Santander Stock Forecast: SAN Upside Potential Backed By DCF And Fundamental Analysis

This article was written by Jose Baabor, an Analyst at I Know First.

This article was written by Jose Baabor, an Analyst at I Know First.

Summary

- Bad performance in banking sector last year caused by uncertainty and declining of profitability.

- Banco Santander’s strong position in Europe and South America helps to diversify risks in different markets.

- Digital transformation is having good performance in the markets.

- DCF analysis shows an undervalued stock price.

Company Overview

Banco Santander (further – SAN) is a Spanish multinational retail and commercial bank and financial services company, founded in 1857 and based in Santander, Spain. Is the largest Spanish banking institution and have presence in continental Europe, United Kingdom, Latin America and United States. The following article will be an analysis of the company using a DCF model for a valuation of the stock price.

Most of the company’s income comes from Latin America with 43% of the total income. 32% comes from continental Europe, 14% from the United States and 11% from the United Kingdom.

Over the past year, Santander stock price fell -31.15% due to the weak outlook for financial institutions and political uncertainties. As reported by the company, trade tensions and the tightening of US monetary policy were the main causes of greater uncertainty. In addition, the Brexit deal is still undefined; if there is no-deal Brexit, the UK would leave with no European trade arrangements and the risks of recession in the country would be higher, and therefore it would negatively affect European banks.

(Source: Yahoo Finance)

Major Causes Of The Fall In 2018

The banking sector in Europe dropped 25% in 2018 due mainly to declining profitability, persistence of negative rates and uncertainty regarding the result of Brexit. The performance of other European banks over the past year was similar as Santander, Lloyds Banking Group plc fell -32.28%, Barclays PLC -31.10% and BBVA -37.82%, among others.

(Source: Yahoo Finance)

In the United States, it was not a beneficial year for the banking sector as well. The S&P 500 bank index fell 18.4% in 2018. The concern about economic growth and the increasing in interest rates made investors more pessimistic. For example the stock prices of Goldman Sachs declined -32.71% over the last year, Citigroup -28.01% and Morgan Stanley -24.03%.

(Source: Yahoo Finance)

The bad situation for the banking sector in Europe and the United States were the main reasons of the big drop in Santander’s stock price last year.

What Will Be The Drivers In 2019?

On the positive side, as almost half of the total income comes from Latin America, the outlook for future years is promising, there is an expected GDP growth of 2.2% for 2019 and 2.6% for 2020. Further, markets have reacted very favorably to Brazilian President Jair Bolsonaro’s victory as evidenced by the Bovespa index rising (see chart below). Brazil (63% of Latin American incomes for Santander) has a positive outlook as well. This year there is an expected 2.3% GDP growth for the region and 2.5% for 2020.

(Source: Yahoo Finance)

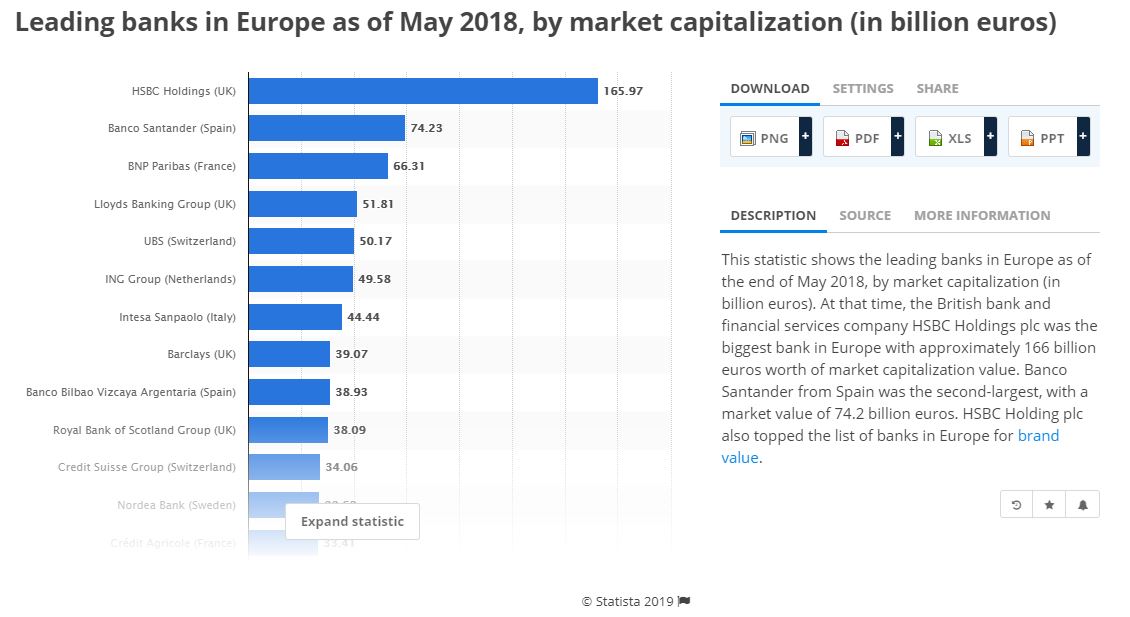

Based on the market capitalization, Banco Santander is the second largest bank of Europe, and has a strong position in the South American financial sector. This helps the company to diversify the risks in different markets across the world.

(Source: Statista)

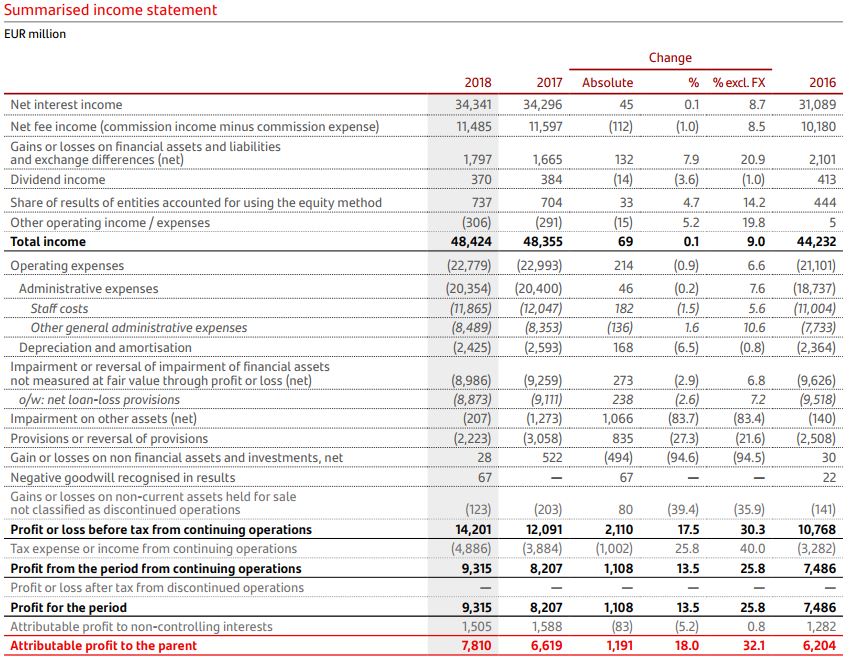

In the last financial report (2018), the exchange differences had an important impact on the profit for the year. The company reported 0.1% increase in net interest income compared to 2017, but if exchange differences are excluded, the net interest income would increase by 9.0% (see chart below). Furthermore, the profit for the year contains significant loss caused by the exchange differences, the profit was 9.31B EUR for 2018 (growth of 13.5% compared to 2017), but without the exchange differences effect would have been 10.32B EUR (growth of 25.8%).

Although, this seems to have a significant negative effect on the company’s financial health, there are a few important factors that positively contributed to the entity during this fiscal year. As Banco Santander has assets all over the world, adverse economic scenarios on individual market level, like a no deal Brexit, could be compensated by the results from the bank’s activities on South American markets.

(Source: Banco Santander)

In terms of strategy, last year the company had good results. The digital transformation is having a good performance, the digital customers grew 26.1%, and the loyal customers grew 15.3%. Customers are using mobile devices to access bank services.

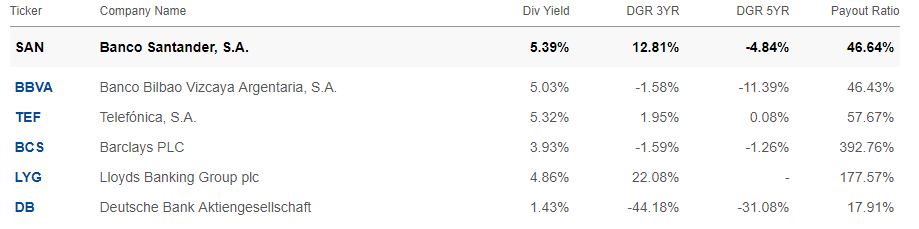

Banco Santander is undervalued by investors with a P/E of 9 times, way lower compared to its peers, although it has a dividend yield of 5.39%, very attractive to investors if they are into the retail banking business.

(Source: Seeking Alpha)

(Source: Seeking Alpha)

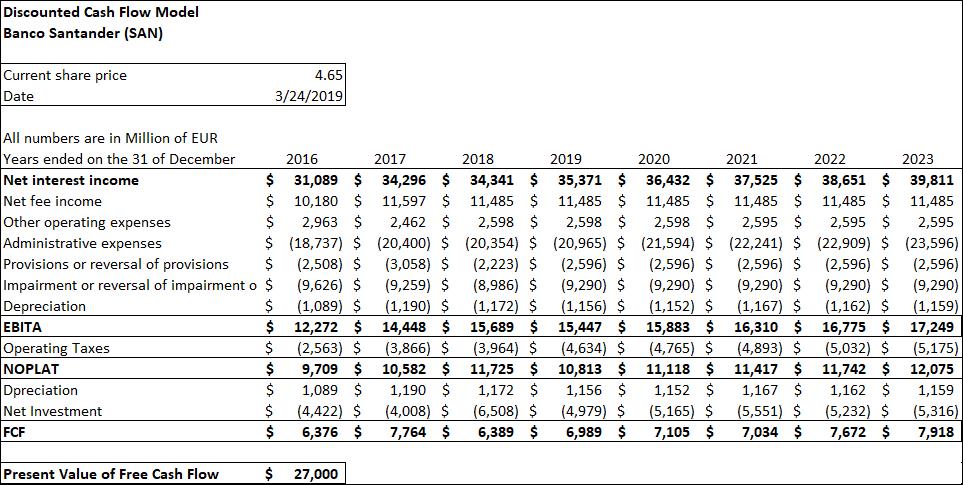

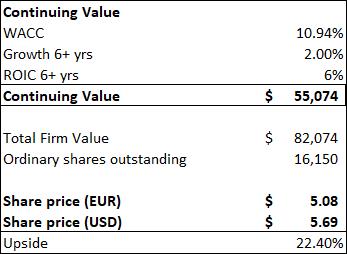

DCF Analysis Shows Santander Is Undervalued

I used a discounted cash flow (DCF) model to yield a valuation of SAN. Future cash flows were projected using historical data combined with an annual outlook of the industry and company. The future cash flows are discounted back to the present to get a valuation of the bank. However, historical data does not give a full outlook of the future data. In addition, it is important to mentioned estimated inputs were used in the projection process. Performing the DCF can give an outlook for SAN’s stock price. Below is the DCF model (notice that all numbers are in millions of euros):

For the analysis, conservative growth figures were used based on historical data to represent a possible future for the company. The results of the DCF analysis shows SAN’s stock is underpriced, therefore investors should be optimistic. The projected share price has an upside of 22.40% by the end of 2023 from the current share price.

Conclusion

Every investment involves risk. There are external factors that affect SAN’s stock price, like the Brexit deal that still is uncertain and the global economic outlook. Banco Santander has a stable growth in income and has the structure to diversify the risks in different markets. Considering this, the promising outlook for Latin American markets, the fact that Santander has a strong position in two continents and that the stock is underpriced according to the DCF results, I am bullish about Santander.

The I Know First Algorithm has a bullish long term forecast for SAN, which is in line with my DCF analysis.

How to interpret this diagram.

I Know First Algorithm Heat-map Explanation

The I Know First algorithm identifies waves in the stock market to forecast its trajectory. Every day the algorithm analyzes raw data to generate an updated forecast for each market. Each forecast includes 2 indicators: signal and predictability.

Signal

The signal represents the predicted movement and direction, be it an increase or decrease, for each particular asset; not a percentage or specific target price. The signal strength indicates how much the current price deviates from what the system considers an equilibrium or “fair” price.

Predictability

The predictability is the historical correlation between the past algorithmic predictions and the actual market movement for each particular asset. The algorithm then averages the results of all the historical predictions, while giving more weight to more recent performances.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.