ZION Stock – Quick Win: 12.80% Gain In 14 Days

ZION Stock

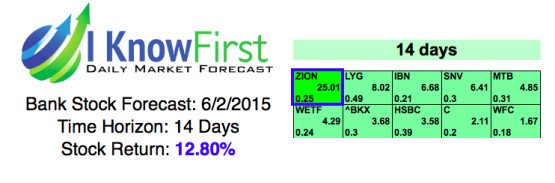

ZION Stock: Zions Bancorporation (ZION) was a Bank Stocks to Buy based on our predictive algorithm recommended to I Know First subscribers on June 2nd for the 14 day time horizon. ZION had the highest signal out of 100 securities put through the algorithm with a signal of 25.01 and a predictability of 0.25. In accordance with the algorithm, the company reported short-term capital gains of 12.80%.

ZION was part of the stock forecast that is found in the “Bank-Stocks” Package.

This Bank Stocks forecast is designed for investors and analysts who need predictions of the best performing stocks for a specific industry: Best Bank Stocks. It includes 20 stocks with bullish and bearish signals and indicates the best bank stocks to buy:

- Top 10 bank stocks for the long position

- Top 10 bank stocks for the short position

Zions Bancorporation (ZION) is a a bank holding company headquartered in Utah, USA and has dozens of subsidiaries. As of July 2008, ZION had $54.6 billion in assets and nearly 11,000 employees and is currently a member of the S&P 500.

On June 11th, Zions announced a restructuring initiative in which the company said it will incorporate seven bank charters into one whilst maintaining the current local CEOs, pricing, branding and credit authority. Additionally, Zions will also create a new chief banking officer position, reinforce risk functions, and “various non-customer facing operations.” The company announced on June 16th that it will sell the totality of its collateralized debt obligations (CDOs). This is a positive signal for investors as it reduce substantially the risk to capital of the bank.

Analysts are attributing the good performance of ZION stock as a result of potential improving fundamentals and efficiencies after the restructuring exercise.

Before making any trading decisions, consult the latest forecast as the algorithm constantly updates predictions daily. While the algorithm can be used for intra-day trading the predictability tends to become stronger with forecasts over longer time-horizons such as the 1-month, 3-month and 1-year forecasts.

Missed the latest trend? Looking for the next best market opportunity? Find out today’s stock forecast based on our advanced self-learning algorithm