Quick Win By The Algorithm: XOMA Reaches Agreement with Novartis, Stock Soars

Quick Win By The Algorithm

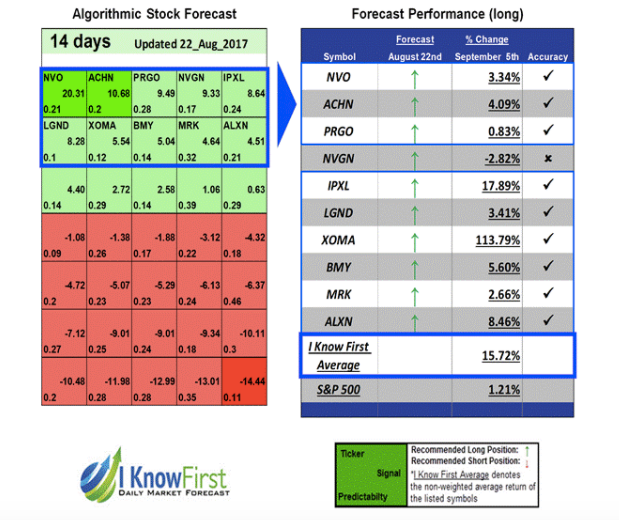

On August 22nd, 2017, I Know First issued a bullish 14-day forecast for XOMA Corporation (NASDAQ: XOMA). The forecast showed a signal of 5.54 and a predictability of 0.12. As a result, in accordance with the forecast, the company’s stock produced a return of 113.79% over this period, solidifying another quick win by the I Know First algorithm.

XOMA Corporation discovers, develops, and commercializes antibody-based therapeutics in the United States, Europe, and the Asia Pacific. The companys product candidates include X358, a human negative allosteric modulating insulin receptor antibody; X213, a allosteric inhibitor for the treatment of prolactinoma and anti-psychotic-induced hyperprolactinemia; and X129, a potent fragment of a monoclonal antibody for the treatment of patients with acute severe hypoglycemia.

For most of 2017, XOMA has been labeled as a “buy”. With professional investors citing that the company’s proprietary technology had potential to be “transformational”. The stock had increased slightly for 2017, as it started on $4.22 on January and was at $7.54 at the time of our bullish forecast. After the forecast the stock soared mightily reaching $16.03 at market close on September 6th.

The reason for such a massive increase was an announcement by XOMA in which they stated that they reached a licensing agreement with Novartis. The deal afforded XOMA the opportunity to pay off 50% of its total outstanding debt to an entity called Les Laboratoires Servier. A 50% reduction in outstanding debt is a big deal for any company at this end of the biotechnology sector and dramatically reduces the risk that the company is asking a shareholder to take on when they pull the trigger on an exposure. In addition, having Novartis on their side opens many opportunities in the healthcare industry.

Current I Know First subscribers received this bullish XOMA forecast on August 22nd, 2017.

Disclaimer

Before making any trading decisions, consult the latest forecast as the algorithm updates predictions daily. You can use the algorithm for intra-day trading. The predictability tends to become stronger with forecasts over longer time-horizons such as the 1-month, 3-month and 1-year forecasts.