Bitcoin Forecast: The Mystery, The Future, The Present

This Bitcoin forecast article was written by Ari Herzog, a Financial Analyst at I Know First

This Bitcoin forecast article was written by Ari Herzog, a Financial Analyst at I Know First

Executive Summary

- Bitcoin’s transactional verifiability, yet personal privacy, lead to its rise in popularity and is what separates itself typical fiat currencies

- Bitcoin is reliant on the people using it to become more secure, thus providing an alternative to the need for a centralized authority

- Bitcoin traders vary on style and exchange preference based on their level of experience and tolerance for risk

- Bitcoin’s 77.68% rise in price over three months of Bitcoin forecast earlier this year was correctly predicted by I Know First’s predictive market algorithm in January

What Is Bitcoin And Where Did It Come From?

The mystery of Bitcoin (BTC) began back in 2008 when its founder Satoshi Nakamoto proposed the idea of an electronic payment system that is independent of central authority and based on mathematical proof, in its initial white paper. Satoshi Nakamoto remained anonymous when he released the concept and, despite numerous investigations and theories into his identity, there is no universal consensus on who he is 11 years later.

Officially created in 2009, Bitcoin is the initial application of blockchain technology in the hopes of an electronic payment system. Despite its rise in popularity and its entrance into mainstream news and political realms, Bitcoin is not and has become more of a store of value than a method of payment for everyday purchases.

To simplify the complex concept of Bitcoin, we can think of the cryptocurrency as having two main components: tokenization and decentralization. For tokenization, Bitcoin is a snapshot of code representing ownership of a digital concept (similar to the idea of a virtual contract). This code is what people refer to when they claim ‘personal ownership of Bitcoin’ or is what they use to gain access to their bitcoin wallet. On the other hand, Bitcoin is also a distributed, or decentralized, network is maintained and progressed by a ledger of balances of Bitcoin ‘coins’ or ‘tokens’. The ledger is what makes Bitcoin verifiable, secure, and anonymous.

Bitcoin has grown in popularity due to its status as the first cryptocurrency, a blossoming asset class held entirely online that can also be used as a payment method, similar to traditional currencies. The main allure of the payment system is that transactions can occur without having to go through a central authority like a bank or commerce department. The primary differences between cryptocurrencies and traditional currencies are that transactions are established due to cryptography, are irreversible and anonymous, and that there is a definitively limited supply of the currency.

What Makes Bitcoin So Special?

Similar to how banks control the traditional financial system and ensure assets and money cannot be stolen or fraudulently copied over, Bitcoin avoids the ‘double-spending problem’ by combining encryption (cryptography) and economic incentives to Bitcoin ‘miners’, who use typical software to increasingly secure the system by lengthening and verifying the electronic ledger.

Since there is no central authority, BTC users do not need to provide their identity when sending or receiving coins. Without receiving the sender’s identity, the ledger checks all previous transactions and confirms that the sender not only has the requested bitcoin but also has the authorization to send them. In order to create transparency in the case of lost funds and to avoid criminal usages of the currency, many exchanges perform identity checks on their customers before allowing them to buy or sell the currency. Yet due to the encryption of the network, the identity of the members within particular transactions is hidden.

Fiat currencies can be issued seemingly whenever by central banks in order to manipulate the value relative to other currencies. In the case of Bitcoin, the founder(s) set a maximum of 21 million units and, due to the mathematical algorithm being able to tightly control supply, only a small number of bitcoin are created every hour. Currently, there are almost 18 million BTC in existence, with only 1,800 new Bitcoins coming out every day, a slowing number as the currency nears its maximum supply.

How Do I Get In On The Wave?

If one wants to get in on the Bitcoin action, they can look no further than cryptocurrency exchanges found online. There are two types of cryptocurrency exchanges: fiat-to-crypto (FTC) exchanges and crypto-to-crypto (CTC) exchanges. Fiat-to-Crypto exchanges let you buy cryptocurrencies with fiat money (including USD) and typically have a beginner-friendly design. Popular fiat-to-crypto exchanges include Coinbase and BitBuy. Once you have an understanding of the crypto market, many experienced crypto traders move over to crypto-to-crypto exchanges, which hold exponentially more types of cryptocurrencies than FTC exchanges and deal with ridiculous daily transactional volumes (over $1 billion USD per day on most sites). A few common CTC exchanges are BitMax, FCoin, and Binance, but the sites are generally catered towards different regions and, thus, the most effective CTC exchange for a US resident might be different from the one for an Italian citizen.

When trading cryptocurrencies such as Bitcoin, traders use four primary methods: day trading, swing trading, scalping, and passive trading. Day trading is the act of buying and selling an asset within one day. It is applicable to crypto if one has knowledge or evidence that points to a rapid short-term movement in price, which happens frequently given BTC’s extreme volatility. Swing traders notice trends in the asset’s price movement and only switch their position once the trend begins to reverse. In BTC, the swings can be severe that this type of trading would require consistent price check-ins and proactive behavior. Scalping is the idea of making several intra-day trades and, as the BTC price can flip at any second, should be avoided at all costs if you do not have substantial experience in the market. Finally, passive trading is used by long-term holders who buy BTC and then hold on to their position for months, or even years, at a time. This type of investing is used by many ‘speculators’ who are interested in the crypto market but do not have the expertise to make frequent trades.

Regardless of which trading method one uses, investors need to be aware that because Bitcoin is not a fiat currency and under the control and regulation of a single government, it is also very volatile and susceptible to major events happening across the world. Weirdly enough, Bitcoin also has seen its price rise during times of instability where fiat currencies appear too exposed to the turmoil to confidently invest in. However, despite this idea pointing to BTC as a ‘safe asset’, its volatility is, in fact, double or even triple the amount of that for typical safe-haven assets such as gold and neutral currencies.

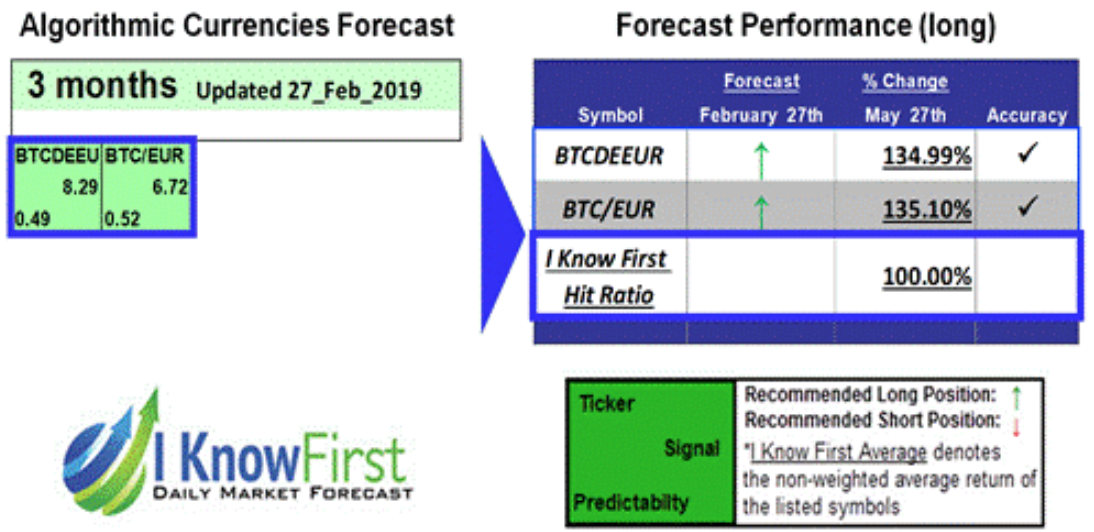

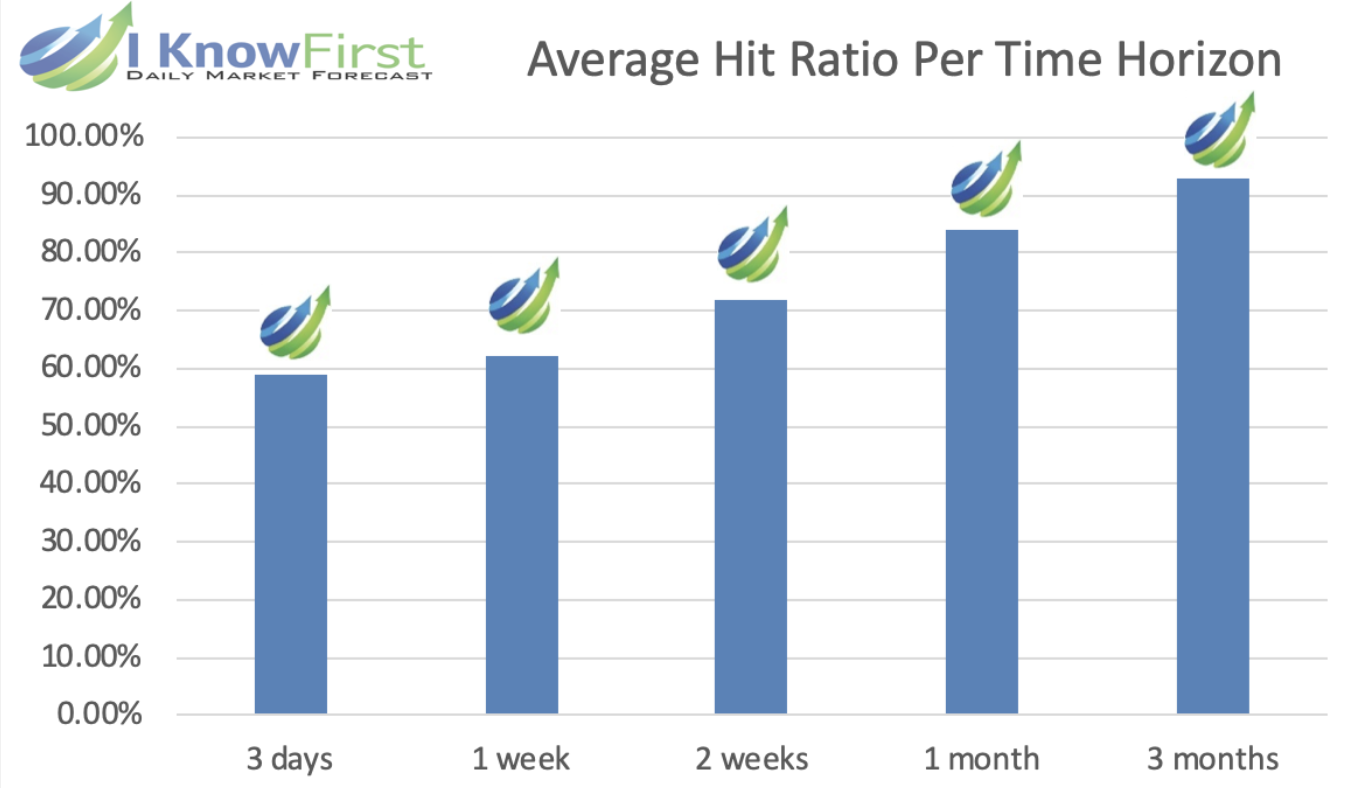

Previous I Know First Success with Bitcoin Forecast

As we discussed in our evaluation report last month, BTC’s price movement from January 1st, 2019 to June 25th, 2019 fell in line with the Bitcoin forecast from I Know First’s market predictive algorithm. In the article, we demonstrate how our bitcoin forecast had positive returns at every time horizon we used – 3 days, 1 week, 2 weeks, 1 month, and 3 months. Our 3 month time horizon provided the best outcome for those who placed their positions in line with the algorithm, as the 3-month predictions led to a positive return of 77.68%, or a 93% Hit Ratio. The 2-weeks and 1-month time horizons gained meaningful returns as well with gains of 9.93% and 20.67% respectively. This bitcoin forecast -indicated a 3-month horizon published on February 27th that was followed by a 135% rise in Bitcoin’s price over the Euro during the 3-month period. All in all, despite BTC being a hard asset to predict from a day-to-day level, the bitcoin forecast success of I Know First’s proves that it can be done over longer periods of time.