Quick Win by the Algorithm: CGG Finds Light at the End of the Tunnel

Quick Win by the Algorithm:

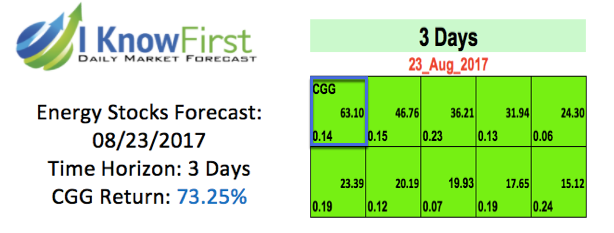

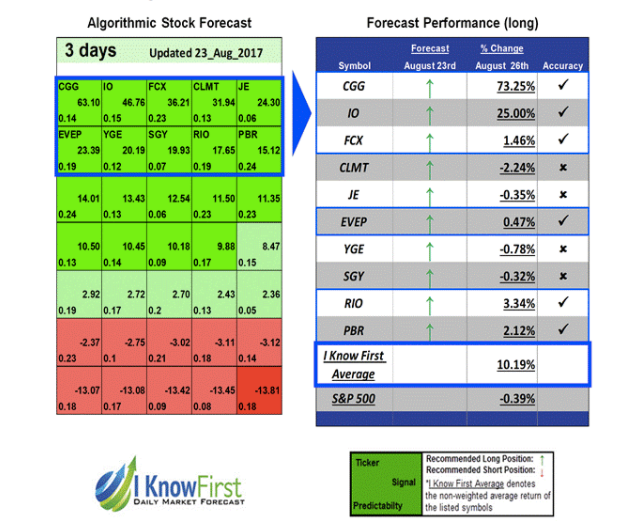

On August 23rd, 2017, the I Know First algorithm issued a bullish 3 day forecast for CGG (NYSE: CGG). The forecast showed a signal of 63.10 and a predictability of 0.14. As a result, in accordance with the forecast, the company’s stock produced a return of 73.25% over this period, solidifying another quick win by the I Know First algorithm.

CGG, a geoscience and oil-services company, provides data imaging, seismic data characterization, geoscience, and petroleum engineering consulting services to the oil and gas exploration and production industry in North America, the Central and South Americas, Europe, Africa, the Middle East, and the Asia Pacific. It operates in Equipment; Contractual Data Acquisition; and Geology, Geophysics & Reservoir (GGR) segments. The company was formerly known as Compagnie Générale de Géophysique Veritas SA and changed its name to CGG in 2013. CGG was founded in 1931 and is headquartered in Paris, France.

CGG has had a tough year overall. In June the company had to file for bankruptcy to restructure and ease a $3 billion outstanding debt. The oil-services giant struggled to keep up with payments on its debt as the big oil groups that use its services proved reluctant to lift exploration spending during a period of low oil prices.

Last week however, two good news reached Paris. First, there is speculation that Chinese company Sinopec will make a bid for CGG. The second one is that there is an element of hedge funds cancelling out negative bets on CGG’s shares falling in the future known as “short covering”. Traders saw the news as an opportunity for profit and began buying stocks. The sudden rise in demand for CGG rose the stock price an outstanding 75.6% in three days.

Current I Know First subscribers received this bullish CGG forecast on August 23rd, 2017.

Before making any trading decisions, consult the latest forecast as the algorithm updates predictions daily. You can use the algorithm for intra-day trading. The predictability tends to become stronger with forecasts over longer time-horizons such as the 1-month, 3-month and 1-year forecasts.