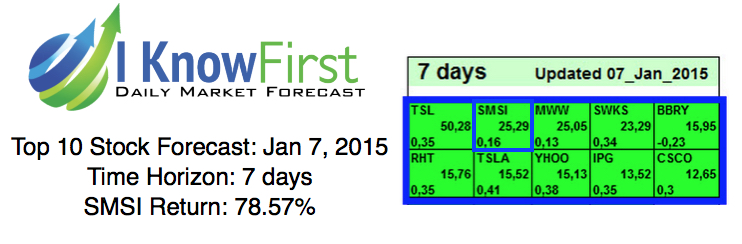

SMSI Stock Forecast: 78.57% Gain In 7 Days!

Smith Micro Software Inc. was a top stock pick based on predictive algorithm recommended to I Know First subscribers on January 15th for the 7-day time horizon. Smith Micro Software had a signal of 25.29 and a predictability of 0.16. In accordance with the algorithm, the company reported short-term capital gains of 78.57%.

Smith Micro Software was part of the stock forecast that can be found in the “Top Tech Stocks” Package.

The full Top 10 Tech Stocks forecast includes a daily prediction for a total of 20 stocks with bullish and bearish signals:

- Top ten stocks picks to long

- Top ten stocks picks to short

Smith Micro Software, Inc., (SMSI) was also included in a 14-day forecast made on December 31st, which can be seen here. In that time, the stock increased 101.15%. The company provides software and services that simplify, secure, and enhance the mobile experience. Founded in 1982, Smith Micro Software is headquartered in Aliso Viejo, California.

The stock had been experiencing modest growth for the past few weeks, most likely because the stock had been oversold. The stock opened at $0.84 on December 31st, below its 50-day moving average of $0.95 and its 200-day moving average of $0.97. The stock opened at $0.96 on January 6th, in line with these averages, but the stock price has continued to increase due to strong fourth quarter results and high guidance for the coming year.

Smith Micro Software reported that revenue for the fiscal 2014 fourth quarter is expected to be between $10.4 million and $10.6 million, above estimates of $10.21 million. Meanwhile, revenue for the first quarter of 2015 is expected to be equal to, or even higher than, the fourth quarter results, and revenue for fiscal 2015 is expected to be between $45 million and $49 million.

The company also expects to be non-GAAP profitable for the fiscal year 2015, which it has not been in the past. This represents a turnaround that started in the third quarter of fiscal 2014, and the company’s CEO, William W. Smith, Jr., expects the company to remain profitable for the entire year while achieving steady quarterly revenue growth.