Stock Market Predictions: Where In The Feedback Loop Is Your Portfolio?

Summary

- Why you can beat the market, even when it does not seem so.

- The importance of loops, patterns, and predictable events.

- Random events are don’t measure risks, and should not affect your decision making.

Some traders follow the trend, and some go against it. At I Know First we work on algorithmic strategies which are neither, we simply try an assess where the next opportunity is and provide stock market predictions. If this means to do what everyone else does, than why not. If it means going against when everyone else does, this is also fine. The tricky part is determining where this opportunities are, this article will discuss how to find opportunities in what can seem as total randomness.

Markets are Complex, but not Unpredictable!

There are two major misconceptions about the stock market. The first one is connected to the classical economic theory which claims markets to be efficient, and as such unpredictable. In this case trying to select one stock over another becomes useless, as no opportunity is ever better than the other. Both stocks are perfectly priced according to their opportunity and risk, with everyone having all information. However, the truth of the matter is that some people profit trading stocks while others lose – this by itself proves the market to be inefficient, and thus exploitable. While US markets are very efficient, and most information is available, not everyone interprets this information the same.

The second wrong conception is that markets are random, or chaotic. If this is the case big trading corporations and investment banks could never consistently profit. In a chaotic market eventually the profits and losses should sum up to 0 over a long period. However, as well all know markets are not completely random, and big corporations are able to show a solid profit year over year.

The reality is somewhat complex. Markets are semi-efficient, they are semi random, and they hold some systematic components. Thus in order to make a accurate predictions one would have to pick a stock which is currently inefficiently trading, and hope that it will move as expected without random events pushing it in the wrong direction.

A healthy comparison is a weather forecast. While the forecaster tried to estimate to the best of his knowledge what will happen based on the information available, he is aware that small changes could cause large changes to the forecast. But people still watch the weather forecast and the reason is simple. He does not have to always be right; he simply has to be more often right than wrong over time.

Finding Patterns in the Chaos

In a system as complex as the stock market there are two elements which play a major role. The first is the involvements of so many actors. There are so many stocks, bonds, ETFs, currencies, and commodities, which drastically increases how complex a system can become. It is however the interdependencies of these actors that makes today’s financial markets what they are. A small change in one asset can, through the butterfly effect cause much larger changes in the system.

While investors often act irrational and respond differently to news based on their emotional bias, the end goal is the same. Everyone wants to attain the highest return for the lowest level or risk, this rule of thumb really has no exceptions across the board. With this information we understand that there is a certain price people are willing to pay, and a fluctuation from that price based on irrationalism and bias; however, over time the stocks will often reach that point again.

Positive & Negative Feedback Loops

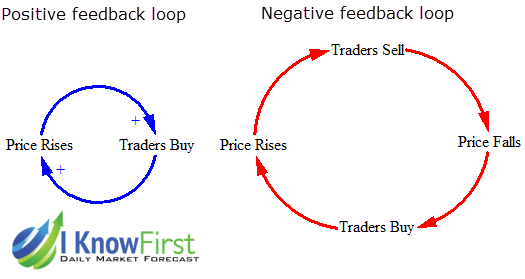

There are two fairly easy patterns to recognize which generally apply themselves to specific types of stocks at specific periods. The first type is the positive feedback loop which is one variable causing the change in one direction to another. The other variable has this property as well, and when it increases it causes that first to have the same effect. For example when Apple is expected to have a new product announcement it often causes its price to go up, and when the price goes up investors believe that the new product will have a positive effect on the price. This causes positive news regarding the price which causes the price to go up.

A negative feedback loop is two negatively correlated variables. When one goes up the other goes down. This is an endless loop around an estimation of when investors believe to be the fair value, often vary speculative. A good example of this is Blackberry. When the price goes up high investors sell, and when the price falls they buy.

Example of positive and negative feedback loop.

Example of a constant negative feedback

The market can be compared to a drunk driver. The positive feedback loop is often overlapped with periods of negative feedback or uncertainty. During a period of negative feedback it is difficult to predict what will happen, one must try to see past that and determine what equity is experiencing an overall positive feedback, and in which direction.

Element of Randomness

Another element is simple randomness, or unforeseeable events. These are not always caused by internal system elements but could also include natural disasters such as earthquakes or floods. Apple’s mini flash crash on February 10th 2011 was caused by high frequency trading (HFT) going a bit out of hand. It is extremely important to ignore this kind of event, and not let it influence your trades. It is always right to go all in with a pair of aces in your hand pre-flop in poker, even if you lost the previous five times by doing so. This element of randomness is hard to digest as the brain is naturally taught to expect positive reinforcement. Sometimes you make the right decision for all the right reasons and still loose, it does not change the decision being correct. Next time you are presented with the same scenario you would have to make the same decision again, even though past experience has not treated you well with it.

Winning despite the Uncertainty

Finding the patterns alone can often be difficult. Between the random events, investor bias, and periods of negative feedback it is often hard to recognize the trend or make sense of the picture. At I Know First we utilize advanced self-learning algorithms to try and separate the predictable from the unpredictable. So the next time you are considering a stock ask yourself where it currently is on its loop, perhaps it is not the time.

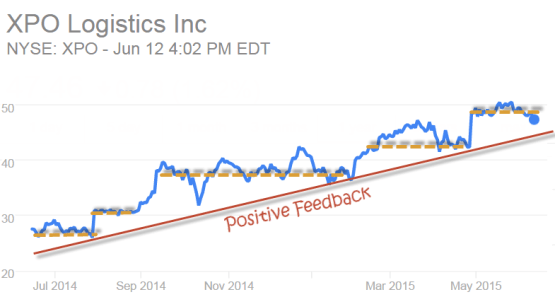

We can apply this knowledge on a regular basis to many market examples. XPO Logistics (NYSE: XPO) is currently a prime example. XPO Logistics, Inc. is an American corporation specializing in transportation logistics. It is the third largest freight brokerage firm, the third largest provider of domestic intermodal services and the largest provider of cross-border Mexico intermodal services.

With a solid overall positive feedback, the stock price is steadily risking; however, because of regular negative feedback loops it is hard to observe the overall trend unless one looks at the longer term picture and knows what to look for.

With a signal of 38 XPO qualifies as the 8th best opportunity according to the algorithm. This hidden gem currently holds 15 buy ratings on Yahoo, and one hold rating.

This stock represents one of the many examples of this portfolio build up strategy. With that said of course it is incredibly important to look at the company’s financial position and fundamentals. However, more often than not, a stock which experiences an overall positive feedback overshadowed by negative periods generally holds a solid fundamental investment base.