Quick Win by the Algorithm: Brazilian Stock SID on the Rise Amidst Political Unrest

Quick Win by the Algorithm

Companhia Siderúrgica Nacional (SID)

Companhia Siderúrgica Nacional (SID) mainly produces steel but operates through five segments including steel, mining, cement, logistics, and energy. The company primarily produces carbon steel and various steel products for the distribution, packaging, automotive, home appliance, and construction industries. The company’s steel products include slabs, which are semi-finished products used for processing hot-rolled, cold-rolled or coated coils, and sheet products.

Brazil is facing turbulent times as a nation, as an autonomous government agency works to reveal the biggest corruption scandal in a democratic state in history. What started as the detention of a convicted money launderer in yet another laundering scheme, led to the unveiling of a scandal big enough to potentially collapse the entire Brazilian government and economy.

In mid-2013, Alberto Youssef was detained for a simple money laundering charge but brought new information to light that led to the full investigation of what is now known as the Petrobras scandal. In response to Youssef’s claims, officials arrested a former Petrobras official named Paulo Roberto Costa in early 2014.

For a year following the arrest of Costa, officials arrested dozens of engineers, company executives and officials in connection with the scheme. The following March, Brazil’s Supreme Court formally announced that 34 political figures would be investigated to determine their involvement. To date, 86 individuals have been charged and convicted in the scandal, the majority being political figures and wealthy elite.

Brazil has a long history of corruption that until very recently was essentially accepted by the nation’s citizens. The magnitude of the Petrobras corruption scheme, however, is too great to be ignored. It is estimated that in total more than $5.3 billion, somewhere between 3-5% of the nation’s GDP, changed hands over the course of this corruption scheme, something that can’t go ignored by the Brazilian people.

Widespread political unrest has arisen in response to the situation, with somewhere between 1 and 3.5 million protestors showing up at demonstrations in just one day. The anger felt by the Brazilian people is only worsened by the fact that the country is facing its deepest recession since the 1930s. The country, the fifth largest in the world, has problems with both debt and inflation due to high government spending.

Despite the obvious negative effects that the Petrobras scandal has had on the country, Brazil’s economy has seen a boost in recent weeks. Shares prices for Brazilian companies have been shooting up, as investors appear to be hopeful for political change.

Companhia Siderúrgica Nacional (SID) in particular has seen tremendous growth since the start of 2016, with share prices more than doubling in the last month alone. Some of this change should, of course, be contributed to the potential that investors see for political reform. Brazil’s economic struggles are structural, rather than cyclical, meaning that political reform would likely have a significant impact on the struggling economy.

By examining the simultaneous growth of U.S. Steel Corp (X), it becomes apparent that the state of the Brazilian government and economy are not the only factors at play here. Despite analyst predictions that iron ore and steel demand would decrease further, both commodities are on the rise as signs of recovery in China’s property market and plans to loosen margin-lending controls in equity trading improve market sentiment.

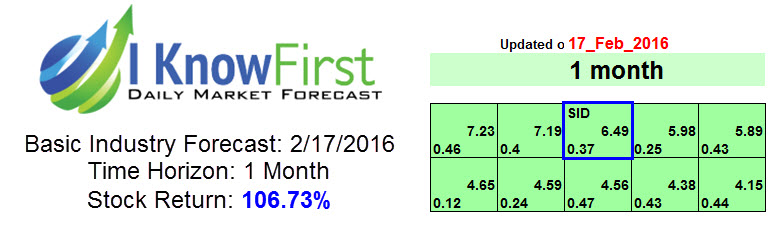

SID was included in the long position for the 1-month forecasts of both the Dividends Stocks and Basic Industry packages from February 17th. In the 30-day time period, the stock saw growth of 106.73%. Below is part of the forecast from the Basic Industry package, showing SID with a signal of 6.49 and a predictability of 0.37.