Tesla Stock Predictions: Downward Momentum Makes Stock Bearish (TSLA)

Tesla Stock Predictions

Summary:

- Tesla is up 645% since the beginning of 2013, as the company’s valuation has approached incredibly high levels.

- While opinion on the stock is split, the price has followed a clear trend in the past that investors can expect to repeat itself.

- The recent comments from UBS are causing Tesla to lose momentum, and the upcoming earnings report is unlikely to help.

- I Know First is bearish on Tesla over the near-term, as a pullback can be expected over the next couple of months.

Tesla Motors (NASDAQ:TSLA) has had an amazing run since the beginning of the year, and the stock price reached its second-highest closing price ever on Monday. Since then, an analyst report from UBS downgraded shares, causing them to fall. Opinion on this stock is split pretty heavily between bulls that believe it is an energy company that will change the world and bears who cite the ludicrous valuation. Debate about the stock tends to devolve into a series of insults and name-calling, as people are very emotional about their positions in this company.

While trying to predict what the auto industry will look like beyond 2020 is extremely difficult, if not impossible, at this point, understanding trading trends of this stock in the short-term is much simpler. Tesla’s stock tends to trade off of recent news and momentum, and the current trend will give bears some hope that Tesla’s valuation might finally come crashing down. While the comments from UBS could easily prove to be a turning point, the proponents of Tesla will end up having the last laugh in the long run.

Price Trend

While detractors from Tesla’s case point to the fact that Tesla has been unable to make material profits, the stock has still managed to climb over 645% since the beginning of 2013. This was not a straight climb, though, as the stock has had many peaks and valleys, as most stocks do. But the movement of Tesla’s looks much more predictable over short-term periods offering clear opportunities for investors looking for quick opportunities.

Figure 1. Source: YCharts

This figure shows the peaks and subsequent pullbacks of Tesla’s stock since the beginning of 2013. Note that the stock has traded up rapidly, followed by a pullback after every case. Looking at what caused the momentum trends can help understand what investors should expect to come next.

Tesla’s stock price increased 445% during the first nine months of 2013, reaching a price of $193.00 on October 1st. This came as the Model S sedan received rave reviews and the company posted its first ever quarterly profit in the first quarter of that year. The stock price quickly fell back to $120.50 over the next couple of months, due to bad publicity and analyst downgrades.

This trend was repeated in February and September of 2014, as the stock price reached new all-time highs in both instances before being pulled back. The all-time highs were reached after announcements about the company’s Gigafactory being built and positive analyst remarks. But the stock price was pulled back in both instances by analysts advising that the valuation was too high, poor earnings results, or just a general lack of positive news to keep the stock trading higher.

Current Trading

This trend has come to fruition once again in recent trading, with the stock price climbing in recent months due to strong sales data for the Model S sedan announced earlier this month and the introduction of new features for the vehicle, including “ludicrous” mode. After reaching its second highest price ever earlier this week, the stock looks like it might be heading for another pullback, as the causes of recent pullbacks can be seen playing a role in trading currently.

In the past, analyst remarks highlighting the speculative valuation and poor earnings results have caused the stock to pull back. In the past month, three analyst reports have cut their target prices or lowered their recommendations, with investment firm UBS the latest to call the current valuation overly optimistic. Tesla investors claim that the “smart money” doesn’t understand that the company is revolutionizing the future of power and is not just an auto company.

Whether this comes to fruition or not, the analyst reports have already caused the stock price to lose momentum and start trading down. That will likely continue with the earnings report, when Tesla is expected to post losses of 60 cents per share according to Yahoo Finance. At this point, a steady stream of content and comments can be expected emphasizing the lack of profits from operations the bloated valuation.

Figure 2. Source: Yahoo! Finance

For short-term investors, this is a solid opportunity to for a quick win. But patient investors that like Tesla, which there are plenty of, should be even more excited. Tesla’s stock has found support at $180 after the previous two dips in the stock price, and it stands to reason that price will act as support again if it falls that far. This will provide a solid buy opportunity for long-term investors.

While I don’t believe that investment firms are trying to lower the price to give themselves opportunities to profit off of lower prices, as many commenters have claimed, it could function that was. The fact is that Tesla’s valuation is extremely high for a company that is not profitable, even one with such growth and vision as Tesla. But that hasn’t stopped the stock price from climbing rapidly and offering huge returns to the company’s supporters.

Figure 3. Source: Green Car Reports

This stock trades off of momentum, and excitement from coming events later this year, such as the expected release of the Model X, will cause this stock to trade higher once again. The UBS comments on the stock might mark a turning point, but long investors should be excited about the possibility of adding to their positions at lower prices.

Algorithmic Analysis

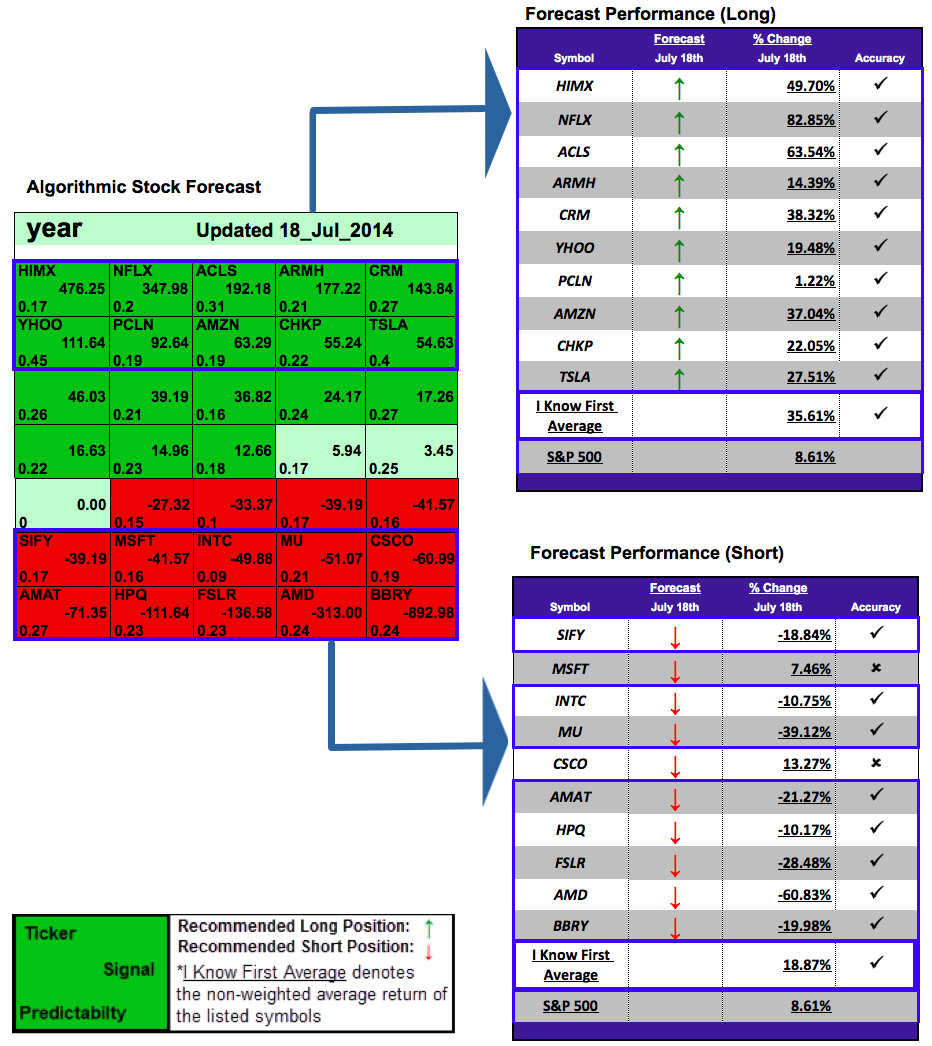

I Know First supplies financial services, mainly through stock forecasts via their predictive algorithm. The algorithm incorporates a 15-year database, and utilizes it to predict the flow of money across 2000 markets. The self-learning algorithm uses artificial intelligence, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets.

The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

I Know First’s algorithm has had success predicting Tesla’s stock performance in the past. In the one-year forecast below, Tesla had a strong signal strength of 54.63 and a predictability indicator of 0.4. In accordance with the algorithm’s prediction, the stock price increased 27.51% during the predicted time horizon.

I Know First also published an article on Seeking Alpha for Tesla on December 31st, 2014, with a bullish algorithmic forecast for the current year. With a strong algorithmic forecast in agreement with the fundamental analysis, the article correctly predicted the stock price’s rise of 21.15% since that time.

Now, I Know First has published another article on Tesla, an American automobile manufacturer, on Seeking Alpha. Having explained how I Know First’s algorithm works, it is worthwhile to see if the algorithm agrees with the current bearish fundamental analysis of the company. The one-month and three-month forecasts for Tesla are included.

Tesla is among the bottom stock picks for both time horizons. The stock has a strong, bearish signal for both, indicating that the stock is currently overvalued. Over the predicted time horizons, the stock price will pullback from its current level, where it is close to an all-time high. This is in agreement with the stock’s historical performance, with pullbacks after large gains. Look for the stock to trade down over the next two months until another round of positive news excites investors once again.

Negative signal strength does not mean investors should automatically buy shorts for the stock. Dr. Roitman, who created the algorithm, created rules for entry for a stock such as Tesla. Using this trading strategy, an investor should buy a stock if the last 5 signal strength’s average is negative and if the last closing price is below the 5-day moving average price. When both of these conditions are met, it is a good time to initiate a position in the stock.

The algorithm is constantly learning and updating its model. The current forecast is for today, but investors should follow a stock’s signal strength and monitor it for at least a few days before making any investment decisions. Sign up for an up to date daily forecast here.

Conclusion

Tesla’s price has peaked in the near term and will experience a pullback over the next couple of months. During the two most recent pullbacks from peak prices, the stock has fallen 21% and 16.5% over the following two months, and a similar pullback can be expected now as analyst sentiment sours and losses are announced in the upcoming earnings report. After the pullback, though, a buying opportunity will present itself. While the UBS note is a turning point, don’t expect Tesla’s valuation to approach normal levels, just for short-term momentum to be negative.

I Know First is bearish on Tesla in the short-term, with a bearish algorithmic forecast to support the technical and fundamental analysis of the company.