Stock Futures Are Risky, But AI Can Help Navigate Investors

This article was written by Hugh Camiener, Analyst at I Know First. Bachelor of Arts candidate at Columbia University.

This article was written by Hugh Camiener, Analyst at I Know First. Bachelor of Arts candidate at Columbia University.

Summary:

- Stock Futures, or future contracts, give traders the ability to lock in a price of an underlying asset or commodity, allowing traders to speculate on the movement of a commodities price.

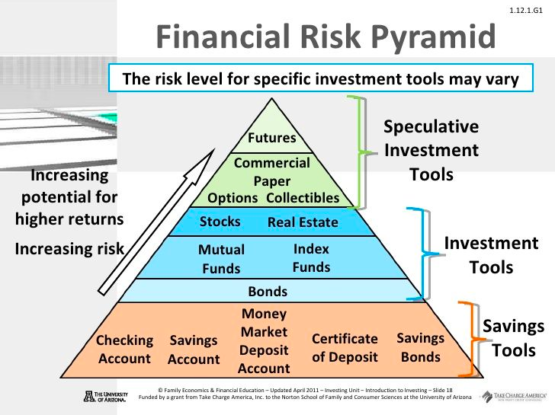

- Future contracts have high leverage, making them high-risk and high-reward.

- Commodity futures all involve the trading of physical, deliverable products like metal, wheat, and energy.

- Financial futures involve the trading of non-deliverable physical assets like stocks, indexes, interest rates, and currencies.

- AI can help investors maximize profits trading Stock Futures

What Are Futures?

Stock Futures, or future contracts, give traders the ability to lock in a price of an underlying asset or commodity. Future contracts have specific stipulations regarding expiration date and prices. The holder of the contract must fulfill the initial stipulations agreed upon. A futures contract allows a trader to speculate on the movement of a commodities price. For example, if one bought a future contract and the price rose beyond the original purchase price, then they would have a profit. Future contracts are constantly changing hands, and the majority of the time are settled in cash and not for the actual commodity. Traders can also take a short or sell speculative position if they believe the price of a commodity will fall. The Futures market contains a wide variety of underlying assets which can then be traded.

Stock Market Futures: Commodities

There are five main components of commodity futures: Grains, Metal, Energy, Softs, and Livestock. Commodity futures all involve the trading of physical, deliverable products. This list does not cover the entirety of the available future commodities, but it makes up a significant portion of the most traded. Almost every commodity imaginable can be traded with future contracts. Commodity future prices are important in establishing consistent and predictable prices for producers and processors of raw materials. This limits the volatility of commodities and allows for a more consistent price of finished materials/good/services in the market. An simple example could be exhibited between producers of corn oil and corn crops. Future contracts would enable corn oil producers to fix a price for corn crops ahead of its harvest and prevent price fluctuations which would impact the price of corn oil.

Stock Market Futures: Financials

Financial futures contracts are trading non-physical financial products. This includes currency futures, interest rate futures, index futures, and single stock futures. Financial futures allow for non-physical assets to become tradable at the end of the contract instead of a physical commodity. Though there are some “deliverable financial assets” like stocks, bonds, and currency, they are not physical commodities such as metals or wheat. Like commodities though, the long in a financial futures contract would benefit from an increase in price from the short, and vise versa.

Significant Risks of Investing in Futures

There remains significant risk for investors who choose to target futures. Investing in futures can amplify gains, but it can also magnify losses. Investing in futures is not just more difficult, but it requires the average investor to be much more attentive. Markets for futures are open 24 hours a day, and traders need to be aware of economic and political activity which could impact their investment. For example, depending on the economic/political activity surrounding oil, one’s initial investment could suffer catastrophic – far beyond their initial investment from a small drop in price. Leverage, the ability to invest with only a portion of total value, inherently makes future trading extremely risky. The maximum leverage in purchasing stocks is no greater than 50%. However, Future Trading offers much greater leverage, around 90-95%. This leverage amplifies the effect of any change in price and can substantially impact profits or losses extremely fast.

How AI Can Help with Stock Market Future Investments

High-risk associated with margins make futures a very risky investment. However, artificial intelligence can help maximize gains and minimize losses. In an abundance of data and statistics in a constantly open market, AI can help guide investors by processing data beyond human capabilities. From economic data to politics, I Know First’s algorithm can offer insight into the direction of different futures from both a long and short position. Although there will always be significant risk with high leverage trading, AI can give a competitive edge within the market.

I Know First’s Stock Futures Packages

I Know First offers packages which can help guide future traders. Stock and index predictors can be applied to Financial Futures. Though this is not a direct forecast for the future, it gives insight into the direction of the stock/index. For those interested in commodity futures, I Know First offers a list of their top 10 from the long and short position. Even amidst significant losses due to the coronavirus, I Know First’s commodity futures package returned up to 20.9% from 4/15/2020 – 7/15/2020.

While futures are highstake, utilizing AI can help investors beat the market and amplify their profits. For those interested in shorter-term futures, I Know First’s 14 day package had returns up to 34.4%.

In total, I Know First’s prediction in the short term averaged 9.98% over 14 days, and 8/10 of the futures increased in price. Though AI does not guarantee success in the market, it can help indicate and guide those interested in futures.

Conclusion

While Futures are a risky investment choice for a practical investor, there does remain unprecedented reward in the market. Futures also have a practical component for companies: guaranteed pricing of a needed commodity. For practical investors, one can consider investing in either commodity futures or financial futures. Trading on a 24 hour market on a margin can be extremely difficult and stressful; However, Artificial Intelligence can help investors navigate the market. I Know First’s Top 10 Commodity Futures Package can help investors better maximize profits and reduce losses while trading Commodity Futures. In addition, I Know First also offers indicators of stocks/indexes applicable for Financial Futures.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.