tailor their strategy to their needs and priorities. A recent report by the company’s team has demonstrated that the AI has been able to beat the benchmark with a high degree of consistency.