Tesla Stock Forecast: Multiple Tailwinds Can Continue to Propel Stock Further

![]() The article was written by David Shabotinsky, a Financial Analyst at I Know First, and who graduated from the Interdisciplinary Center, Herzliya, with a bachelor in business administration.

The article was written by David Shabotinsky, a Financial Analyst at I Know First, and who graduated from the Interdisciplinary Center, Herzliya, with a bachelor in business administration.

Tesla Stock Forecast

“When Henry Ford made cheap, reliable cars, people said, ‘Nah, what’s wrong with a horse?’ That was a huge bet he made, and it worked.”

-Elon Musk, CEO of Tesla Inc.

In 2018, Tesla is expected to finally deliver its affordable and innovative technology to consumers, and continue to grow as an energy storage and solution company. TSLA investors large risk may finally pay off in 2018.

Tesla Inc. is a vertically integrated sustainable energy company. It designs, develops, manufactures and sells high-performance fully electric vehicles and electric vehicle powertrain components. The iconic electric car maker (EV) has made major strides during the past year in 2017, as evident by its stock price rising more than 50% during 2017.

During the past year, positive momentum has strongly helped the TSLA stock surge and continue to surge. Though they have undelivered in the production of the model 3 sedan, they have continued to implement their vertical integration strategy and R&D growth. Demand exists and continues to grow for affordable electric vehicles (EV). This is evident from the $90 billion investment by global automakers into developing their own line of EV. Many of these companies are as well using Tesla lithium technology to help build, or need to outsource to other companies for vital resources such as lithium (which Tesla can supply itself). However, TSLA as many analyst reports is ahead of the curve and has a strong brand equity in regards to alternative energy and EV. Recently on January 18th, TSLA began showcases its Model 3 Sedan. Additionally, analysts from KeyBanc interviewed many Tesla employees recently and now estimated 5000 model 3 sedans to be delivered by the end of 2017 (will be revealed after Q4 2017 reports).

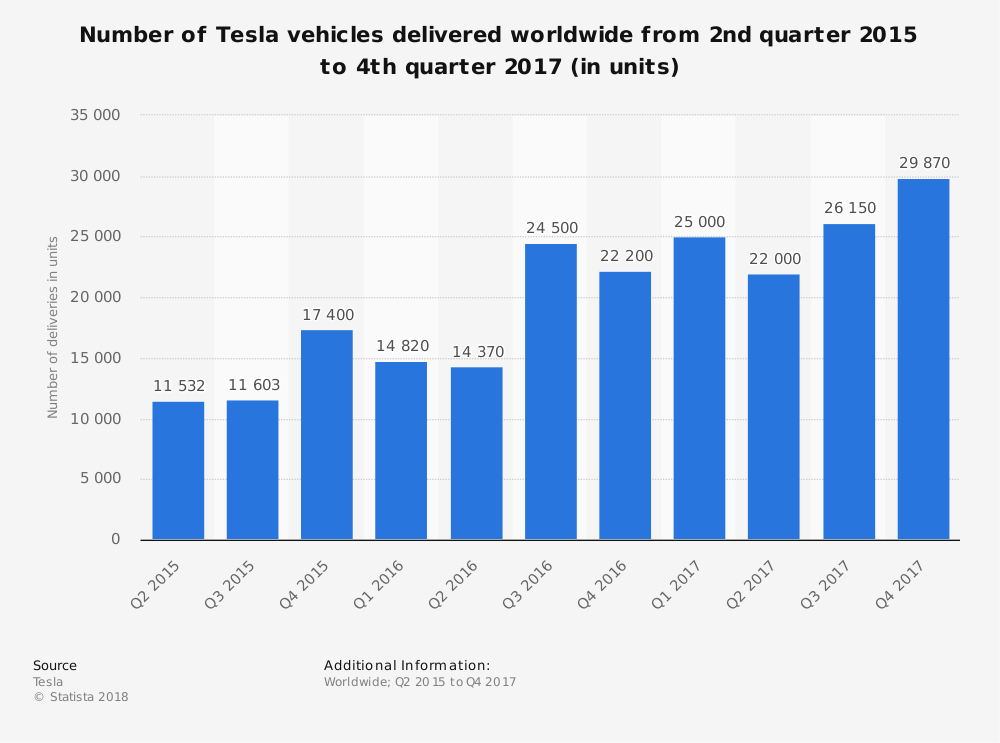

Though there are concerns that Tesla’s model 3 sedans will fail to help turn the tide in profitability, with its construction of Gigafactories – it is becoming a vertically integrated sustainable energy company. However, taking a step back and looking at its historical performance; it continues to increase its rate of delivery. Therefore, Tesla is slowly filling the demand for EV.

Not only have they been increasing deliveries over the past couple years, their revenue has exponentially grown during the same time period. Though Tesla reinvests most of their earnings back into the company, the increase in revenue represents a growing demand for their products.

Not only have they been increasing deliveries over the past couple years, their revenue has exponentially grown during the same time period. Though Tesla reinvests most of their earnings back into the company, the increase in revenue represents a growing demand for their products.

Additionally, though many car makers are investing large sums of money into developing their line of EVs, Tesla is one of the few to own an infrastructure to support the usage EV (and has the most developed one). Meaning, the developed EV will need charging stations in prime locations, otherwise; consumers will not be able to use these vehicles in long range.

Despite Tesla is a leader in the EV market. It’s Model S is the most used vehicle from all other EV makers.

Besides for its more traditional selling proposition, during the past year, TSLA has shown that it is becoming more an energy company with storage and energy solutions company. They recently completed the installation of a backup battery – worlds largest mega battery. It was such a great success that after Hurricane Maria destroyed Puerto Rico, Governor Ricardo Rossello is now in talks with Elon Musk (CEO of Tesla) to find a way to rebuild the infrastructure grid for a population of 3.4 million people.

Analysts estimated that as a result of power outages in America in an estimate of $150B in damages are associated. If TSLA continues to deliver energy solutions to governments, it can help prevent those damages by helping rebuild America’s crumbling infrastructure.

I Know First Past Stock Forecast on Tesla Inc.

Below is I Know First’s AI-based self-learning algorithm’s long-term bullish outlook on TSLA stock. The algorithm maintains a 1-year signal strength of 110.59 and a predictability indicator of 0.71.

I Know First Algorithm Heat-map Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm, allowing the user to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.

I Know First’s self-learning algorithm has been bullish on Tesla Inc. in previous forecasts. On January 8th, 2017, a senior I Know First analyst wrote a long-term bullish outlook on TSLA. Since then, Tesla has risen by almost 53%.