Tesla Stock Predictions: The Most Innovative And Eco Friendly Company In The Transportation Sector

Tesla Stock Predictions: Summary

- Tesla’s 3Q results are still not very promising as they are still operating at loss, precisely, EPS was recorded at $-0.58

- 3Q was big for Tesla this year as they unveiled their first SUV, the Tesla model X, what seems to be a clear success

- Tesla is known for it’s leading edge technology, appealing product portfolio and differentiated business portfolio

- Another big release in 3Q for Tesla is their autopilot, a proprietary system which seems to function well

Equity Profile

| Equity Rating | Overweight |

| Price | $232.36 |

| Date of Price | 06 Nov 15 |

| Market Cap (mn) | 25,854.15 |

| Price Target | $285 |

| Price Target end Date | Nov 16 |

“I Know First” has recently taken a bullish view on Tesla. Even though they still operate at a loss, their equity price keeps on surging. In 3Q many investment bankers wrongly underestimated Tesla’s production capabilities. It is now known that those predictions were wrong, and Tesla was able to fully produce what was required of them.

Our prediction on Tesla was strongly based on our Algorithm. Our daily forecasts based on machine learning provide us with very accurate predictions on the movements stocks will have within the market and different sectors.

Tesla has managed to create an emotional connection with many aspirational and potential users. Apparently once you get a Tesla you can never go back. What they’ve managed to achieve technology wise is pretty incredible; a supercar on a battery with an autopilot!

Tesla Model X + Autopilot Features

The model X is supposed to be a huge success, it got a record 30,000 pre-orders, compared to 12,000 for the model S. We estimate that by end 2016 the Model X will be the new symbolic car of Tesla. Two models are offered on the market, the P90 Signature that retails for about $150,000 and the Founder retailing at about $75,000.

Tesla’s new “autopilot” system is also bound to be a success; consumers are actually beta testing the system on Tesla’s behalf, and after some due diligence we can safely say it works pretty well.

Source: Tesla.com

Investment Thesis, Valuation and Risks

We rate Tesla’s shares Overweight based on our “I Know First” algorithm’s prediction, on top of our fundamental analysis which we’ve calculated by inserting a 4.5x multiple to our EV/EBITDA for 2017. Our Price target for Nov 16 remains constant at $285. Demand for Tesla’s vehicles will grow drastically as awareness builds, which is correlated to our belief that the market for electric cars will grow very rapidly. After an analysis in the oil prices we’ve come to the conclusion that oil prices will probably rise once again, as they’ve always done. If a drastic increase in oil prices were to happen, demand for electric vehicles would set off.

On the other hand Tesla has some risks as well, what is most worrying is that Tesla is saddled with OPEB and other legacy costs that more often than not burden large entrenched automakers. Another concern is that if demand was really to surge Tesla wouldn’t be able to keep up with supply, and so customers would go looking for other options, such as BMW.

Source: JP Morgan

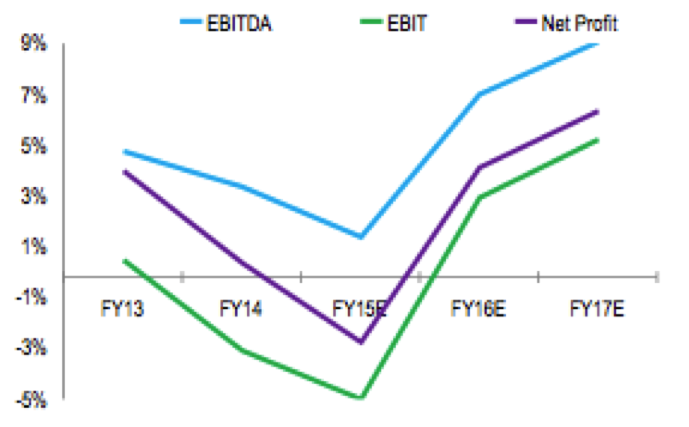

On top we can look at a forecast of Tesla’s future in terms if EBIT, EBITDA and Net Profit.

Source: JP Morgan

Above we can take a quick look at the company’s financials, and expected returns for the years to come.

Exclusive New Insight:

Multiple press articles report that LG Chem is in the final stage of negotiations to supply EV batteries to TSLA. We were recently informed of the fact that LG Chem revealed that there is a possibility for a partnership, but the contract is not certain yet. It is worth noting that the company seems to be back in the race for TSLA market share, given it was believed until recently to have dropped from competition. We believe an additional investment will be required anyhow due to the fact that Chem probably wont have the capacity to build enough NCA batteries, even though they have the capability to do so.

Tesla has recently showed interest in potentially building a battery plant in India. The deal with LG Chem coming in as a main competitor to Panasonic, who currently supplies Tesla with Electric batteries could be a game changer. If they were to acquire an exclusive deal with Tesla, this would significantly reduce battery costs for carmaker. It could also be interesting to look at LG Chem as an investment if they manage to secure the deal.

Interesting Facts:

When Uber CEO Travis Kalanick heard that Tesla was starting to implement the autopilot in their Model S cars he committed to buying 500,000 Tesla cars if and when they will be able to drive without the need of a human.

General Motors’ enterprise value is less than three times as big as Tesla’s heady $33bn. Yet GM revenues for the last 12 months are 38 times higher and its net income is $5.4bn, compared with a $675m loss at its electric rival. One of the reasons recently Goldman Sachs analysts have nicknamed “Elon as Henry Ford”.

Algorithmic Analysis

While algorithmic analysis is not to be considered conclusive, it is useful when combined with traditional techniques. Where such stocks as Tesla are concerned, algorithmic analysis – which relies upon historical trends and other information – can be especially useful in carefully piecing apart one’s investment decisions, which may otherwise be subjective to surrounding (in this case, overwhelmingly positive) bias.

I Know First is an investment firm that uses an advanced self-learning algorithm based on artificial intelligence, machine learning, and artificial neural networks to supplement its fundamental analyses. In doing so, it predicts the flow of money in almost 2,000 markets across a range of time frames (e.g., 3-days, 1-month, 1-year). It should be noted that the algorithm’s predictability (i.e., its accuracy) becomes stronger in 1-month, 3-month, and 1-year forecasts; as such, it can – when coupled with traditional analysis and careful reasoning – most effectively be used to analyze both short-term and long-term trends, but is not as convenient where intraday trading is concerned. The algorithm has seen a high degree of accuracy. As such, while it may seem tempting to disregard its predictions, cross-checking with its suggestions can be helpful in deciding where to place your money.

In particular, I Know First has previously helped investors decide how to engage with Tesla. Recently, in fact, the algorithm successfully predicted that Tesla would be bearish in the one-year time frame between September 7th, 2014 and September 7th, 2015: this forecast was accurate, as can be seen below, yielding returns of -12.78% (Figure 5).

Figure 1. One-year forecast for Tesla, last updated September 7th, 2014; Tesla was deemed bearish (left), and this prediction coincided with its actual behavior (right).

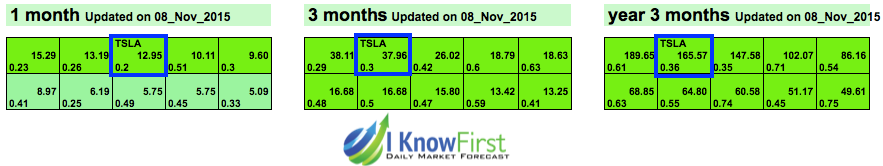

Given that the algorithm appears relatively accurate, then, its most recent Tesla-related forecast (Figure 1) is shown below. Bright green signifies a highly bullish signal; light green also indicates that the forecast is bullish, but not as strongly so. Bright red, in turn, signifies a bearish forecast; correspondingly, light red indicates a bearish forecast as well, but not as negative a forecast. Each compartment contains two numbers: the strength of the signal itself (represented by the number in the middle of each box, to the right), and its predictability (found in the bottom left corner, this is the approximate level of confidence the algorithm has in the forecast).

Figure 2. Newly updated one-month, three-month and one-year forecast for Tesla, last predicted November 8th, 2015;

Tesla, boxed in blue for emphasis, has been deemed strongly bullish in the months to come; this coincides with fundamentals explained above.

Tesla’s position on the algorithmic chart, then, indicates a strongly bullish signal for the company in the months to come; in the short term, of course, this signal may not be as accurate but this appears to coincide well with longer-term (i.e., three month) business developments and technology innovations discussed earlier.

Conclusion:

We are convinced Tesla’s price will keep on rising. Our conviction is a core long position in Tesla’s equity, based on our fundamental analysis of the firm, looking at their financials and projected earnings. Even more so, thanks to our outstanding algorithm, which provides us with new data, related to the company every day to keep us updated. At “I Know First” we share Tesla’s vision for the future and believe it will change the world.